-

A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

February 5 -

Community banks generally make digital a consumer play, but TransPecos Bank, with its BankMD brand, is focusing on doctor practices, which tend to weather economic downturns well.

February 1 -

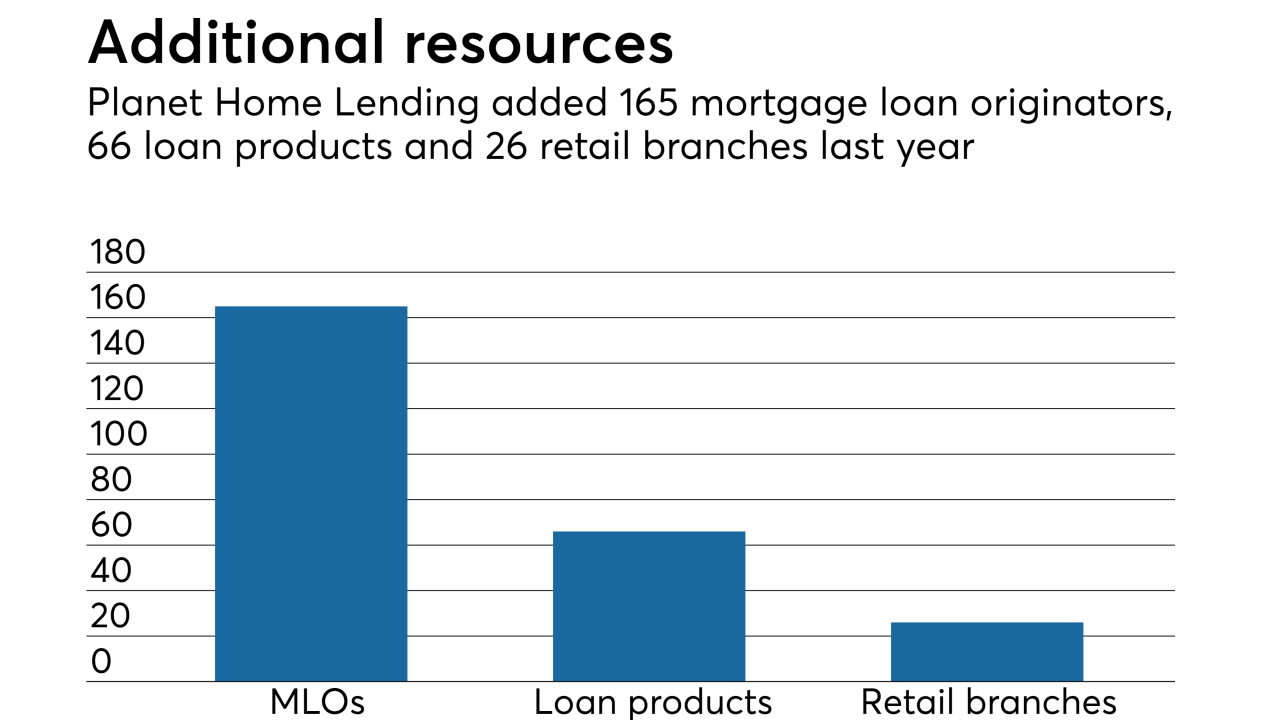

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

January 29 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

MGIC Investment Corp. responded to the broad-based roll out of "black box" pricing engines from the other mortgage insurers by bringing its version to market.

January 17 -

As the industry shuffles closer to completely digital mortgages, the next wave of technology aims to usher in total automation and uniformity.

January 16 -

Radian and Essent will make their "black box" mortgage insurance pricing methods live on Jan. 21, leaving MGIC as the only company yet to announce its adoption.

January 14 -

The mortgage industry faces myriad questions and challenges in 2019. Here's a look at 12 executives who will be behind the waves being made this year.

January 8