-

ClosingCorp, a San Diego-based provider of closing cost data, has purchased the WESTvm mortgage loan order management technology from West, an affiliate of Williston Financial Group.

January 8 -

WeWork co-founder Adam Neumann's family office is in discussions to put additional capital in Peach Street Inc., a startup focused on mortgage servicing.

January 7 -

Quicken Loans, which has a history of advertising its Rocket Mortgage digital application with high-profile Super Bowl promotions, is doubling down on its ties to the National Football League event.

January 7 -

Wyndham Capital Mortgage realigned its executive suite with the promotions of Ben Cowen to president and Josh Hankins to chief operating officer.

January 6 -

There are no statutory restrictions on the books in any state prohibiting lenders from conducting mortgage closings electronically or remotely.

December 20 NotaryCam

NotaryCam -

Better.com saw huge growth in mortgages to traditionally underserved customer bases in 2019 and believes digital applications led to the avoidance of discriminatory lending.

December 17 -

Hometap, a fintech company providing an alternative to traditional home equity lending, secured $100 million in new financing as it looks to expand its geographic reach.

December 11 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 4 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

-

What the initiation of the California Consumer Privacy Act means for the mortgage industry.

December 2 -

In a recent interview, Plaza Home Loans CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

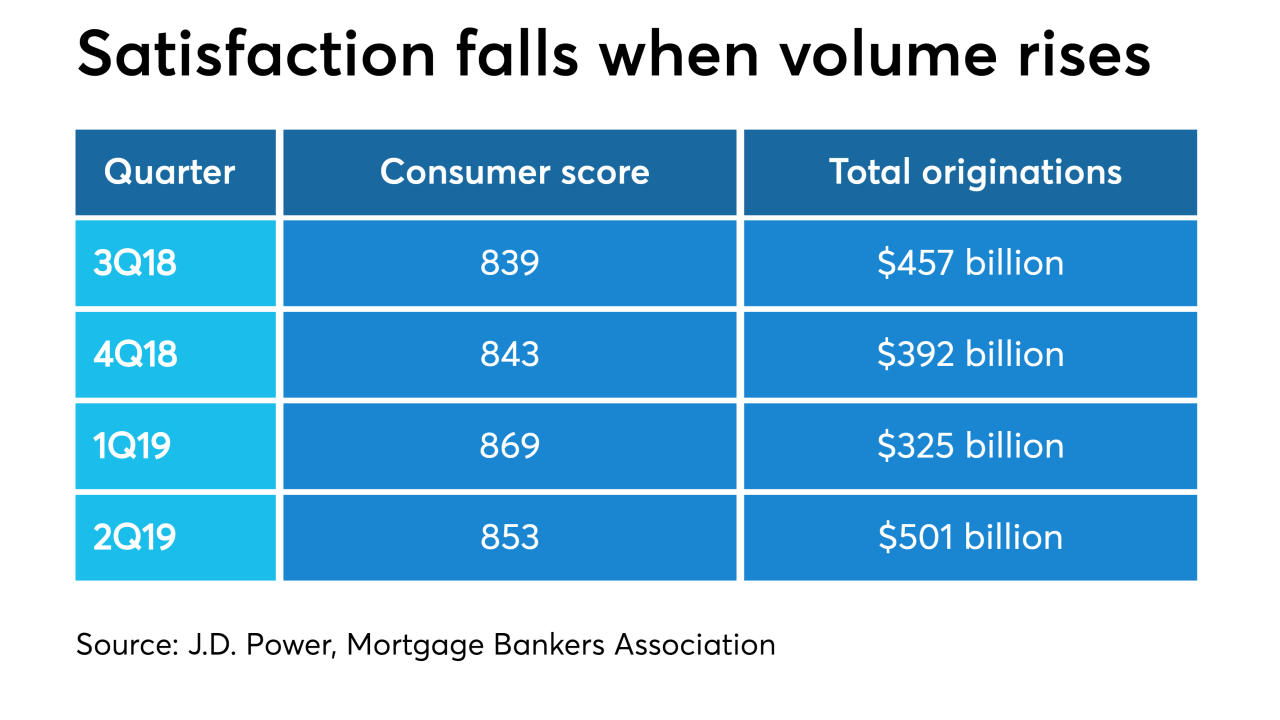

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

-

In the latest example of a new wave of mortgage-related fintech investment, Snapdocs will boost its artificial-intelligence capabilities with its new $25 million funding round.

November 7 -