-

Equitable Group Inc. and Home Capital Group Inc. are reaping a windfall from Canada's tighter mortgage regulations.

July 31 -

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

Some believe the administration will delay action on Fannie Mae and Freddie Mac to avoid any political fallout. Others say the window for reform is closing.

July 29 -

The Department of Housing and Urban Development approved a settlement in favor of the California Reinvestment Coalition against CIT Group's OneWest Bank, which Steven Mnuchin ran before he became Treasury secretary.

July 29 -

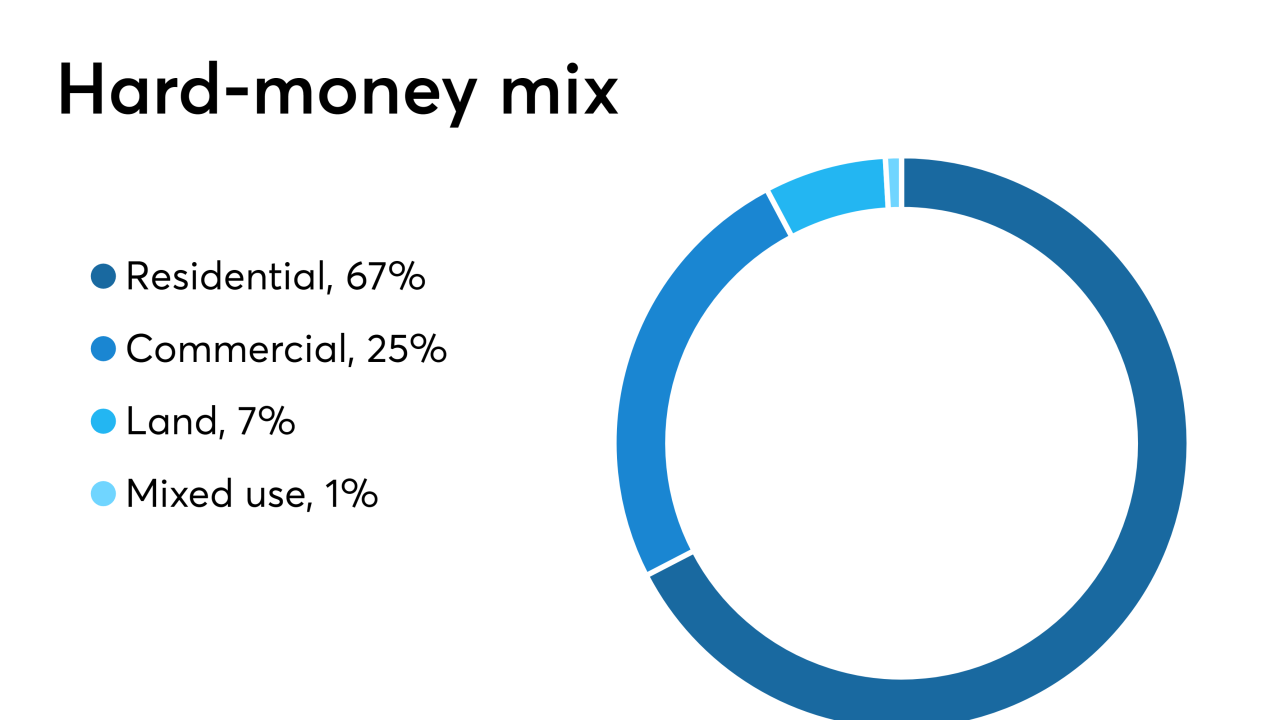

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

The. U.S. housing market is splitting along racial lines, with black homeownership dropping to the lowest level since at least 1970 — just two years after the Fair Housing Act was passed.

July 26 -

The agency’s director said it will let a temporary GSE exemption from the “qualified mortgage” regulation expire.

July 25