-

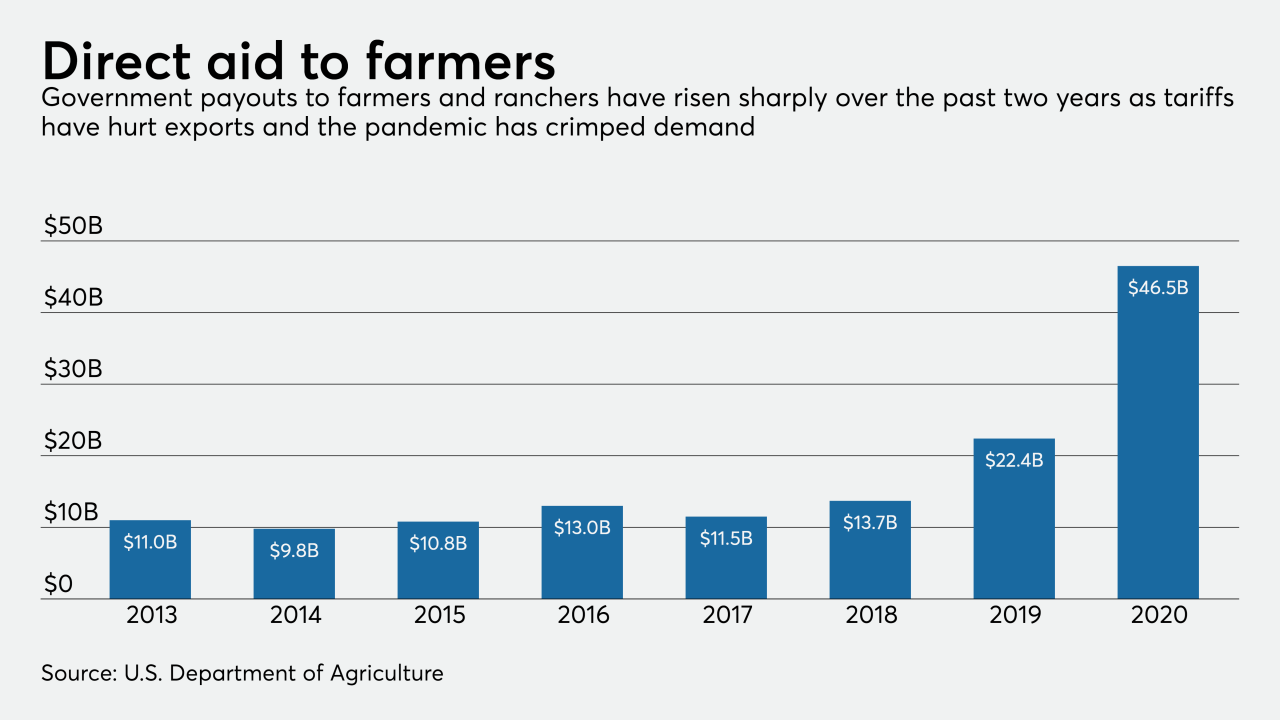

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

People with scores below 500 are often in communities that suffer the most from economic hardship and violence. Banks and regulators can do more to qualify them for financing, ultimately creating healthier local economies.

December 2 Operation HOPE Inc.

Operation HOPE Inc. -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Brookfield and JV partner Swig Co. are refinancing debt and cashing out $200M in equity in the iconic, sloped-base midtown Manhattan office tower.

November 5 -

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

The bank operating system’s integration with a technology platform for construction loans adds to indications of nCino’s increasing relevance to real estate-secured lending.

October 29 -

The predominantly white universe of real estate investors may be used to working with people and companies with enough financial resources to have a track record in the business, but historic inequities have limited those opportunities for Black executives.

October 16 -

Providers, including investors in low-income housing tax credits, have become hesitant to make deals.

October 14 -

Deferrals may be hiding credit issues, leading lenders to track deposit flows, property maintenance and other factors to gauge the true health of their portfolios.

October 8 -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

September 23 -

Commercial real estate companies are among those left out of the Federal Reserve’s middle-market relief program, but House members said they need government-backed financing to navigate the pandemic as much as anyone.

September 22 -

Congress should pass legislation that would allow Home Loan banks to backstop deposits by local governments at commercial banks and lower the cost of bond financing, two mayors argue.

September 16 City of Miami

City of Miami -

A new report on bank-held commercial real estate and C&I loans indicates troubled borrowers may be skipping payments on loans they won't be able to refinance or extend over the next year, leading to a potential wave of defaults over the next four to six quarters.

September 15 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

While cutting losers to buy winners is an age-old investment proposition, the Covid-19 pandemic may create even more openings than the past crises that became bonanzas for real estate investors.

August 24 -

The CFPB is giving stakeholders until Dec. 1 to file comments on a potential overhaul to its rules related to the Equal Credit Opportunity Act, which prohibits discrimination in credit and lending decisions.

August 20

![Fed Chairman Jerome Powell said the central bank had previously concluded that asset-based borrowers were able to secure financing elsewhere. Treasury Secretary Steven Mnuchin said “small hotels do not fit into [the Main Street Lending Program] because they already have other indebtedness.”](https://arizent.brightspotcdn.com/dims4/default/71a30be/2147483647/strip/true/crop/1600x900+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fb3%2F79%2F3b1db6264efa9eab86e05b296afc%2Fpowell-jerome-mnuchin-steven-bl-092220.png)