-

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

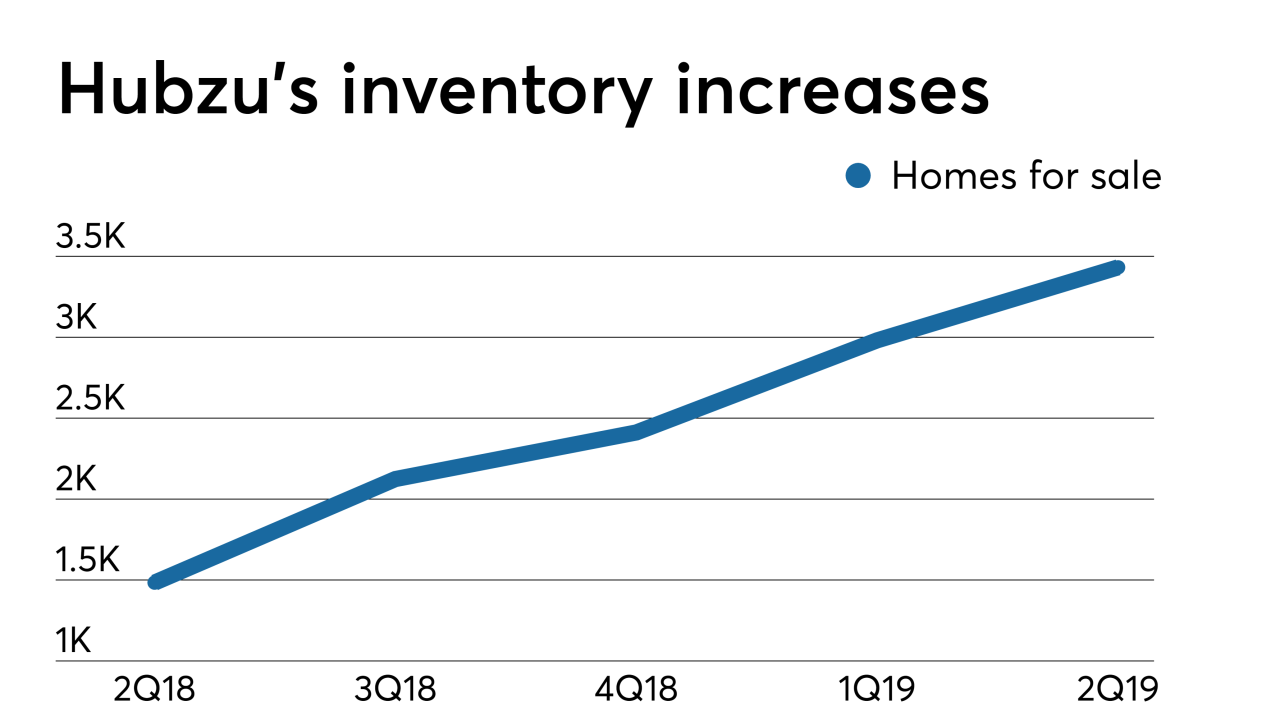

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

Marianne Lake, seen in recent months as a leading candidate to replace CEO Jamie Dimon, got the post she may have needed to round out her resume — consumer lending chief. And Jennifer Piepszak, another rising star at the company, will take over as CFO from Lake.

April 17 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

Tim Sloan couldn't hang on any longer. Here are insights about why he left now, what role policymakers played in the decision and will continue to have in the company's future, and who in the world would want to lead Wells Fargo.

March 28 -

Borrowers were more than twice as likely to use a lender they found online in 2018 as they were in 2017, making search engines the mortgage industry's top source of referrals.

March 12 -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

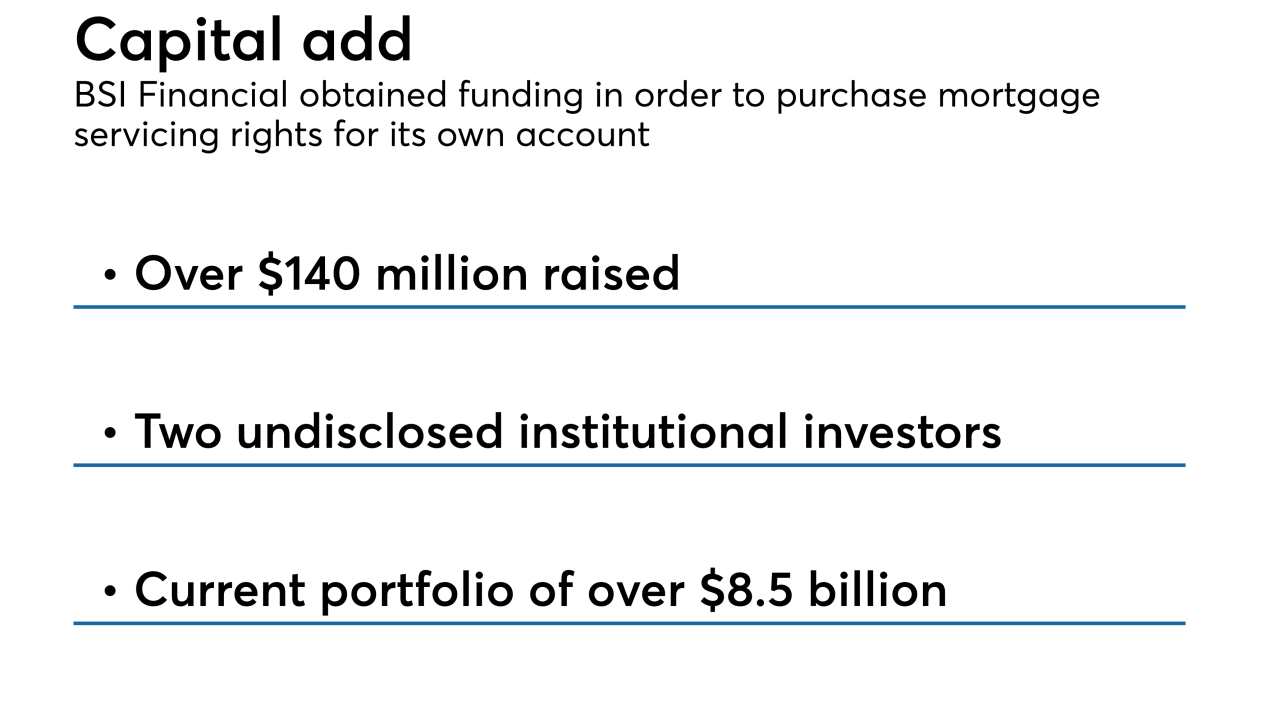

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

February 21 -

The industry's largest acquisition in more than a decade will create the sixth-biggest bank in the country, with assets of more than $442 billion.

February 7 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

Bank OZK's George Gleason, one of our community bankers to watch in 2019, needs to rein in the Arkansas bank's commercial real estate exposure to placate nervous investors.

December 31 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31 -

As ominous as the dark smoke that choked the Bay Area while California's most destructive wildfire raged 200 miles north, a second tragedy now is looming over the state — the loss of thousands of homes in an already housing-starved region.

December 5 -

The Woolsey Fire in Southern California destroyed or damaged as much as $6 billion in real estate, a new estimate shows.

November 28 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Challenges will likely increase as interest rates rise and investors grow more concerned about a downward turn in the economic cycle.

November 16