-

Just three months ago, U.S. banks were still using the expiring benchmark rate for the vast majority of their new loans. But regulators said Friday the transition to alternative rates has accelerated ahead of a year-end cutoff.

December 17 -

Under the Federal Housing Finance Agency rule, the GSEs would need to lay out how levels will change under a variety of stress tests, including required ratios separately proposed for amendment.

December 16 -

Since the pandemic began, there have been fewer active managers buying the less liquid types of securitized debt, creating big opportunities for bargain hunting in securities like mortgage bonds and collateralized loan obligations, hedge fund Ellington Management Group says in a new report.

December 16 -

Under Home Partners Holdings’ right to purchase (RTP) program, RTP prices exceed purchase valuations by about $33.2 million, and on 817 properties.

December 15 -

The AOMT 2021-8 waterfall will distribute principal to A-1 through A-3 certificates at all times, and notes are taking a Fitch haircut amid inflated home values.

December 14 -

Founded in the wake of the global financial crisis, KBRA has issued more than 51,000 ratings representing almost $3 trillion in rated issuance since 2010.

December 13 -

Credit enhancement includes subordination, shored up by excess spread generated from excess spread between the cash flow on the collateral and the certificates.

December 10 -

Bigger loans make mortgage bonds riskier for investors. When homeowners have larger loans, they become more likely to refinance even with relatively small declines in interest rates.

December 9 -

Velocity Commercial Capital, 2021-4 uses subordination and excess spread that will cover both current and cumulative realized losses.

December 9 -

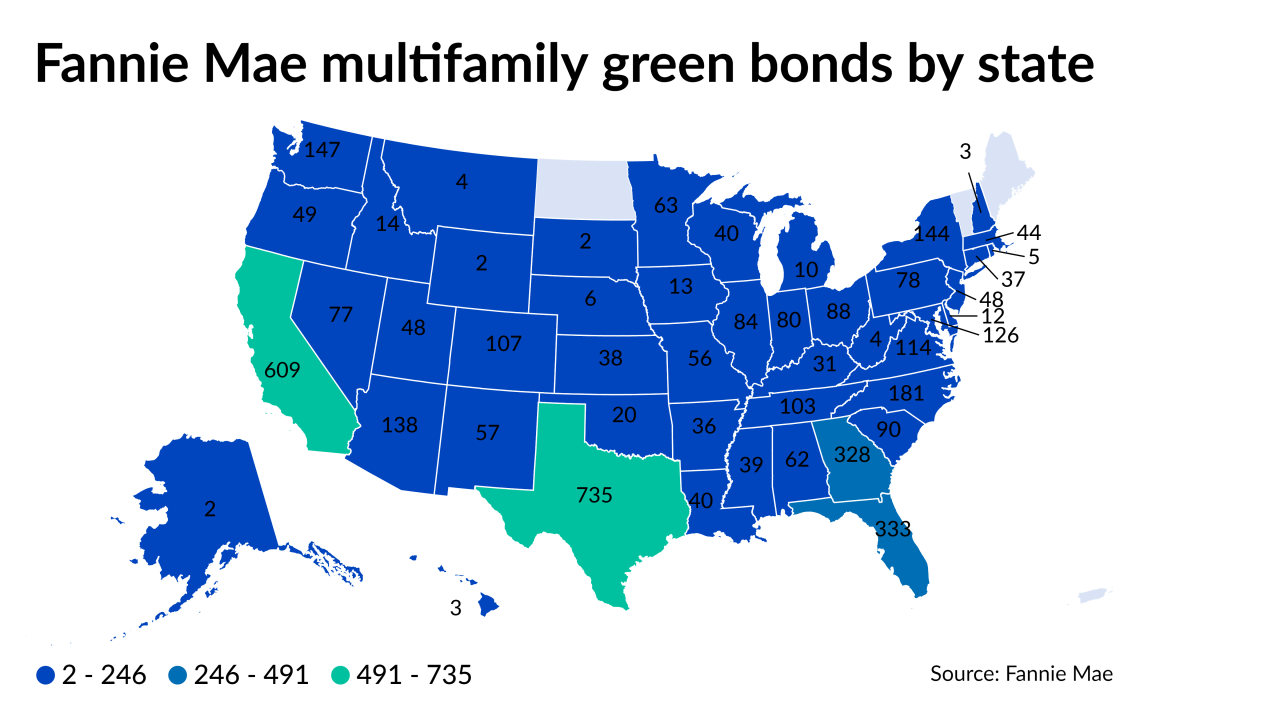

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8 -

The pool includes a high concentration of loans originated through alternative underwriting, and on investment properties. Just 10.3% of the pool received COVID forbearance.

December 8 -

The findings in a new TransUnion study could lend momentum to recent efforts by Fannie Mae and Freddie Mac to encourage the reporting and use of rental-payment information in lending.

December 7 -

Bain Capital and American Family Ventures were among the investors in this funding round for the company, which has more than doubled its staff in the past 12 months.

December 6 -

All of the loans are non-prime loans, and this is the first transaction that BREDS will sponsor using the BINOM shelf.

December 3 -

A group of 20 insurers and reinsurers provided coverage for the government-sponsored enterprise’s credit insurance risk transfer deal, which was the biggest in its category to date.

December 3 -

The entire collateral pool is made up of conforming, high-balance mortgage loans underwritten using an automated system designated by Fannie Mae or Freddie Mac.

December 3 -

He also told the Senate that he wanted to retire the word “transitory” to describe price increases, and he said inflation pressures will “linger well into next year.”

December 1 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

Higher sales commissions helped to drive production costs to their second-highest level since the Mortgage Bankers Association started its survey in 2008.

November 30 -

The collateral pools consists of 578 loans, and the trust uses a senior-subordinate, shifting-interest structure that helps maintain a longer subordination period.

November 29