Hannah Lang is a Washington-based reporter who writes about federal mortgage policy and the U.S. housing finance system for American Banker and National Mortgage News. She is a former multimedia reporter for the Capital News Service and a graduate of the University of Maryland at College Park.

-

The 2013 rule, which was weakened under the Trump administration, established a comparatively low bar for plaintiffs alleging discrimination.

By Hannah LangJune 25 -

Gordon is currently president of the National Community Stabilization Trust, a nonprofit organization that promotes neighborhood revitalization and housing affordability.

By Hannah LangJune 24 -

Thompson, who was most recently the deputy director of the FHFA’s Division of Housing and Mission Goals, replaces Mark Calabria, who was fired Wednesday afternoon.

By Hannah LangJune 23 -

President Biden removed Mark Calabria as Federal Housing Finance Agency director hours after a Supreme Court ruling made the move possible. The administration is expected to offer up a nominee who will prioritize affordable housing and racial equity in housing instead of reforming Fannie Mae and Freddie Mac.

By Hannah LangJune 23 -

The president will oust Federal Housing Finance Agency Director Mark Calabria, a Trump appointee, now that the high court says the chief executive can do so at will. It's "critical that the agency implement the administration’s housing policies," said a White House official.

By Hannah LangJune 23 -

A majority of the justices concluded that the law establishing the Federal Housing Finance Agency violated the Constitution when it said a president may only remove the agency's chief "for cause."

By Hannah LangJune 23 -

A congressional hearing on reforming the National Flood Insurance Program focused on whether mortgage companies need to disclose incremental risks even if a homeowner lives outside a federally designated floodplain.

By Hannah LangJune 17 -

The Department of Housing and Urban Development reinstituted the “affirmatively furthering fair housing" measure, which the Trump administration had argued was overly prescriptive, and promised a later rulemaking to bolster the policy.

By Hannah LangJune 10 -

The Federal Housing Finance Agency said it is reviewing compensation policies for Fannie Mae and Freddie Mac and requesting feedback from the public. Some have said the $600,000 limit for executives imposed by Congress makes it hard to find talent.

By Hannah LangJune 10 -

Financial institutions spent nearly $214 billion last year — an 18% jump from 2019 — to meet regulatory requirements for fighting financial crimes, a new study says. The spending included more staffing to manage risks posed by customer growth.

