-

American Banker's Rob Blackwell and Cowen’s Jaret Seiberg discuss Fannie Mae, Freddie Mac and the future of housing finance

March 27 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

As lawmakers discuss reform legislation, the president’s memo calls on agencies to draft both administrative and legislative reform options and deliver their reports “as soon as practicable.”

March 27 -

Senators dove into how to ensure housing finance reform serves lenders of all sizes, just as the Trump administration moved closer to crafting its own GSE plan.

March 27 -

Hugh Frater loses the "interim" title, taking full control of the government-sponsored enterprise as Congress begins debating (again) the future of Fannie as well as Freddie Mac.

March 27 -

The government-sponsored enterprises have continued to expand over the past decade, despite being in conservatorship. New leadership at the FHFA should reverse this trend.

March 26 American Enterprise Institute

American Enterprise Institute -

Lawmakers still have a long way to go before enacting housing finance reform, but the testimony could signal how future legislative talks will play out.

March 26 -

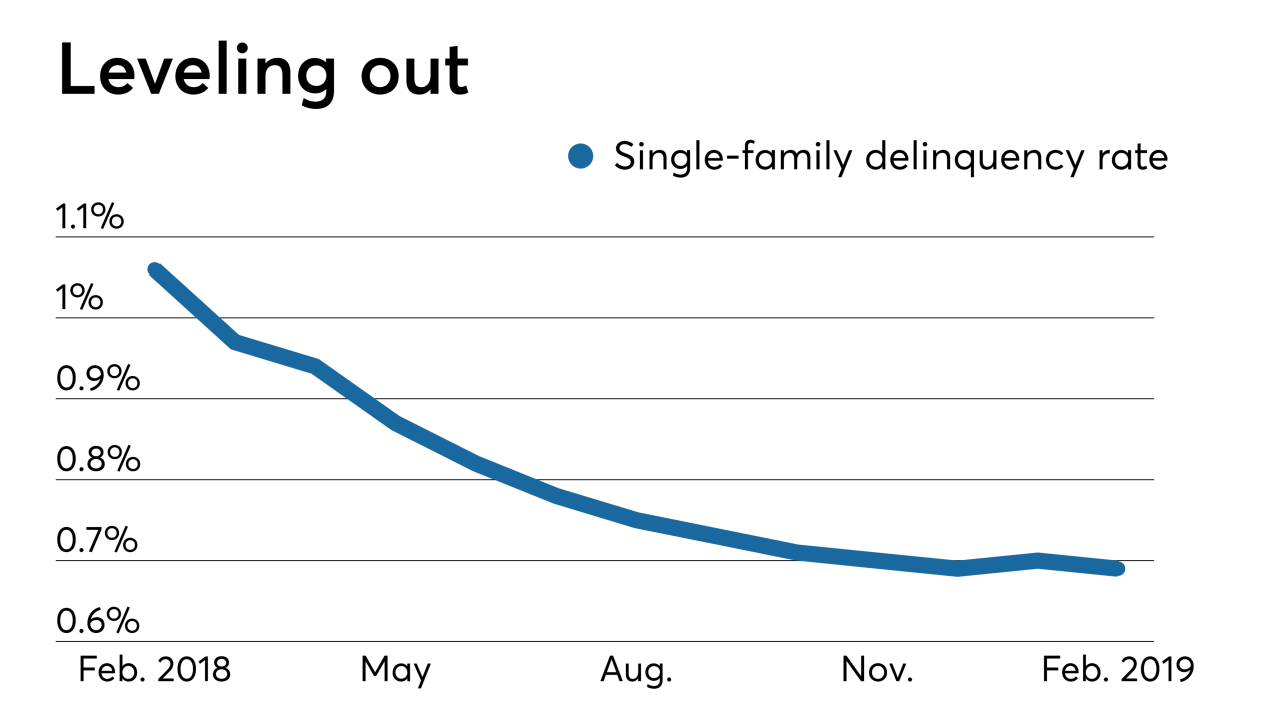

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

Home retention actions for loans owned by Fannie Mae and Freddie Mac declined in the fourth quarter and that trend is likely to continue given the strong economy.

March 26 -

At $230 million, GSMBST 2019-PJ1 is notably smaller than recent transactions from JPMorgan and Redwood Trust; borrowers also have less equity in their homes.

March 25 -

The Federal Housing Finance Agency in recent years has required Fannie Mae and Freddie Mac to contribute to the funds every March, but has yet to make a 2019 request. Housing groups see the delay as a troubling sign.

March 25 -

Starting March 26, Senate Banking Committee Chairman Mike Crapo will hold two days of hearings on his plan for returning Fannie Mae and Freddie Mac to private ownership.

March 25 -

In the second lawsuit of its kind, more than a dozen of the world's largest banks are accused of price fixing on roughly $486 billion of bonds issued by Fannie Mae and Freddie Mac.

March 22 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

Mark Calabria has notably criticized the government’s role in housing, but some groups have taken him at his word when he told senators that he supported affordable housing initiatives.

March 20 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20 -

There’s bipartisan consensus that the conservatorships of Fannie Mae and Freddie Mac are unsustainable, but that may not be enough for lawmakers to upend the current system.

March 19 -

As debate over the future of the mortgage finance system heats up, policymakers must ensure that small banks and credit unions maintain equitable access to the secondary market.

March 15

-

The Senate Banking Committee will hold two hearings at the end of March on Chairman Mike Crapo’s most recent framework for housing finance reform.

March 15