Earnings

Earnings

-

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

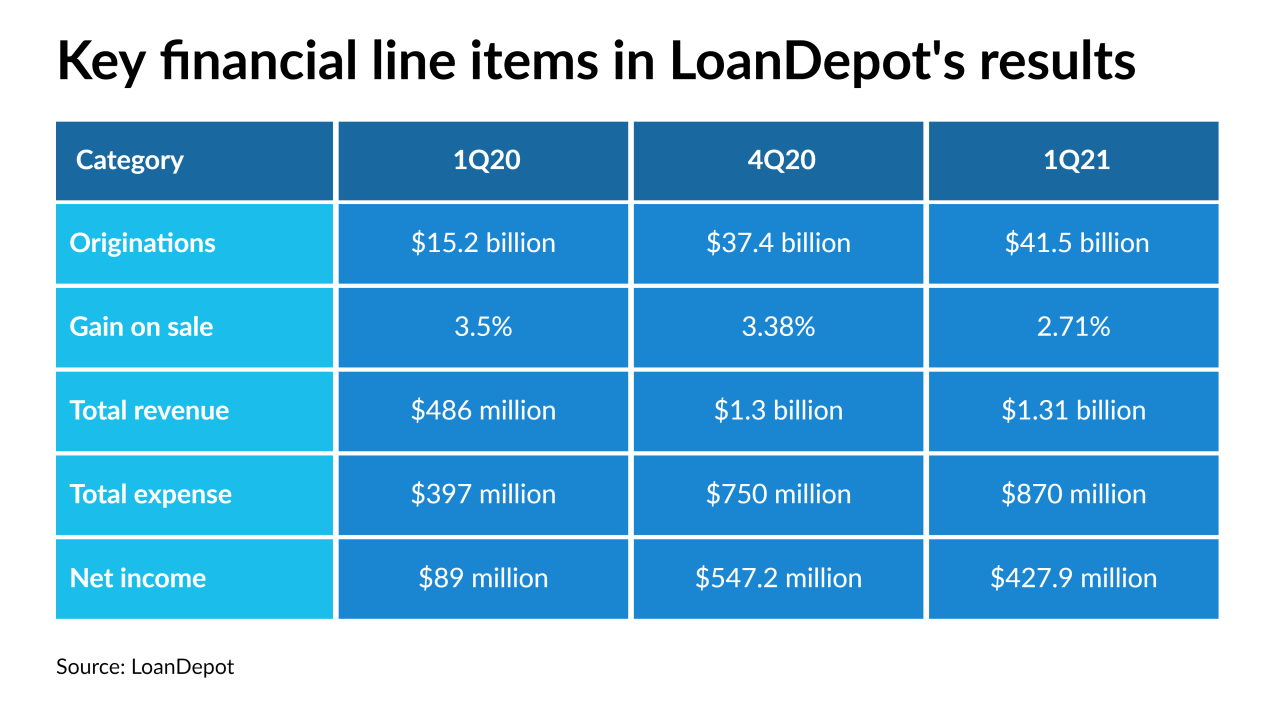

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

The West Palm Beach, Fla.-based lender sees an opportunity for even more growth after its deal to acquire a servicing portfolio from Texas Capital Bank.

April 29 -

The company says its first quarter net income nearly doubled from its showing in Q4 2020, due in part to cost-cutting and servicing income. It also revealed more information about unauthorized payment drafts by its vendor.

April 29 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

First quarter volume was up 3% among eight depositories that reported so far, compared with models that predicted industry-wide drops as large as 13%.

April 20 -

The company expects loan growth in the “mid-teens” this year, despite concerns that a housing supply crunch could stymie new mortgage originations. “As soon as COVID fades into the background we'll pick up volume,” CEO and Chairman Jim Herbert said.