By Hannah LangJune 9 -

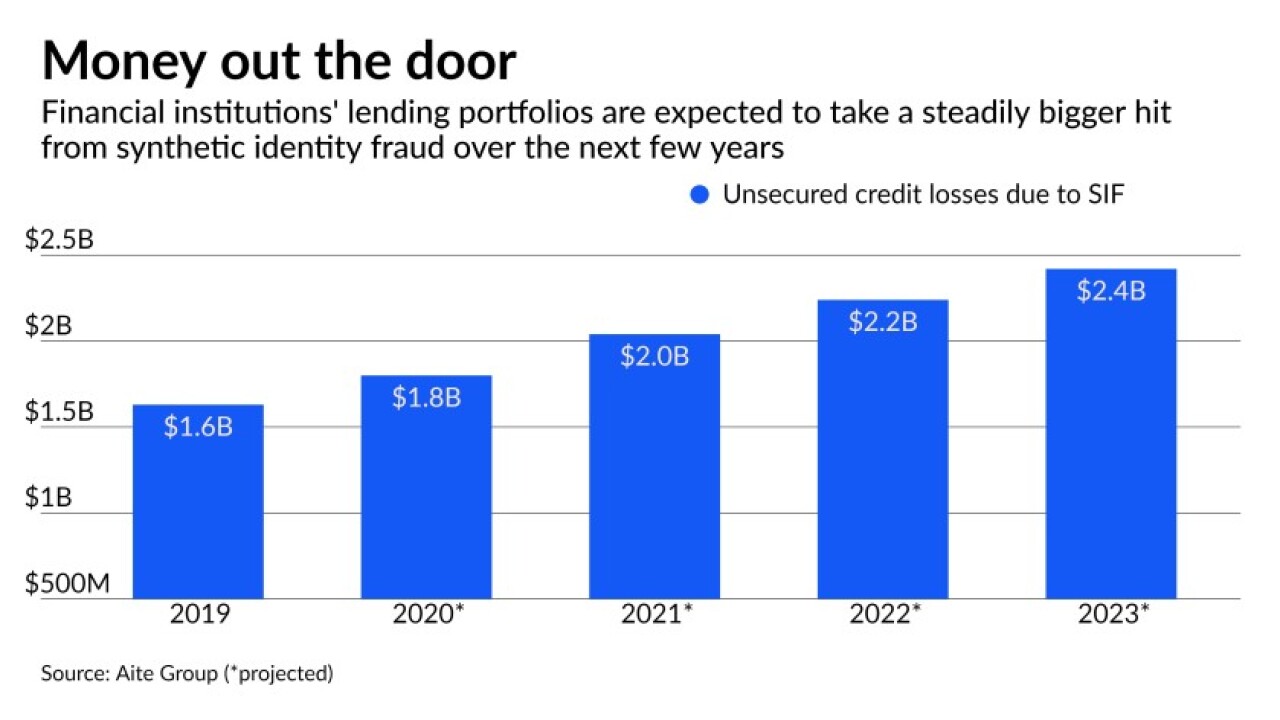

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

By Hannah LangJune 2 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

By Hannah LangMay 28 -

The Treasury secretary previewed President Biden's budget by urging lawmakers to fund the Financial Crimes Enforcement Network's establishment of a beneficial ownership regime.

By Hannah LangMay 27 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

By Hannah LangMay 18 -

Fannie and Freddie's regulator says the companies must comply with the new Qualified Mortgage standard by the summer, while the Consumer Financial Protection Bureau has extended the deadline to 2022. The conflicting timetables have stoked uncertainty in the market.

By Kate BerryMay 7 -

The head of the Federal Reserve appeared to support Congress’s expanding the scope of the Community Reinvestment Act to unregulated institutions, just as regulators weigh how to modernize the framework for banks.

By Hannah LangMay 3 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

By Hannah LangApril 28 -

It would be available to homeowners making 80% or less of their area’s median income who weren't eligible to tap into low rates last year.

By Hannah LangApril 28 -

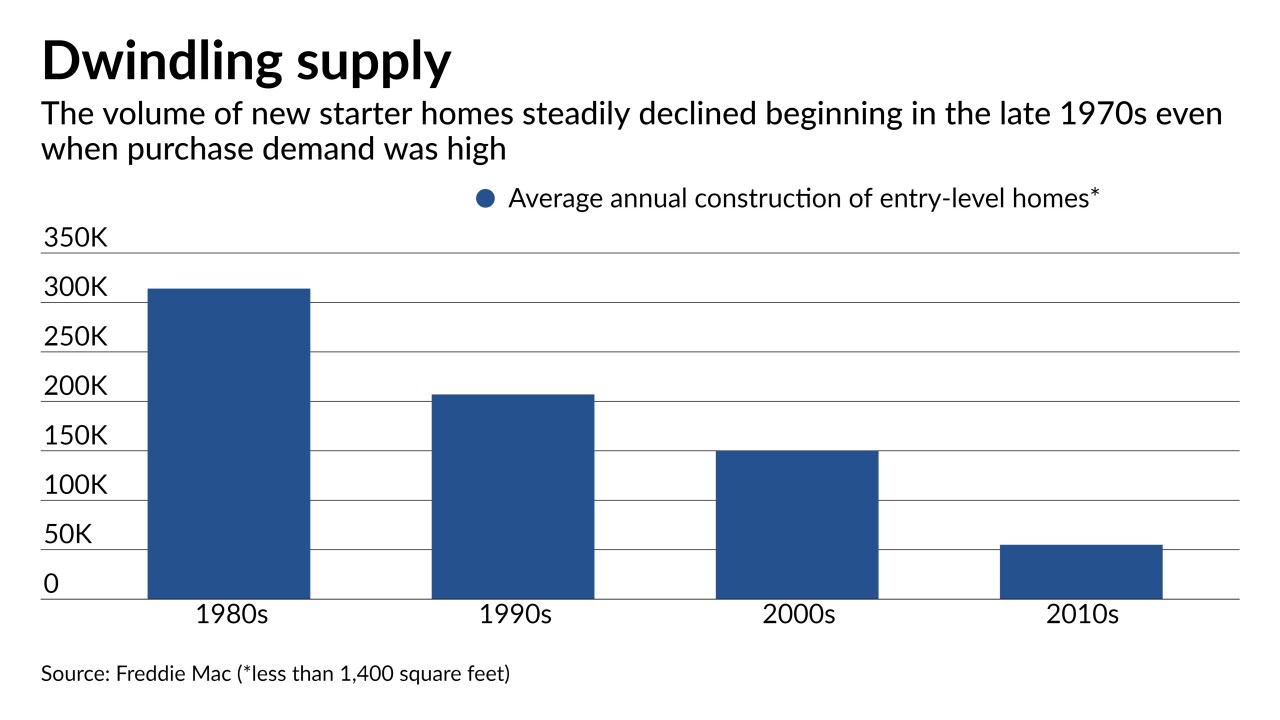

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

By Hannah LangApril 27 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

By Hannah LangApril 20