Earnings

Earnings

-

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

Earnings at four of the private mortgage insurers increased significantly over last year's third quarter even as total mortgage origination volume shrunk during the same time frame.

October 31 -

Black Knight's third-quarter net earnings were slightly below the same period last year, although total revenue increased by 7% compared with one year prior.

October 30 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25 -

Builder M/I Homes set third-quarter records in four areas and recorded consistent levels of mortgages held for sale in its most recent earnings results.

October 24 -

Despite an overall weak mortgage originations market, Flagstar Bancorp's third-quarter earnings grew 20%, due in large part to its ongoing efforts to diversify operations.

October 23 -

The company is facing criticism after a big chargeoff on two properties, showing that investors have little patience when a risky business model shows signs of distress.

October 19 -

Rising mortgage interest rates not only will continue to constrain banks' once-robust revenue from this business, they will also affect existing borrower credit quality, a report from Moody's said.

October 19 -

The Providence, R.I., company reported a 27% gain in profits thanks partly to a boost in fee income from its purchase of Franklin American Mortgage in August.

October 19 -

The Portland, Ore, company also benefited from lower expenses and an improved efficiency ratio.

October 18 -

MGIC Investment Corp.'s quarterly earnings were again driven by better-than-expected loss development, and those favorable results should be seen in the other private mortgage insurers' results as well, an industry analyst said.

October 17 -

A notable drop in home equity lending at Bank of America during the third quarter contributed to an overall decline in new single-family loans produced by the company.

October 16 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

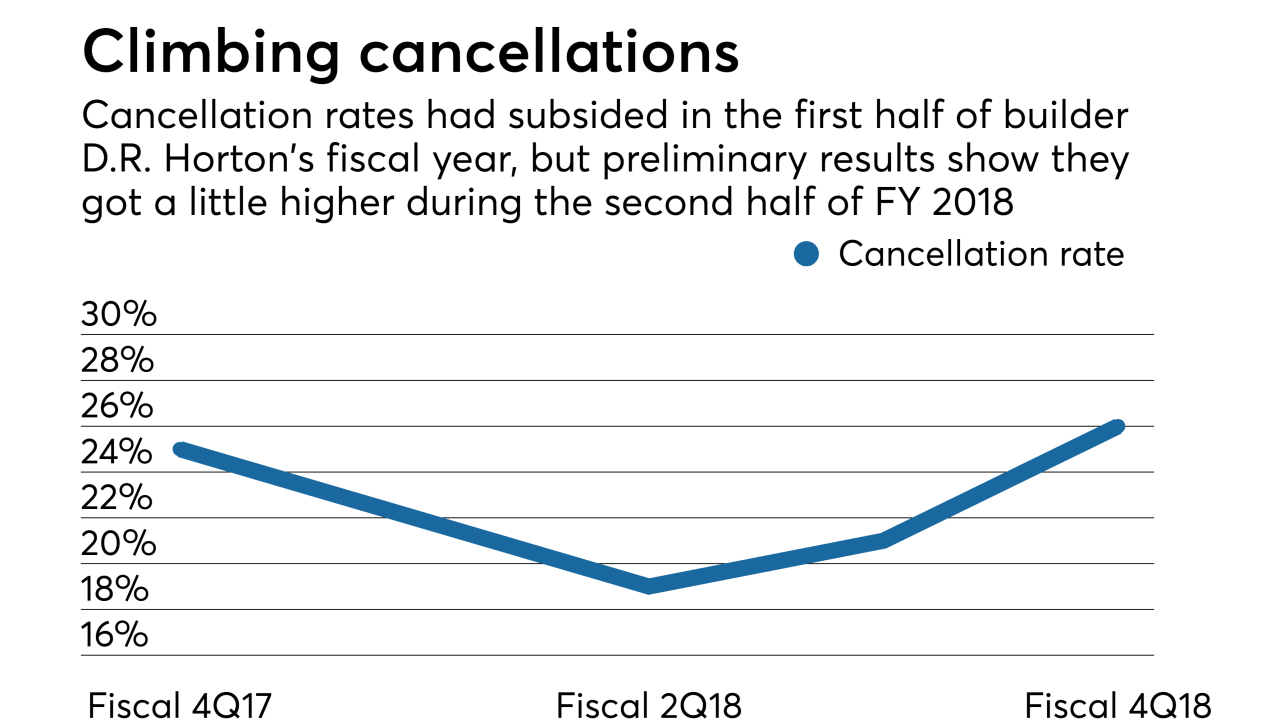

D.R. Horton is selling more homes, but its cancellation rates also are higher in the company's primary fiscal year results, a sign that rising mortgage rates may be affecting the market.

October 9 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

A deceleration in mortgage balances ends CIBC's three-year streak of outpacing Canada's other large lenders on mortgage growth. Royal Bank of Canada said this week that mortgage balances were 5.9% higher than a year earlier.

August 23 -

Ditech will eliminate 450 positions when it closes its Rapid City, S.D., call center late next year, as the company seeks to regain profitability after emerging from bankruptcy.

August 17 -

Ditech Holding Corp. posted a net loss of $40.5 million in its first full operating quarter since emerging from bankruptcy protection in February.

August 9 -

Redwood Trust's net income was down 30% from the prior quarter as mortgage banking activities earnings fell by 60%.

August 8