-

The Money Source has filed three provisional patent applications as part of its efforts to develop new innovations in mortgage servicing, including the use of blockchain technology.

February 27 -

Figure, the startup headed by Mike Cagney, uses blockchain technology to provide home equity loans in as little as five days. It intends to use the newly raised funds to offer other services, including wealth management.

February 27 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22 -

Mike Cagney, who built SoFi into America's biggest student loan refinancer before quitting amid allegations of sexual harassment at the fintech firm, is preparing for his second act: a startup offering home-equity loans.

April 30 -

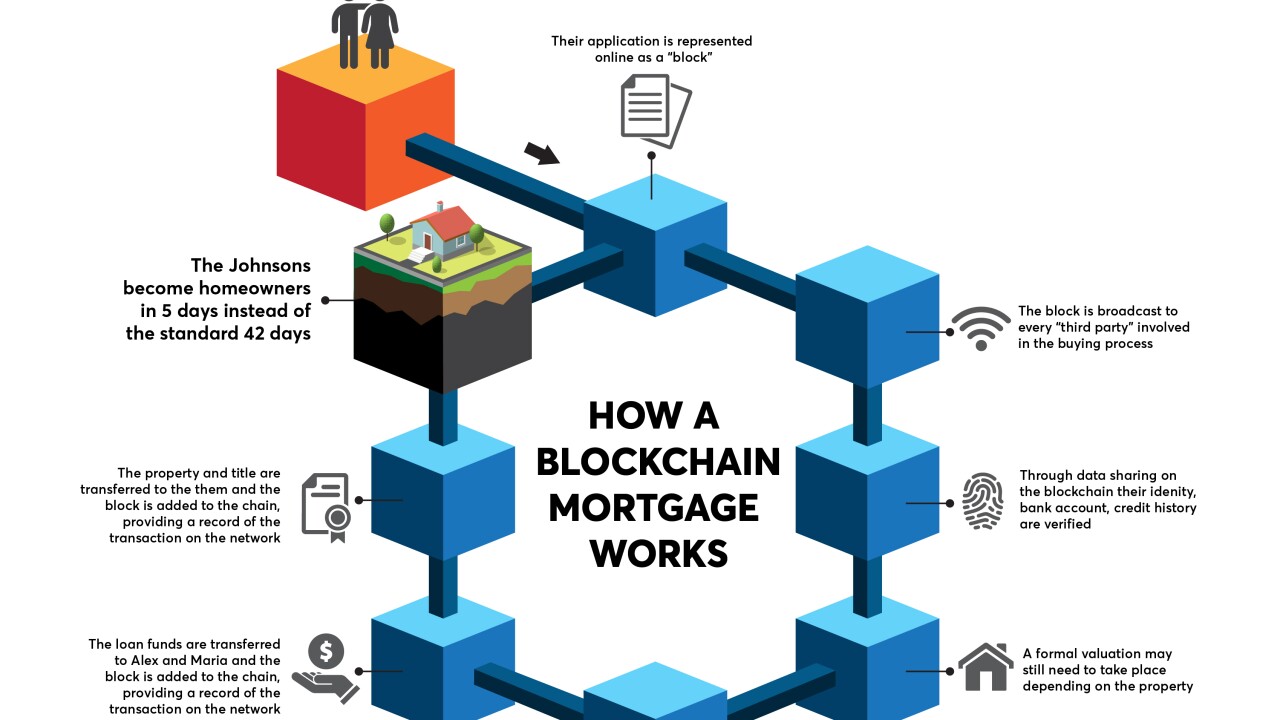

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

Ranieri Solutions, a fintech investment firm in the mortgage space, has partnered with blockchain and smart contract company Symbiont to explore opportunities to implement blockchain technology in the mortgage industry.

April 6 -

Governments are studying ways blockchain can safeguard property records and simplify how they get tracked.

March 26 Hodgson Russ

Hodgson Russ -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

Startups that have developed the technology for real estate finance are starting to conduct a broader array of transactions, including property sales.

January 2 -

Block One Capital has signed a binding term sheet to acquire 40% of the equity of Finzat, a private entity aiming to develop a blockchain system to create a safer, more compliant digital mortgage process.

December 6 -

During his time as Fed governor, chair-designate Jerome Powell has outlined his views on a host of bank regulatory matters, including the need for regulatory relief, the push for housing finance reform, blockchain and much more.

November 5 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

Collaboration will help make up for cost concerns from adopting the technology and ensure that the core vendors get the message of community banks’ interest.

August 14 U.S. Century Bank

U.S. Century Bank