-

Mortgage servicing rights can look more attractive to originators as they become increasingly interested in building their customer base, but some may want to sell due to thinner margins or regulatory uncertainty.

October 28 -

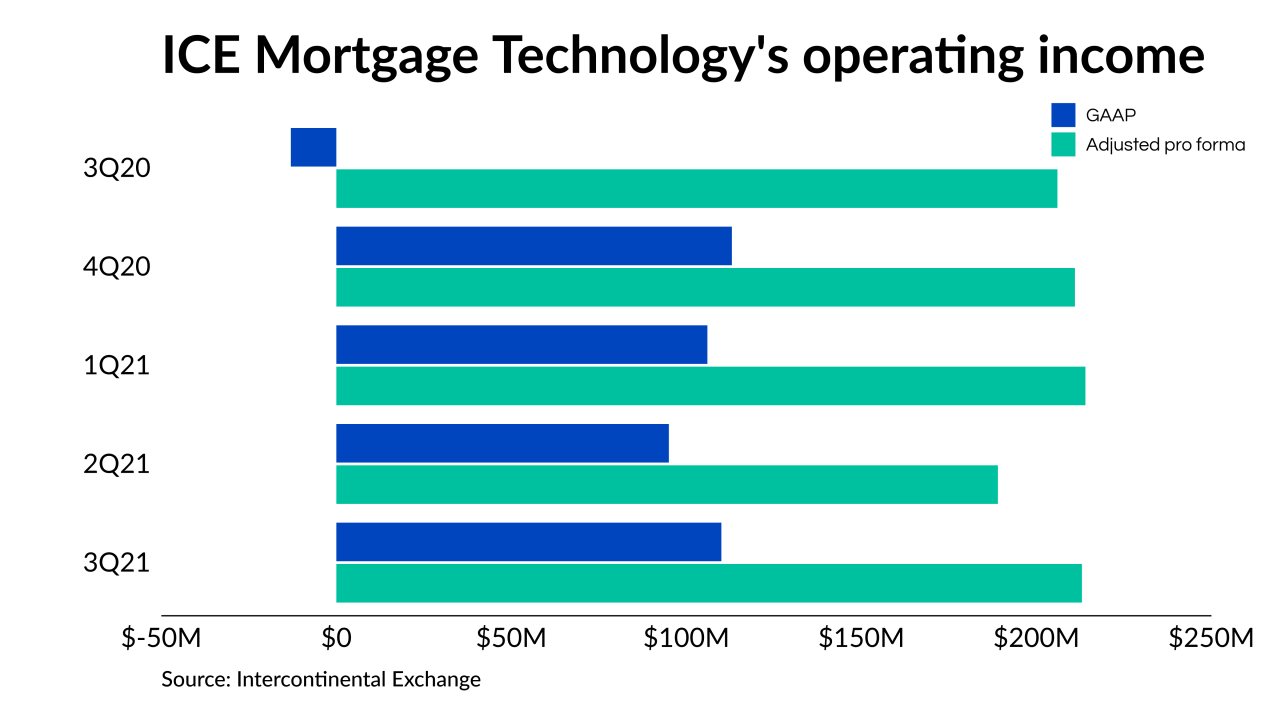

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The company sees an opportunity as its competitors have to sell to make up for lost income due to tighter origination margins.

October 28 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

The increased complexity of loss mitigation in the wake of the pandemic has increasingly prompted a growing number of mid-sized players to outsource, so constraints on one player could affect others.

October 27 -

The deal for Michigan-based Flagstar Bancorp, announced in April, was originally expected to be completed by the end of the year. The New York bank’s CEO expressed optimism that it will still get regulatory approval.

October 27 -

Maxwell, a startup that operates an online platform catering to mortgage loan officers and smaller lenders, raised $28.5 million in equity funding from investors led by the venture firm Fin VC and Wells Fargo Strategic Capital.

October 26 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25 -

The enormous issuance is backed by a single loan secured by first-priority mortgages on a pool of about 6,148 single-family rental homes, and 299 townhouses.

October 25 -

The Series B investment round for the power buyer comes at a time when all-cash purchases account for almost a quarter of the market.

October 22 -

The Alabama company agreed to buy two nonbank lenders earlier this year. It’s still on the lookout for possible deals, potentially in corporate finance or wealth management, its chief financial officer told American Banker.

October 22 -

The firm, dubbed Polpo Capital, is looking to produce a 15% net return to investors with modest leverage by capitalizing on the coming distress in commercial mortgage debt as forbearance agreements expire

October 22 -

Several housing groups wrote a letter calling for “substantially improved written proposals” for the period starting in 2022, and support for chattel manufactured-home loans.

October 21 -

One winning bidder, who bought two of the four pools in the government-sponsored enterprise’s nonperforming loan offering, is a repeat buyer affiliated with a minority- and women-owned business.

October 20 -

The reception in the market to structured single-family CRTs' return at the government-sponsored enterprise was strong enough for it to plan to follow up this transaction with another one next month.

October 20 -

Gain on sale has dipped 130 basis points per loan since the third quarter last year, but over the same period, per loan expense is up by $1,216.

October 19 -

CEO Michael DeVito told attendees at the Mortgage Bankers Association’s annual convention in San Diego that the move is among the types of “cash-flow underwriting” updates the government-sponsored enterprise is considering.

October 19 -

The multichannel lender plans to expand its footprint in the non-agency market as a result of the majority shareholder investment in the company changing hands.

October 18 -

The bonanza from Wall Street operations is a source of relief for banks struggling to earn more from traditional lending operations, which have suffered from lukewarm demand and a prolonged period of low interest rates.

October 14 -

The problem loans mature right around when tenants in the offices are due to renew — or end — their leases. That may unsettle investors in commercial mortgage-backed securities, analysts at Moody’s Analytics warned this week.

October 14