-

The FHFA chief told Fox an offering could be done near term - but may not be - while a Treasury official addressed conservatorship questions at an FSOC hearing.

February 6 -

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

February 5 -

Rising defaults, fraud risks, and collapsing rents are converging in urban multifamily, threatening lenders and taxpayers, according to the Chairman of Whalen Global Advisors.

February 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The documents that the Housing Policy Council obtained from FHFA show past debate over one newer score and concerns about a single report with redacted context.

February 5 -

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

February 4 -

Home equity investment platforms continue to attract dollars from the venture capital community but also face a proposed de facto ban in one state.

February 4 -

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

February 4 -

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

February 4 -

Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

February 3 -

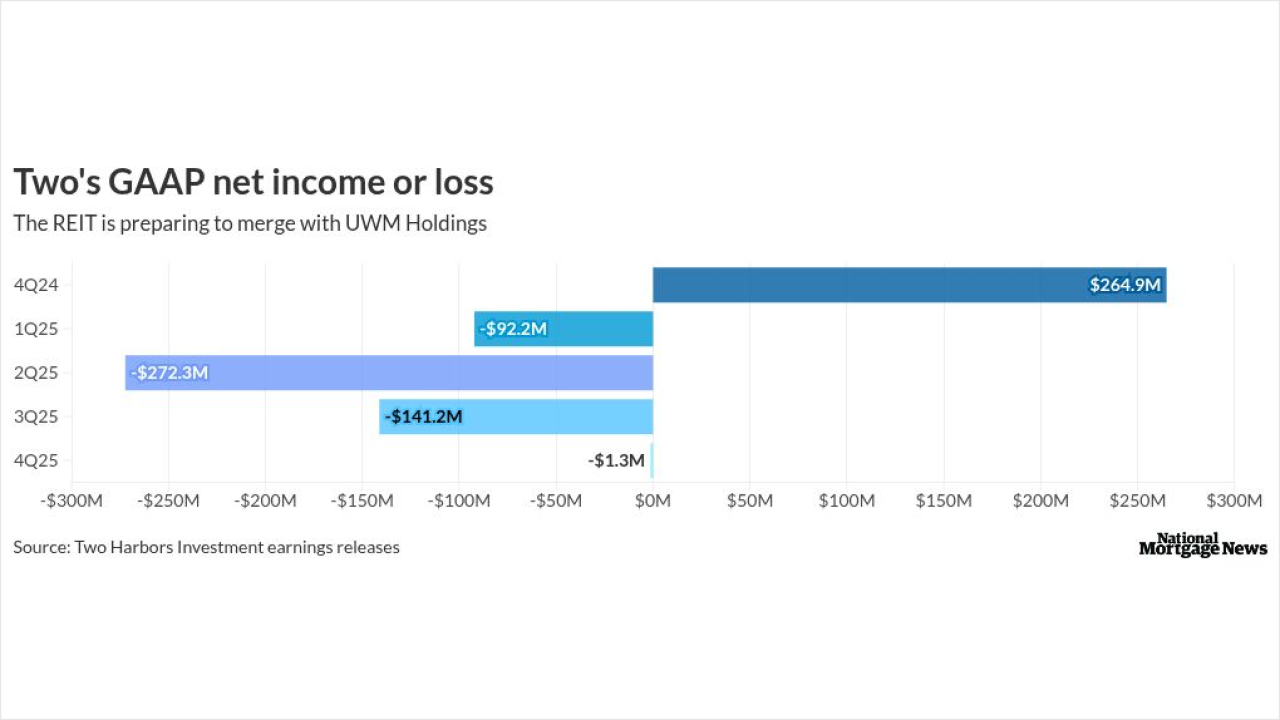

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3 -

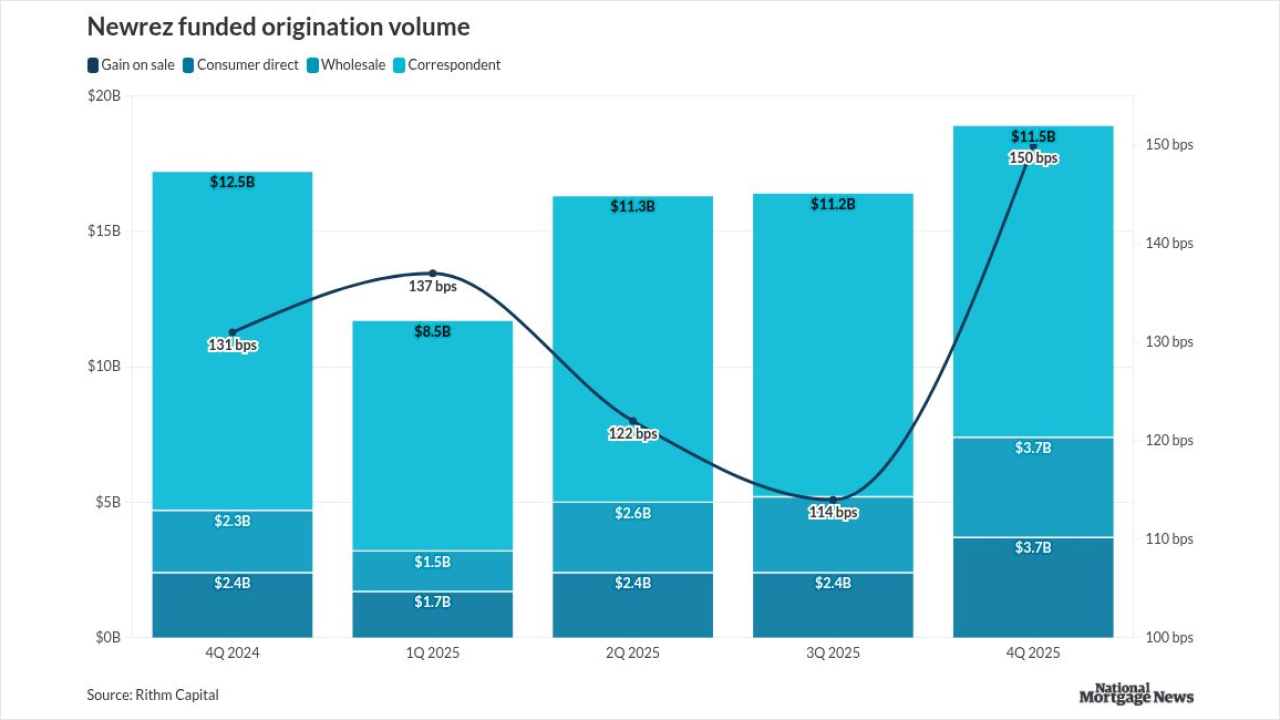

Mortgage rate trends in late 2025 led the lender into the red in the fourth quarter, even as Newrez originations picked up from the prior quarter and year.

February 3 -

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

February 2 -

Although investor properties, which are prone to higher chances of default, account for 58% of the pool, the strong borrower and collateral quality mitigate the credit stress.

February 2 -

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

January 30 -

Fourth quarter pretax income of $900,000 and net income of $656,000 for the segment compared with year ago losses of $625,000 and $197,000 respectively.

January 30 -

DRMT 2026-INV1, is backed by a pool of 1,153 non-prime investment property mortgages, which have a moderate leverage levels of an original, combined loan-to-value (CLTV) ratio of 69.9%.

January 29 -

Competition that impacted margins and prepayments in excess of expectations were challenges during the period, but executives report first quarter improvement.

January 29 -

Analysts estimate Pennymac, Rocket, UWM and Loandepot will post an improved earnings per share and total loan origination volume than the same time a year prior.

January 29 -

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

January 29 -

Supply chain attacks have doubled since 2021, with professional services firms increasingly acting as "stepping stones" to access bank data.

January 29