Earnings

Earnings

-

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

CoreLogic's fourth-quarter earnings reflect the success of the transformation to an appraisal management company business model accelerated in the prior-year period.

February 27 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

February 25 -

Equifax has released a series of bundled services aimed at helping financial institutions use data and analytics to manage tasks associated with the process of servicing mortgage loans.

February 24 -

The CEO of Freedom Mortgage, Stanley Middleman, provides his take on trends affecting independent mortgage bankers as well as the residential real estate finance industry at large.

February 20 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

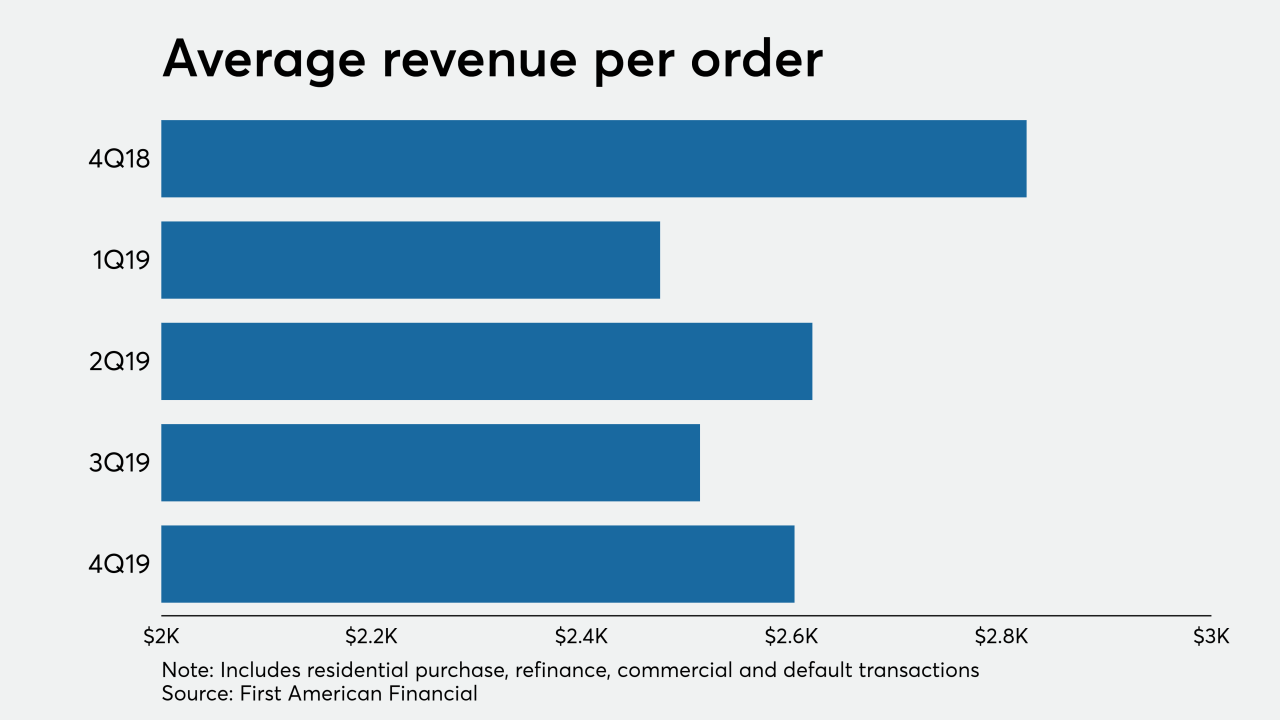

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

The strong refinance market in the fourth quarter propelled earnings at three different mortgage-related business that also were dealing with merger and acquisition activity during and after the period.

February 6 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

A booming housing market coupled with low interest rates helped M/I Homes report record results for 2019.

February 5 -

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

February 4 -

A 10-basis-point year-over-year increase in gross margin on loans sold, along with a nearly 30% increase in origination volume, helped Waterstone Mortgage turn around its fourth-quarter results.

January 31 -

The largest bank in Puerto Rico said hundreds of millions of dollars of its mortgages and consumer loans are tied to the parts of the island hit by the recent quake or still recovering from two hurricanes.

January 28 -

Flasgstar Bancorp's mixed results in its fourth-quarter earnings report are a sign strategic shifts it made to make its earnings less volatile are working.

January 28 -

Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings.

January 22