After a few months of conducting business in a pandemic, lenders and servicers now have a sharper view of the largest challenges they face.

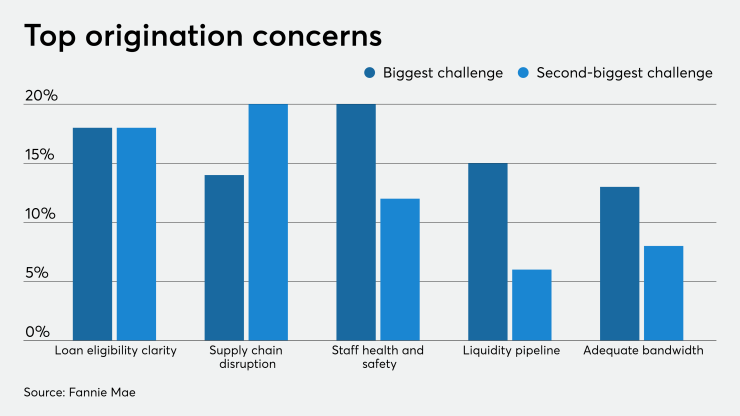

About 36% of originators said clarity on loan eligibility guidelines from secondary investors was either first or second on their list of concerns, according to Fannie Mae's special COVID-19 Mortgage Lender Sentiment Survey. Following that, 34% claimed supply chain disruption for loans was of highest concern, while 32% said the health and safety of its staff presented the biggest challenges.

On the servicing side, 44% have the most trouble with "understanding and navigating post-forbearance options for distressed borrowers," while 33% need clarity on forbearance programs. Nearly 30% of servicers said that their biggest challenge is handling the evolving compliance requirements for mortgage relief. An equal share found that having adequate bandwidth to manage distressed borrowers remained the biggest challenge.

With the pandemic ushering in a host of changes at a breakneck pace, the industry's lack of clarity on the new rules makes sense.

"The industry contended with a litany of policy updates, temporary servicing and origination flexibilities, new state and local guidance, and federal

Business priorities shifted in the second quarter of 2020, but the

Firms that are looking to cut costs expect that they will do so by making cuts in administrative expenses, back-office staff and loan officers.

Fannie's special second-quarter MLSS consisted of 254 senior mortgage executive participants, with 89 from nonbanks, 89 from depositories, 46 from credit unions and 30 from housing finance agencies or investment banks.