Laura Alix is a reporter at American Banker.

-

Rather than pull up stakes and leave two low-income Mississippi towns at the mercy of payday lenders, Regions Bank donated the branches to a local credit union and kicked in another $500,000 for operating costs.

By Laura AlixNovember 7 -

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

By Laura AlixOctober 30 -

BOK Financial benefited from rising interest rates in the third quarter even as it reported declines in fee income and commercial real estate loan balances.

By Laura AlixOctober 25 -

Hawaii's booming economy contributed to the Honolulu bank's 10% increase in loans and 9% increase in deposits in the third quarter.

By Laura AlixOctober 23 -

Net income for the Oregon regional bank was $61.3 million, a slight decline from the same quarter last year. It earned 28 cents per share and fell short of analysts’ expectations,

By Laura AlixOctober 19 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

By Laura AlixOctober 13 -

A change in the formula that banks use to calculate borrowers’ debt-to-income ratios, announced by Fannie Mae in April, appears to be spurring more lending.

By Laura AlixOctober 6 -

At 1.56%, the delinquency rate on consumer loans remains well below historic averages, the American Bankers Association said Thursday.

By Laura AlixOctober 5 -

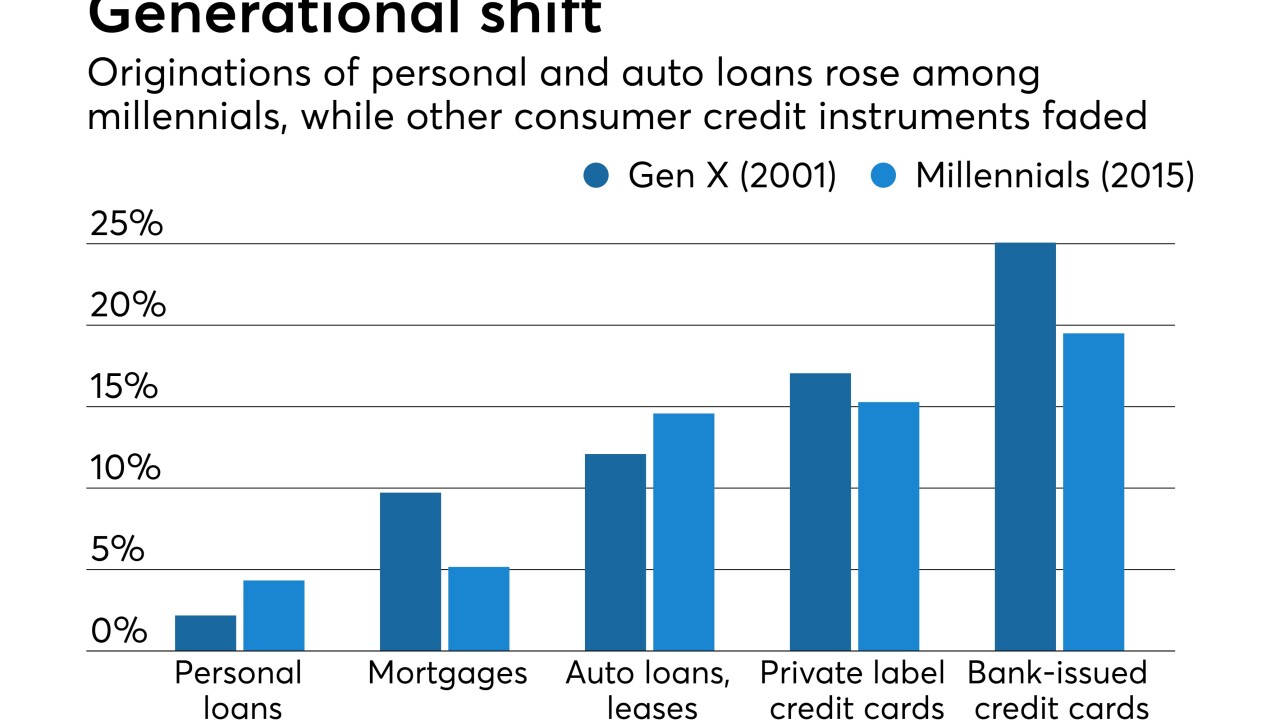

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

By Laura AlixSeptember 11 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

By Laura AlixAugust 1 -

The Salt Lake City company also benefited from increases in investment securities and several large loan recoveries during the quarter.

By Laura AlixJuly 25 -

Auto risks mounting. Mortgage market tightening. Are there any good risks these days in consumer lending? Regional bank executives insist partnerships with online lenders, unsecured personal loans and other niche efforts can work if done properly.

July 21 -

The Pittsburgh company, pleased with employee and client retention from its March purchase of Yadkin Financial, is looking to hire lenders from other institutions.

By Laura AlixJuly 20 -

The Buffalo, N.Y., bank also said commercial and consumer lending ticked up, while residential real estate fell during the second quarter.

By Laura AlixJuly 19 -

The Georgia company made more loans and controlled costs. As a result, it had a 1% return on assets and an efficiency ratio below 60%.

By Laura AlixJuly 18 -

On the first big day of 2Q results, bankers said their investments in middle-market lending have started paying off. JPMorgan Chase and PNC have added commercial loan officers in new markets across the country.

July 14 -

While the courts have affirmed cities’ right to file predatory lending suits, they are also now holding them to a much higher standard in proving that banks knowingly steered minority borrowers into high-cost home loans.

By Laura AlixJune 14 -

Canada's big banks are pursuing wholesale banking, capital markets and select M&A opportunities across the border to hedge against a slowing mortgage market and other economic concerns on the home front.

By Laura AlixMay 26 -

The city joins a growing list of municipalities that have filed similar lawsuits, just two weeks after the Supreme Court ruled that municipalities have standing to sue lenders under the Fair Housing Act.

By Laura AlixMay 15