-

The private equity firm obtained an $825 million mortgage on the portfolio from Citi, Deutsche Bank and Barclays; proceeds, along with $500 million of mezzanine debt, will be used to repay exist debt and cash out $207 million of equity.

By Glen FestJuly 31 -

It's the sponsor's first securitization to be rated by Morningstar; DBRS and Kroll Bond Rating Agency are still capping their ratings of Property Assessed Clean Energy bonds at double-A.

By Glen FestJuly 25 -

BANK 2017-BNK6 is a transaction backed by 72 fixed-rate commercial property loans covering 189 properties, including midtown Manhattan's iconic General Motors Building.

By Glen FestJuly 11 -

With risk premiums on collateralized loan obligations at or near their tightest levels since the financial crisis, there may be nowhere to go but out, according to Wells Fargo Securities.

By Glen FestJuly 3 -

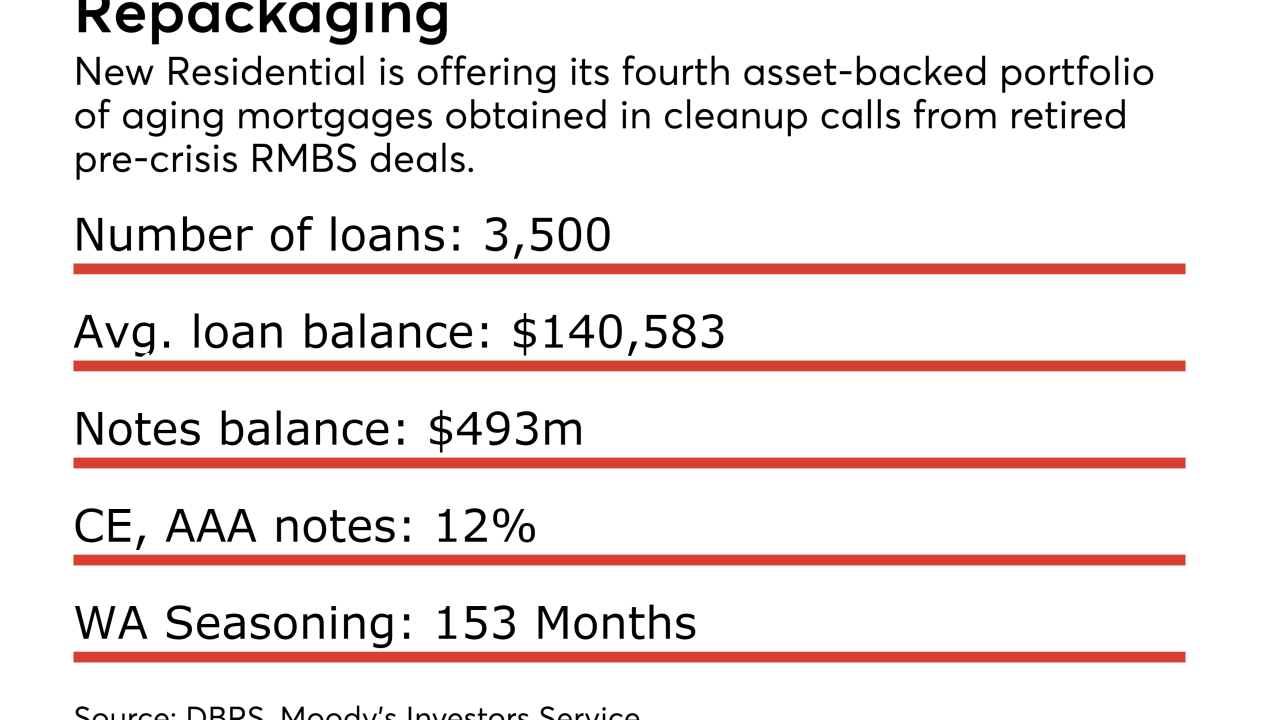

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

By Glen FestJune 28 -

Over 45% of the borrowers the collateral pool have FICO scores above 760, compared with just 36.42% in the marketplace lender's most recent transaction, completed in May.

By Glen FestJune 22 -

CLO managers who accept lower interest payments on loans risk running afoul of deal covenants; but if they take their money back, there are few attractive options for putting it back to work

By Glen FestJune 20 -

The move follows mounting criticism that many homeowners using property assessments to finance energy efficiency upgrades can neither understand, nor afford, the terms of deals.

By Glen FestJune 15 -

The $500 million commercial mortgage that serves as collateral was underwritten by Deutsche Bank and Citigroup; it allowed the building's owner, Alexander's, to cash out $187 million of equity.

By Glen FestJune 13 -

The Trump Administration’s anti-regulatory agenda has yet to permeate the Securities and Exchange Commission, which remains opposed to relief for collateralized loan obligations.

By Glen FestJune 9 -

The former Bear Stearns headquarters building at 245 Park Avenue, a long-time home to cornerstone financial services tenants as well as Major League Baseball, is the sole property backing a new single-borrower $500 million commercial mortgage securitization.

By Glen FestMay 12 -

Velocity Commercial Capital is launching a small-balance commercial mortgage securitization, according to Kroll Bond Rating Agency.

By Glen FestMay 4 -

Bayview Asset Management is marketing another $183 million of bonds backed by reperforming mortgages acquired last year from CitiFinancial Credit Co.

By Glen FestApril 28 -

The Loan Syndications and Trading Association is appealing directly to Treasury Secretary Steven Mnuchin to exempt collateralized loan obligation managers from rules requiring "skin in the game" of deals.

By Glen FestApril 13 -

Some are wording the language of amendments used to refinance deals so as to be able to benefit if risk retention rules are repealed.

By Glen FestApril 12 -

Mill City Holdings is returning to market with its fourth securitization of reperforming residential mortgages, this time with a sliver of home equity lines of credit added to the mix of collateral.

By Glen FestMarch 9 -

The bank is holding on to $31.7 million of the notes to be issued in the $635 million conduit transaction in order to comply with risk retention rules, according to ratings agency presale reports.

By Glen FestFebruary 23 -

Nonprime mortgage securitization has roughly doubled each of the last two years, and it shows no signs of stopping, according to Fitch Ratings.

By Glen FestJanuary 26 -

Opus Bank has completed a $509 million securitization of its multifamily loans through a Freddie Mac-sponsored "Q-deal" risk-transfer securitization.

By Glen FestDecember 27 -

JPMorgan is returning to a familiar structure as it again pools large-market prime jumbo mortgages for investors in collateralized residential mortgage loans.

By Glen FestDecember 16