-

The number of loans going into coronavirus-related forbearance dropped for the third consecutive week, as the growth rate fell 8 basis points between June 22 and June 28, according to the Mortgage Bankers Association.

July 7 -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

Legal experts say it is now more likely that the Supreme Court will strike down the single-director governance framework for Fannie Mae and Freddie Mac’s regulator.

July 2 -

Mortgage insurers had been operating under the belief that rules pertaining to natural disaster delinquencies apply with COVID-19, but now it's in writing.

July 1 -

In a letter to Director Mark Calabria, 17 organizations requested an additional 60 days to weigh in on the proposal meant to strengthen Fannie Mae and Freddie Mac's balance sheets post-conservatorship.

July 1 -

Lenders and servicers' biggest pandemic challenges revolve around clarity for loan eligibility and understanding options for their borrowers once the forbearance period ends.

July 1 -

Multifamily borrowers with loans from Fannie Mae and Freddie Mac will get an extended break for coronavirus-related hardships if they continue to give their tenants relief as well.

June 30 -

The number of loans going into coronavirus-related forbearance edged down slightly, with the growth rate dipping 1 basis point between June 15 and June 21, according to the Mortgage Bankers Association.

June 29 -

The Consumer Financial Protection Bureau plans to change the definition of what constitutes a qualified mortgage from a 43% debt-to-income limit to a price-based threshold, and further extend a temporary exemption given to Fannie Mae and Freddie Mac.

June 22 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

New Residential Investment Corp., fresh off a substantial first-quarter reduction of its asset holdings, is now planning to securitize the receivables on its $200 billion servicing portfolio of Fannie Mae-owned mortgages.

June 17 -

The FHFA and FHA both announced for the second time that they were delaying the freeze to protect borrowers and renters during the coronavirus pandemic.

June 17 -

The report by Unison also advised investors to focus on "diversified residential real estate" over traditional retail and office spaces.

June 17 -

The Federal Housing Finance Agency was supposed to finalize its original proposal this month, but will redraft it because it was drawn up before the coronavirus emerged as a concern.

June 15 -

As they prepare to exit government conservatorship, Fannie Mae and Freddie Mac have enlisted the investment banks to help them boost capital and evaluate market opportunities.

June 15 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

A federal grand jury indicted Ronald J. McCord, 69, of Oklahoma City, on charges of defrauding two banks, Fannie Mae, and others of millions of dollars, money laundering, and making a false statement to a financial institution, said Timothy J. Downing, U.S. attorney for the Western District of Oklahoma.

June 9 -

The FHFA’s proposal is intended to strengthen Fannie Mae and Freddie Mac, but many experts warn that it could boost guarantee fees for lenders that they say may be passed on to borrowers.

June 8 -

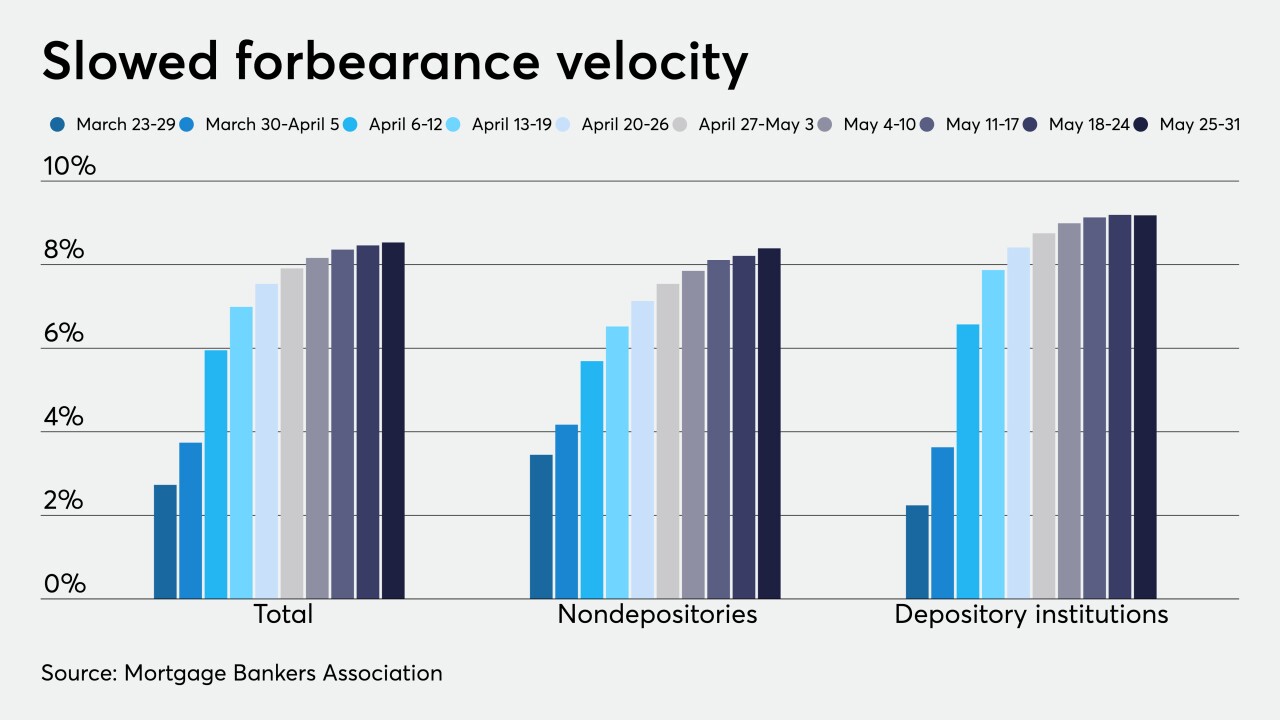

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8