April 14 -

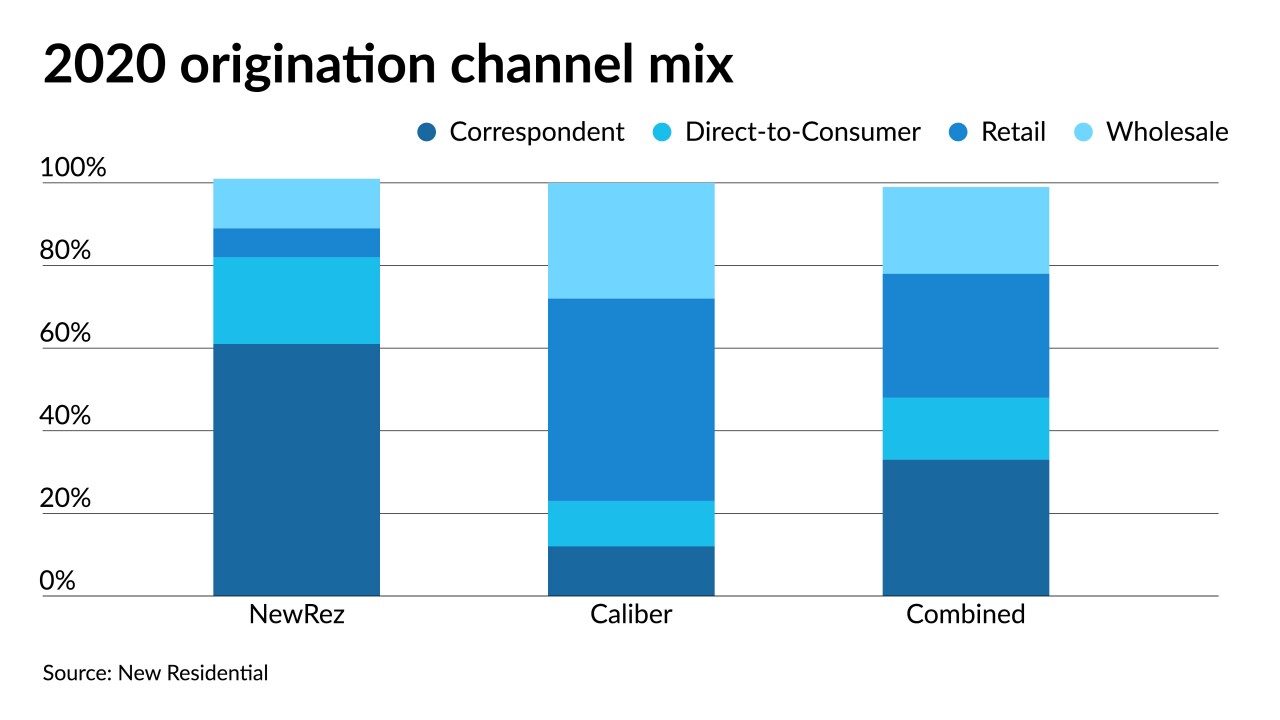

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

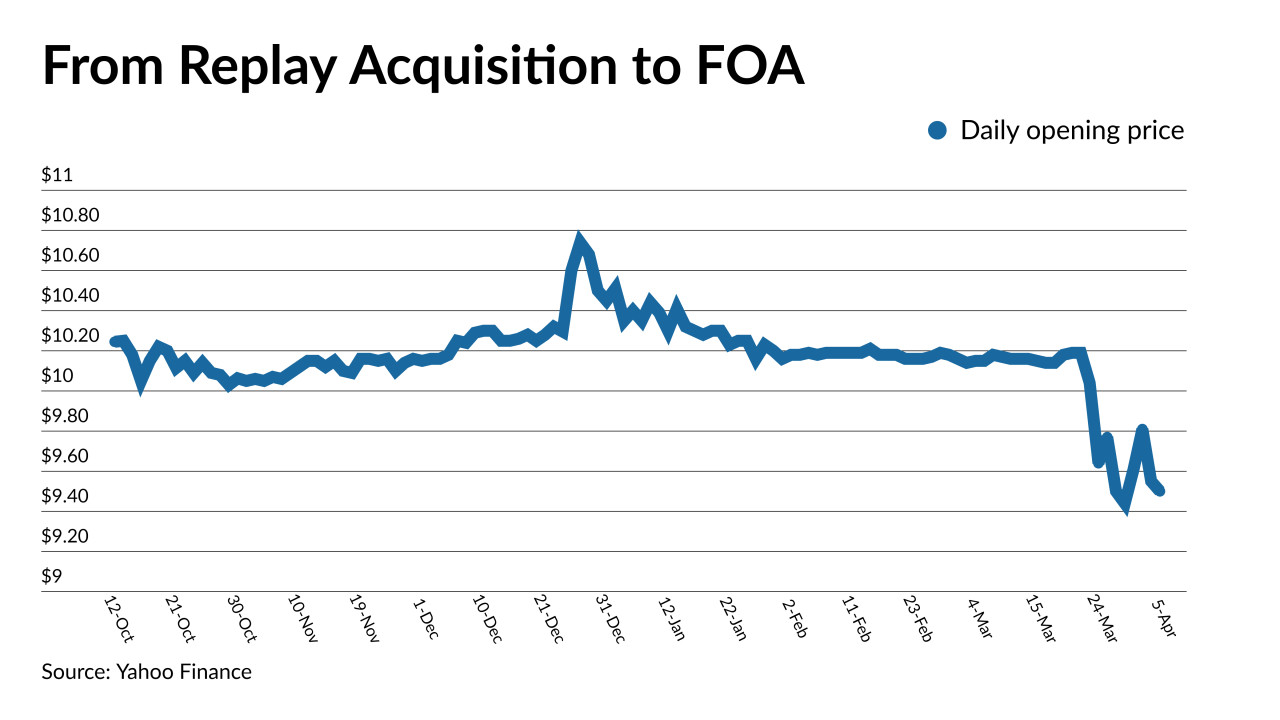

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23 -

The company posted an $88 million loss for 2020 after shutting down for nearly the entire second quarter.

March 12 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Mortgage brokers are telling the company that they "are looking for another large source," according to President and CEO Willie Newman.

March 11