Earnings

Earnings

-

Pretax operating margins came in much narrower than what is projected for the three stand-alone underwriters.

February 1 -

The company also reported a large fourth-quarter loss that reflected a significant increase in its loan-loss provision.

February 1 -

For a surprising number of companies pursuing an IPO is a mistake, Endurance Advisory Partners CEO Stephen Curry says.

January 27 -

The auto finance company, which had stumbled in forays into the credit card business, is now seeing rapid growth in mortgage and unsecured consumer lending.

January 22 -

Despite that decline, the company notched its second-best quarterly earnings ever over that period.

January 21 -

The investments, part of a post-merger effort to wring out more profits, include new commercial and mortgage lending platforms.

January 21 -

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

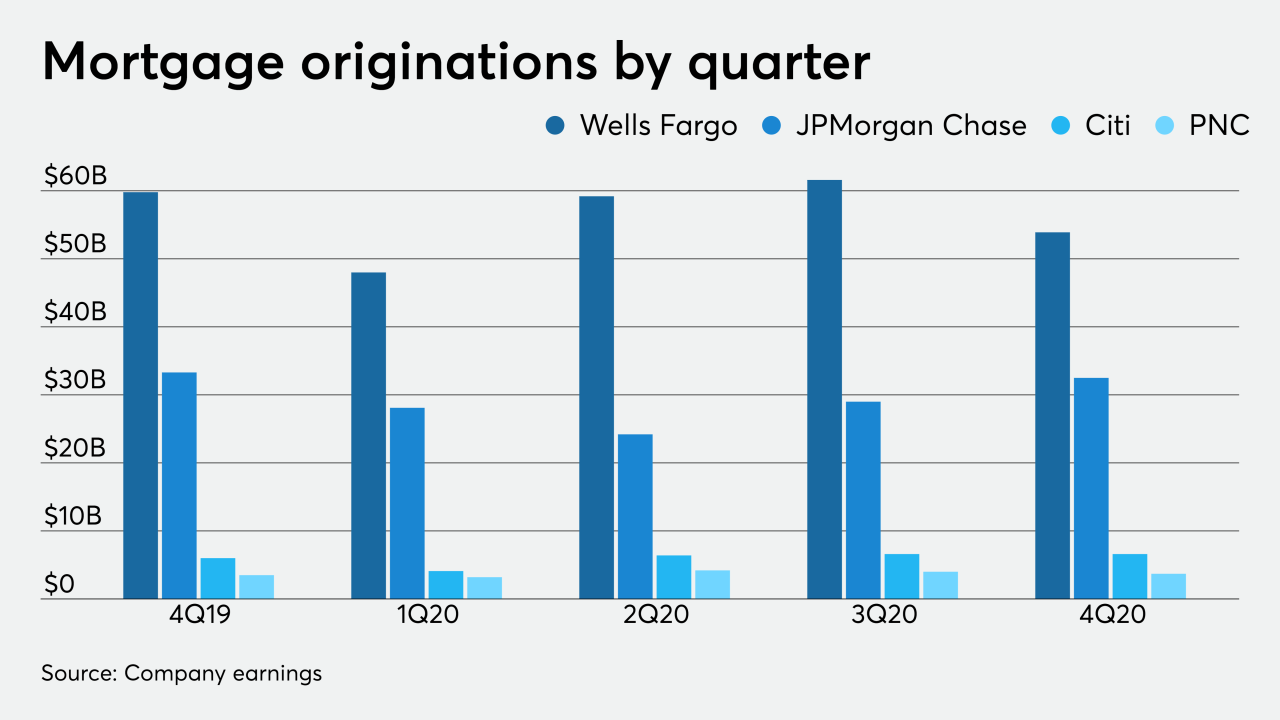

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

But will the company's second attempt to go public come to fruition in a market where two lenders already put their offerings on hold?

January 12 -

The company had canceled its planned pricing of the deal at the end of October over stock market volatility.

January 5 -

Strong earnings expected in the next year will provide the best opportunity in decades to raise capital and monetize equity, Stephen Curry of Endurance Advisory Partners argues.

December 21 -

Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

December 17 -

The results are in the middle of the range provided before the company went public in October.

December 3 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

Rick Thornberry discusses the company's third-quarter results and the decision to drop traditional appraisals.

November 11 -

The company reached a new record high for closed loan volume, and reported a cyclical drop in gain-on-sale margins reflecting changes in its product and channel mix.

November 11 -

The company, which earned $535 million in net income in 3Q20, has been prioritizing purchase volume and managing costs to account for a possible decline in originations next year.

November 6 -

For most of the underwriters it was a strong quarter, but concerns remain over government-sponsored enterprise reform and potential claims after forbearances end.

November 6 -

The company is finding it challenging to ramp originations back up after spending most of the second quarter on the sidelines.

November 5 -

Compared with the second quarter, the title insurer had 154,000 more orders opened and earned $89 per residential file.

November 5