CFPB News & Analysis

CFPB News & Analysis

-

Majority Leader Mitch McConnell filed a motion for cloture on the nomination of Kathy Kraninger to run the agency, setting up a potential vote later this month.

November 15 -

Regulators typically write rules before applying them. But the CFPB is attempting the reverse.

November 11 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Questions surrounding Eric Blankenstein, a senior CFPB official whose racially charged writings from over a decade ago have led to calls for his resignation, have been referred to the agency's watchdog.

October 16 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac have launched an online clearinghouse with resources to assist lenders in serving borrowers with limited English proficiency.

October 15 -

Retiring baby boomers will intensify the affordable housing shortage unless public officials find a way to add significantly more low-cost homes to the market.

October 12 -

The uproar over the incendiary writings of a Consumer Financial Protection Bureau official have led to calls for his removal, but the agency’s interim chief says he won’t “let any outside group dictate who works here.”

October 11 -

Senate Democrats on Wednesday called for acting CFPB Director Mick Mulvaney to reveal the vetting process that led to the hiring of a political appointee whose past incendiary writings have caused an uproar at the agency.

October 3 -

The senior Democratic lawmaker said the CFPB chief and the Trump administration "are doing everything in their power to roll back consumer protections."

October 2 -

The head of the National Treasury Employees Union said the appointment of Eric Blankenstein to a senior role “reflects poorly on CFPB management.”

October 2 -

Eric Blankenstein, a political appointee overseeing fair-lending policy at the agency, said in an email to staff that his blog posts from 14 years ago that used a racial epithet “reflected poor judgment.”

October 1 -

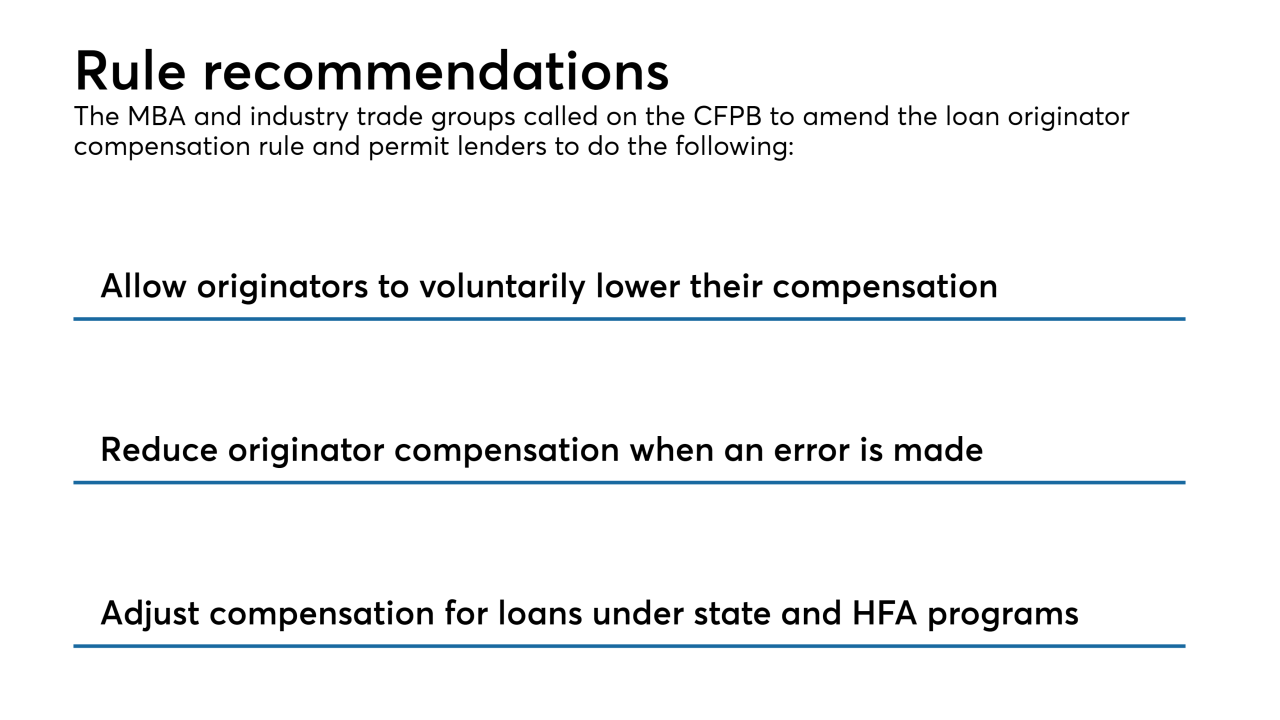

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

What started as a single senior official at the CFPB voicing concerns about blog posts written 14 years ago by Eric Blankenstein, a top agency political appointee, is rapidly becoming a rising chorus of discontent.

September 30 -

A former Ocwen Financial executive is settling Securities and Exchange Commission charges that he engaged in insider trading related to his company's dealings with Altisource Portfolio Solutions following a CFPB enforcement action and its upcoming merger with PHH Corp.

September 28 -

The head of the agency’s fair-lending office cast doubt on a proposed reorganization of her office and raised concerns about blog posts written years ago by the political appointee overseeing the project.

September 28 -

At least six Trump administration picks to fill financial posts are still pending, but the bitterly partisan divide over Judge Brett Kavanaugh has taken up most of the energy in Congress.

September 28 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26