-

Despite soaring home prices, other factors needed to inflate a housing bubble are absent from the real estate market. But experts warn falling home values and rising mortgage defaults are inevitable, even if conditions naturally cool off.

March 28 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Fannie Mae and Freddie Mac had a 9% increase in total foreclosure prevention actions taken during 2017 as a result of three September hurricanes, according to the Federal Housing Finance Agency.

March 26 -

News that the GSEs need an infusion from Treasury to cover quarterly losses underscores problems with the government’s 2012 decision to “sweep” the housing giants’ profits.

March 23 The Delaware Bay Company

The Delaware Bay Company -

As tight housing inventory continues challenging prospective borrowers, Newfi Lending has launched a new portfolio lending platform in an effort to make homeownership more attainable.

March 22 -

As policymakers take another crack at housing finance reform, federal leaders and the housing lobby are once again perpetuating the false notion that ending government guarantees would cause the 30-year, fixed-rate mortgage to vanish.

March 21 American Enterprise Institute

American Enterprise Institute -

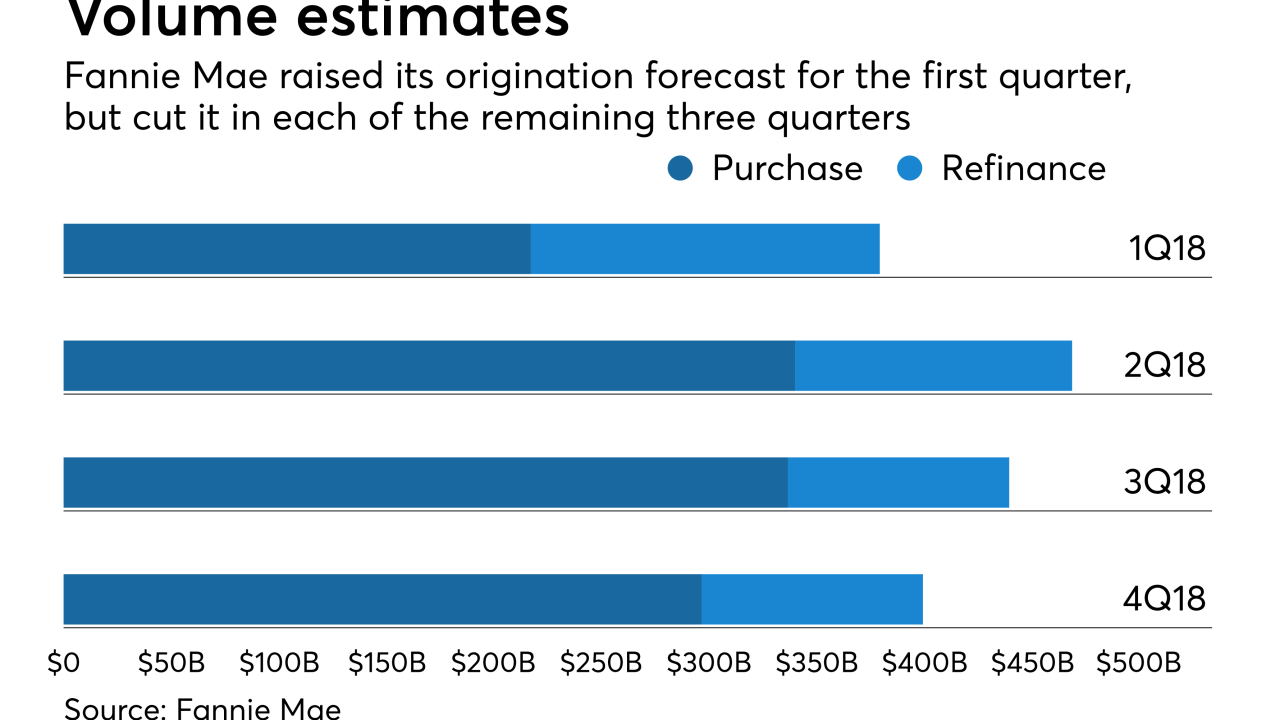

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Fannie Mae is about to roll out a new underwriting system that will address some concerns about layered risk that cropped up after it raised its maximum debt-to-income ratio.

March 16 -

Mortgage lenders are growing more pessimistic about their profitability, with the highest percentage ever seen in Fannie Mae's first-quarter industry sentiment survey expecting a decline in margins.

March 15 -

The security that was incorporated into the index is backed exclusively by loans on green building certified properties; the GSE is still working on acceptance of financing for green upgrades.

March 15 -

Freddie Mac and Arch Capital are testing a new form of risk-sharing deal to boost investor appetite for low down payment mortgages. But the pilot is raising concerns about "charter creep" because it dictates private mortgage insurance decisions typically made by lenders.

March 14 -

A late addition to regulatory relief legislation would direct the Federal Housing Finance Agency to review credit-scoring alternatives, but some say the provision is redundant.

March 13 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

A Senate proposal calling for a federal guarantee on mortgage-backed securities would only benefit the largest banks and increase the risk of bailouts.

March 8

-

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

Consumer confidence in the housing market fell in February, with fewer Americans sharing positive thoughts on mortgage rates, home buying and home prices, according to Fannie Mae.

March 7 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1