-

The increase in the delinquency rate for securitized CRE loans for March ended an eight-month streak of declines.

By Glen FestApril 3 -

The non-bank lender's $299.8 million prime, high-balance deal is no surprise; it follows a warehouse securitization last year. Angel Oak is also in the market with a $238.8 million deal.

By Glen FestMarch 28 -

Acting commissioner Dana Wade said the agency is "vigilantly" watching whether it needs to take action on PACE assessments placed on mortgages after they are endorsed by the agency.

By Glen FestFebruary 27 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

By Glen FestFebruary 8 -

The $401.2 million COLT 2018-1 is the eighth overall securitization of non-qualified jumbo mortgages issued by the Lone Star Funds affiliate.

By Glen FestJanuary 12 -

Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

By Glen FestDecember 28 -

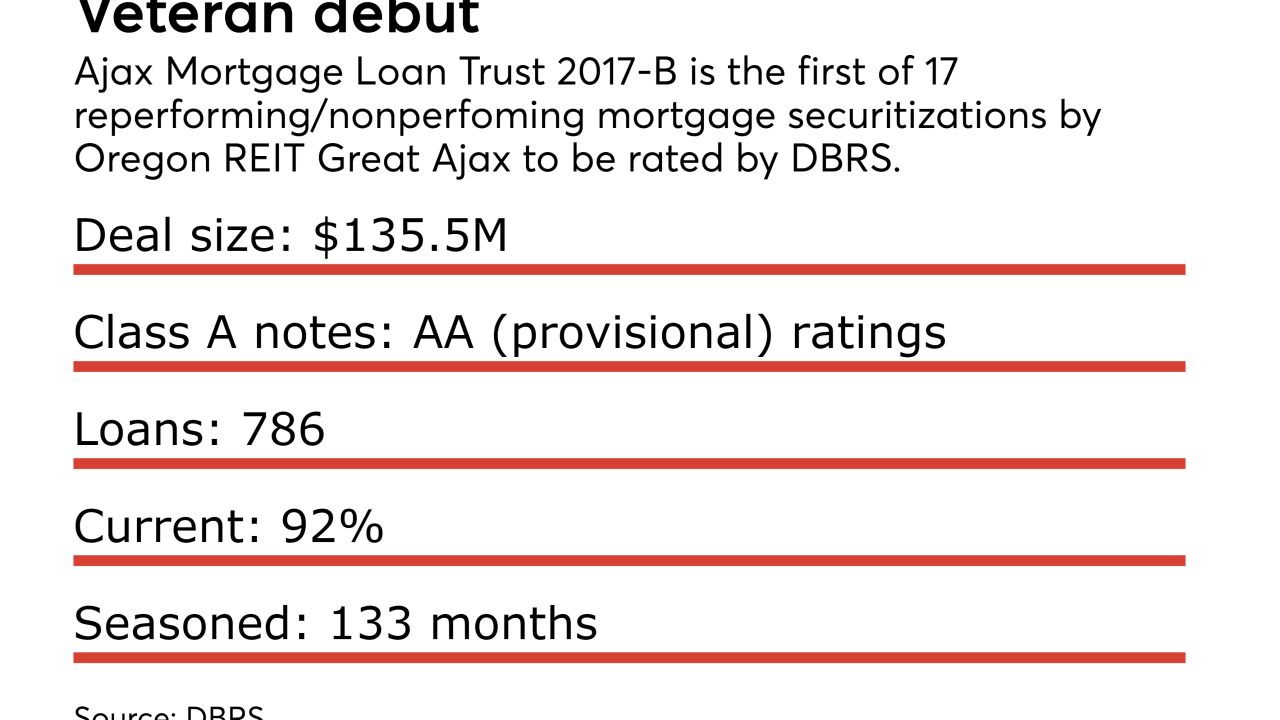

The real estate investment trust has already completed 16 unrated offerings of bonds backed by legacy loans that were once delinquent; those prior deals were backed by more deeply distressed loans.

By Glen FestDecember 15 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

By Glen FestDecember 12 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

By Glen FestDecember 11 -

A $92 million portion of $194.4 million mortgage on a portfolio of 36 ExtraSpace Self Storage locations is the largest of 42 loans backed backing MSC 2017-HR2.

By Glen FestDecember 7 -

The measure assigns the CFPB the task of developing ability-to-pay standards for financing repaid through local tax assessments; it has the support of both the PACE industry as well as mortgage bankers and Realtors.

By Glen FestNovember 20 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

By Glen FestNovember 15 -

The $785 million transaction, 2017-C41, is backed by a pool of 52 loans with an average balance of just $15.1 million, according to Kroll Bond Rating Agency; retail, hotel and office properties dominate the mix.

By Glen FestNovember 14 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

By Glen FestOctober 26 -

Cisco DeVries, the chief executive of Renew Financial, said the bills will bring much-needed stability to Property Assessed Clean Energy, which uses a property assessment to finance upgrades.

By Glen FestSeptember 18 -

The 4,443 single-family rental homes securing Starwood Waypoint Homes 2017-1 have an average age of 30 years, older than any previous transaction by the sponsor, but are bringing in more than $1,700 apiece in monthly rent.

By Glen FestSeptember 6 -

Damages have typically not been a "disruptive problem" with hurricanes because of commercial properties' insurance, Trepp reports, but expiring leases of major tenants and the energy industry fallout have already had an impact on Houston-area office buildings.

By Glen FestAugust 29 -

The average home value backing the loans is $117,000, well below the average $150,000 of other recent RPL securitizations, according to Fitch Ratings.

By Glen FestAugust 28 -

Five deals launched in the first week include another whole loan participation in New York's GM Building, as well as a single-borrower ABS for the Park Avenue office tower complex that includes Facebook and Buzzfeed as tenants.

By Glen FestAugust 9 -

The 1999 Avenue of the Stars tower in the Century City submarket is part of a second Goldman Sachs CMBS transaction, and is the largest loan in the new 2017-GS7 portfolio.

By Glen FestAugust 8