Consumer banking

Consumer banking

-

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

The regulators have yet to complete rules on regional bank supervision, community bank capital and other provisions meant to ease institutions' burden.

August 1 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

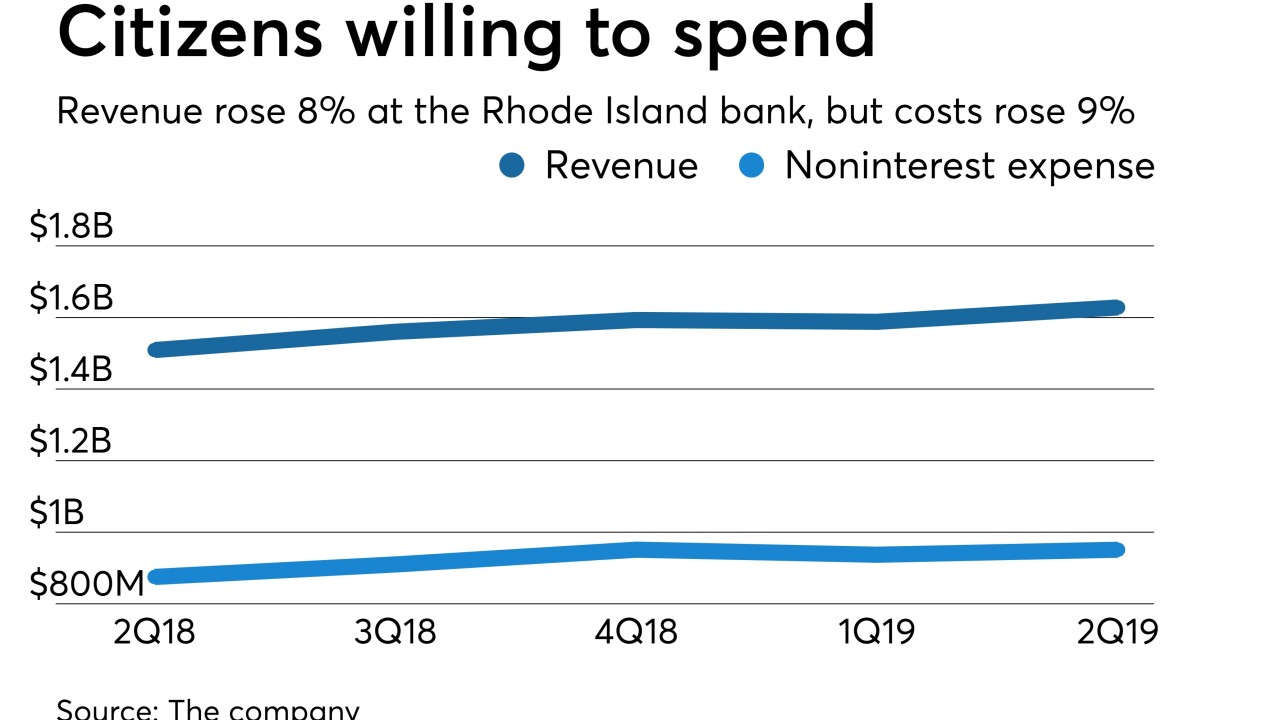

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

As budget questions loom over the most popular Small Business Administration loans, lenders have embraced the previously overshadowed 504 program after a key policy tweak.

July 18 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

As policymakers mull ways to update the 42-year-old Community Reinvestment Act, economists at the San Francisco Fed have put forth a novel proposal.

July 2 -

The bank said it could record a $7 million charge in the second quarter after the client unexpectedly closed in May.

July 1 -

The ban, which came to light Monday, will remain in effect until either the final disposition of Stephen Calk’s court case or until it is terminated by Comptroller Joseph Otting.

July 1 -

FB Financial is selling its correspondent lending channel to Rushmore Loan Management Services, which will complete the bank holding company's restructuring of its mortgage business.

June 27 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Nearly half the nation's state regulators have agreed to a new multistate licensing business for money servicers, including fintechs.

June 24 -

Large banks had huge losses from originating mortgages in 2018 as costs were three times higher than similar-sized independent lenders, according to research conducted by Stratmor and the Mortgage Bankers Association.

June 21 -

All of the Seattle company's directors, including CEO Mark Mason, were backed by shareholders despite a challenge by Blue Lion Partners.

June 21 -

House Financial Services Committee Chairwoman Maxine Waters and Rep. Patrick McHenry, the top GOP panel member, said Facebook must testify about Project Libra.

June 18 -

Banks fear that more competition from nonbanks in commercial real estate will drive down pricing and lead to a relaxation of terms.

June 14 -

The Indiana company, which has an acquisition pending, will make more loans in minority neighborhoods around Indianapolis.

June 13 -

Sens. Elizabeth Warren, D-Mass., and Doug Jones, D-Ala., cited research that found algorithmic lending can lead to higher interest rates for minority borrowers.

June 12