-

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13 -

Whether Congress and/or the mortgage industry is able to untangle two opposing threads in the Trump administration's plans is anyone's guess.

September 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Deutsche Bank is cooperating with the Justice Department's antitrust investigation into whether several of the largest global banks conspired to rig trading in unsecured bonds issued by Fannie Mae and Freddie Mac.

September 12 -

The Supreme Court may be closer to examining a key restraint on a president's ability to change CFPB leadership.

September 12 -

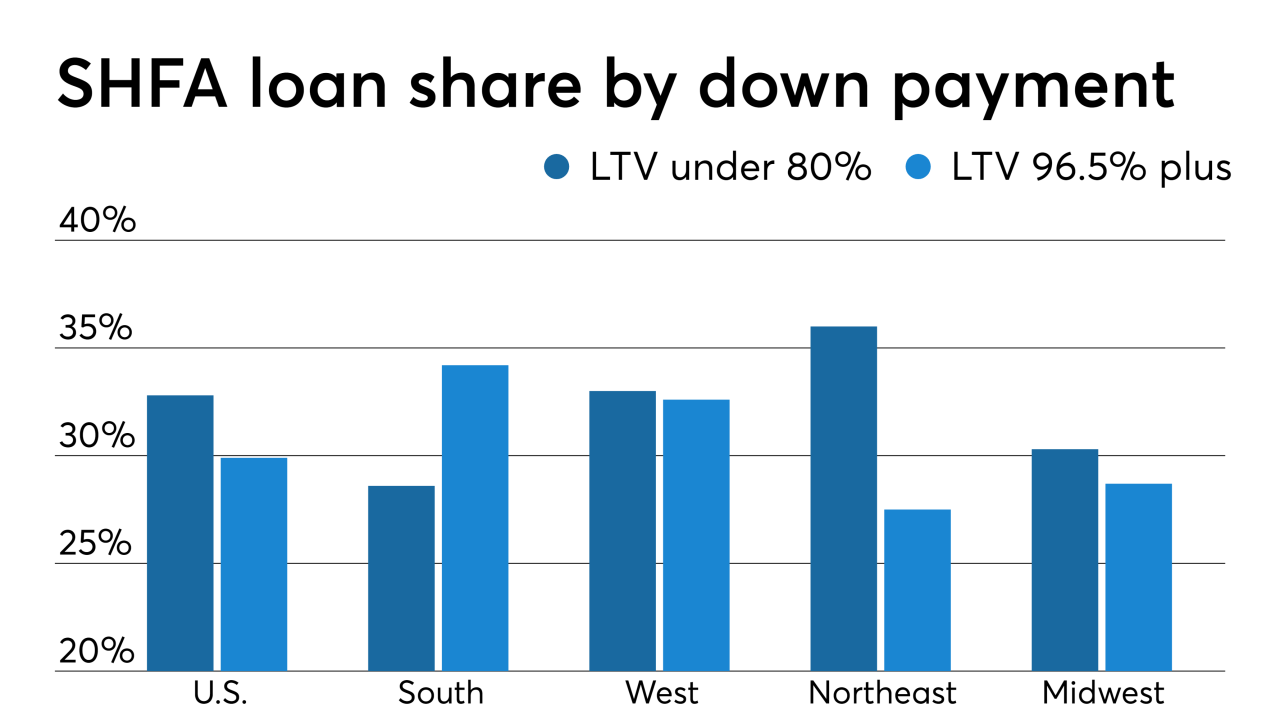

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

The regulator for Fannie Mae and Freddie Mac suggested that a finalized capital framework for the two mortgage giants could be published by the end of the year.

September 11 -

A West Chicago, Ill., property developer is accused by federal authorities of operating a Ponzi scheme that defrauded more than 300 investors in 32 states of at least $41.6 million.

September 11 -

Federal appeals court judges in New Orleans on Friday appeared to back claims by investors that Treasury's "net worth sweep" is illegal.

September 10 -

Senate Banking Committee members feel urgency to pass a bill dealing with Fannie Mae and Freddie Mac, but the same obstacles that have stalled congressional action for years remain.

September 10 -

Stewart Information Services has decided to make some big changes at the top following the dissolution of a planned merger with Fidelity National Financial.

September 10