Earnings

Earnings

-

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

The bank is expecting to benefit from the discount airline's first flights to the Aloha State even as a white-hot local housing market starts to cool.

April 22 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

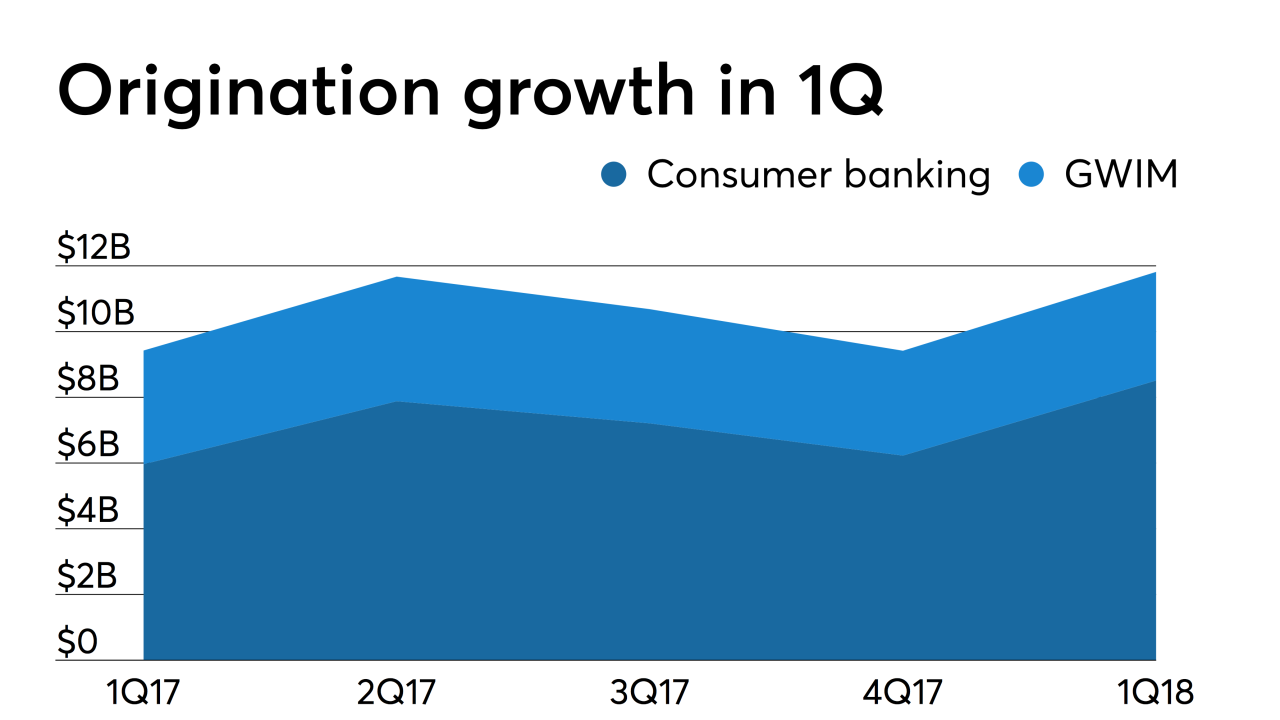

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase could be an early sign of an improving industry.

April 12 -

The Los Angeles bank will take a $1.4 million hit to earnings after the multifamily properties sold for less than their book value.

April 1 -

Falling mortgage rates are giving a lift to homebuilders just in time for the key spring selling season.

March 27 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

The California banking company has two loans tied to DC Solar that are on nonaccrual status.

March 15 -

Falling interest rates contributed to efforts that helped Hovnanian Enterprises nearly halve its net loss during its fiscal first quarter, when it maintained a strong sales pace by selling more low-priced homes.

March 11 -

Mark Calabria, who could be confirmed as early as this month, is expected to focus on changes to Fannie Mae and Freddie Mac’s conservatorships to let the mortgage giants keep more of their profits.

March 10 -

Mr. Cooper Group took a net loss of $136 million in the fourth quarter after lower rates hurt the mark-to-market value of its larger mortgage servicing rights portfolio harder than its peers.

March 7 -

New York regulators rejected Fidelity National Financial's acquisition of Stewart Information Services because the combination would have a dominant share of title insurance in the state.

March 6 -

Arch Capital Group named Michael Schmeiser president and CEO of its U.S. mortgage insurance business as the former head moved up the corporate ladder.

March 4 -

Ocwen Financial reduced the size of its net loss by nearly half during 2018 thanks to cost-cutting measures, and economies of scale from its acquisition of PHH Corp.

February 27 -

CoreLogic's fourth-quarter earnings declined from the previous year because of the slower mortgage origination market and an $8 million impairment charge due to its restructuring plans.

February 27 -

Altisource Portfolio Solutions recorded multimillion-dollar net losses in the fourth quarter and the full year for 2018, due to the reduction of the Ocwen Financial servicing portfolio and other repositioning activities.

February 26 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

Zillow Group Inc., the housing search website that's taken a hit to its stock price as it pursues an ambitious plan to buy homes and originate mortgages, is bringing back its first chief executive officer to lead the transformation.

February 21