-

The COVID-19 pandemic has exacerbated income inequality in America, and that has implications for banks and other lenders. Among those suffering most: renters, front-line workers and minority small-business owners.

By Kevin WackAugust 23 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

By Jon PriorAugust 10 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

By Jon PriorAugust 2 -

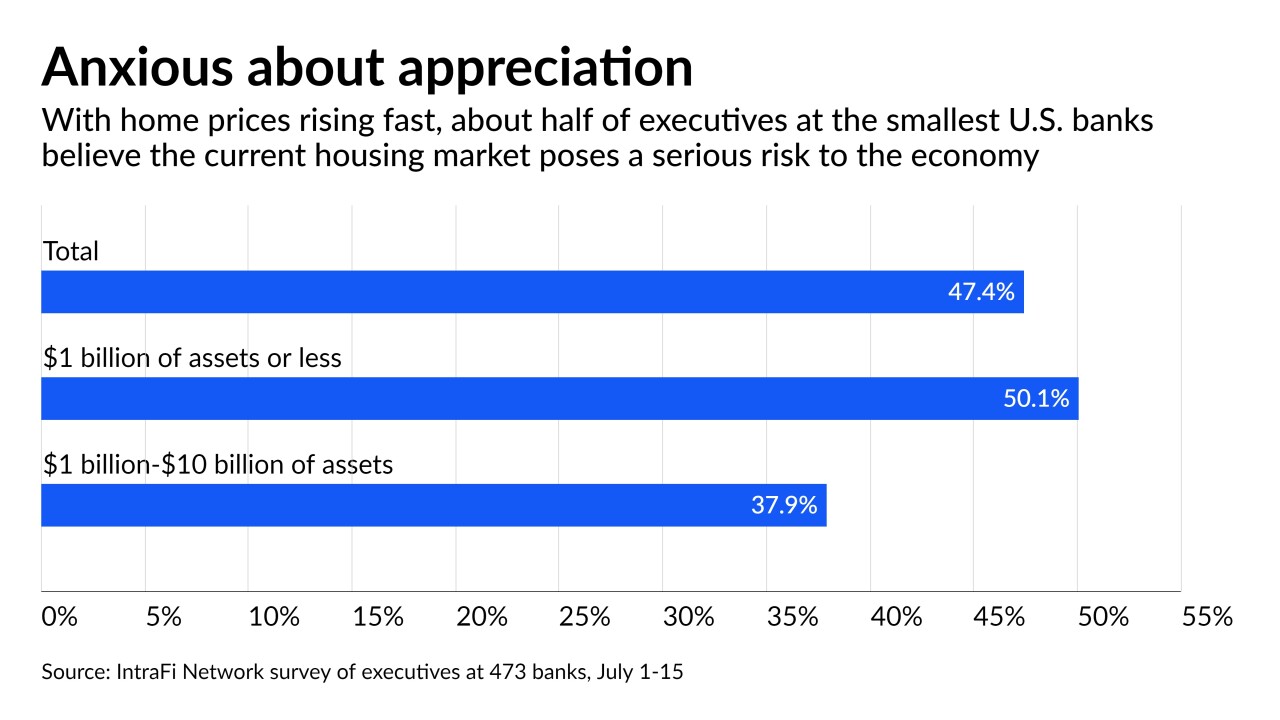

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

By Jon PriorJuly 27 -

The White House is calling on the Department of Justice and federal regulators to give bank deals more scrutiny as part of a broader executive order meant to encourage competition across the U.S. economy.

By Jon PriorJuly 9 -

The company expects loan growth in the “mid-teens” this year, despite concerns that a housing supply crunch could stymie new mortgage originations. “As soon as COVID fades into the background we'll pick up volume,” CEO and Chairman Jim Herbert said.

By Jon PriorApril 14 -

Already contending with stressed retail, hotel and restaurant loans, bankers are beginning to view office lending — historically a safe bet — as increasingly risky as companies of all types rethink their space needs.

By Jon PriorFebruary 28 -

The industry legend turned around a struggling Minneapolis company and even escaped a kidnapping to build the firm that is now the nation’s fifth-largest bank.

By Jon PriorJanuary 28 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

By Jon PriorJanuary 4 -

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

By Jon PriorDecember 18 -

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

By Jon PriorDecember 10 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

By Jon PriorNovember 17 -

The former FDIC chief oversaw the resolution of hundreds of failed banks during the financial crisis and knows how to build relationships with regulators. Those skills could be crucial in helping Fannie exit federal control.

By Jon PriorNovember 9 -

One of the top banking regulators during the 2008 financial crisis could have a hand in nudging Fannie Mae out of conservatorship.

By Jon PriorNovember 5 -

The Buffalo, N.Y., bank will pay a $546,000 penalty, which will be passed on to the National Flood Insurance Program to help offset costs.

By Jon PriorOctober 15 -

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

By Jon PriorSeptember 4 -

Late fees on loan payments and late-arriving documents tied to forbearance and loan forgiveness are just some examples of how delays caused by cutbacks at the U.S. Postal Service could affect lenders and their customers.

By Jon PriorAugust 24 -

Housing advocates say lenders should require property owners who request loan forbearance to pause evictions during the coronavirus pandemic. But the banking industry says what’s really needed is another round of government stimulus.

By Jon PriorAugust 16 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

By Jon PriorJuly 20 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

By Jon PriorJuly 15