-

Sequoia Mortgage Trust is among the first to include a distributed ledger agent in its reporting processes.

September 17 -

Changes proposed this week stand to reverse the effect of the Trump-era rule, which disincentivized Fannie Mae and Freddie Mac from making such deals, according to critics.

September 17 -

While the loss coverage is subsequently lower for the notes, totaling $194.2 million, it is expected to be sufficient to cover required rating multiples.

September 17 -

The Department of Housing and Urban Development increased the share of reverse mortgage assets it will give community organizations a first crack at, in line with goals of the Biden administration.

September 16 -

Required use of the Federal Housing Administration’s Catalyst platform may accelerate data collection on valuations from a government agency that’s insuring nearly one-fifth of all purchase loans.

September 16 -

The move generally gets a thumbs up from industry participants, but what can happen in the long-term is uncertain.

September 15 -

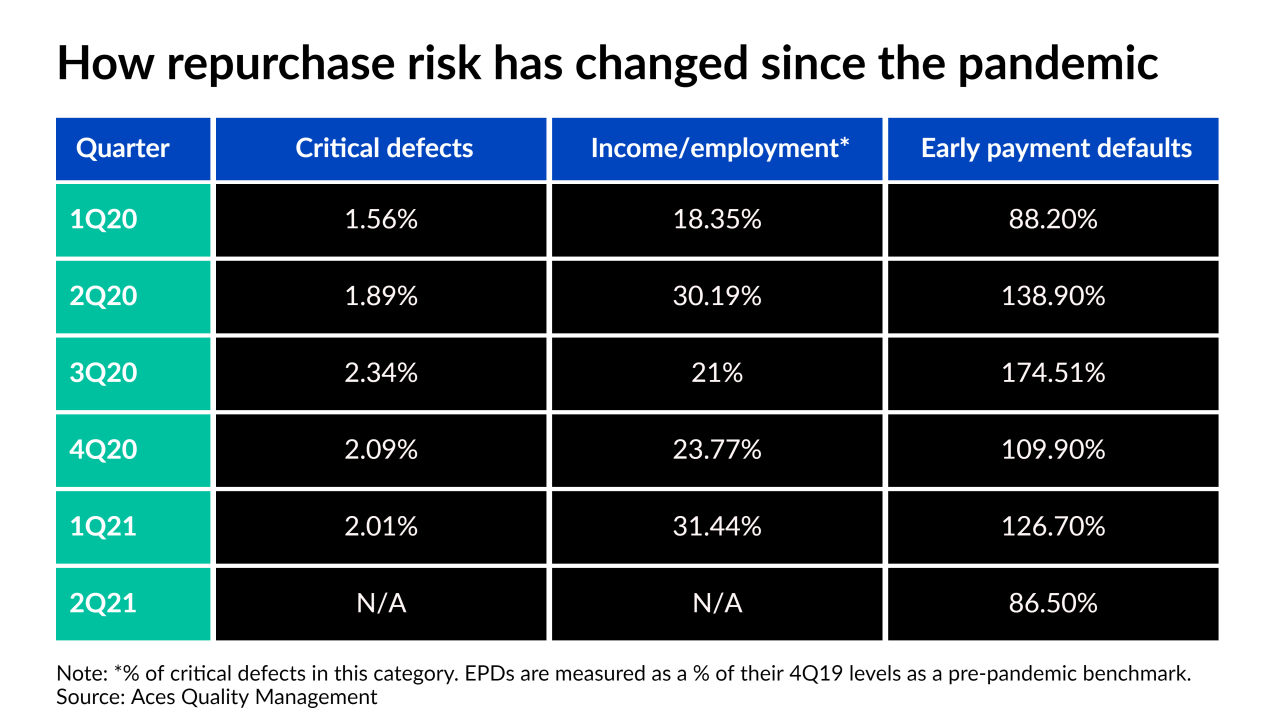

Critical defects fell as well, but the percentage that are related to income or employment concerns set a new record, surpassing the one set in the second quarter of last year.

September 15 -

Rather than add debt through a HELOC, the company’s product allows clients to get cash in exchange for a portion of the property's value.

September 14 -

Fitch Ratings’ second quarter numbers suggest even those facing some of the highest repayment hurdles may have been motivated enough by economic improvement to exit before many expirations were due.

September 14 -

The fintech projects the Series C capital will enable $10 billion in annual housing transactions through its system and expansion to half the U.S.

September 14 -

The move suggests the government bond insurer doesn’t expect to see loan performance return to normal levels until next summer.

September 13 -

The technology could help firms that have had less access to automation and generally have conducted trades used to hedge loan pipelines by phone.

September 10 -

While overall volume was down in August, it remained historically strong, particularly in the securitized market for home equity withdrawal loans made to borrowers age 62 and up.

September 9 -

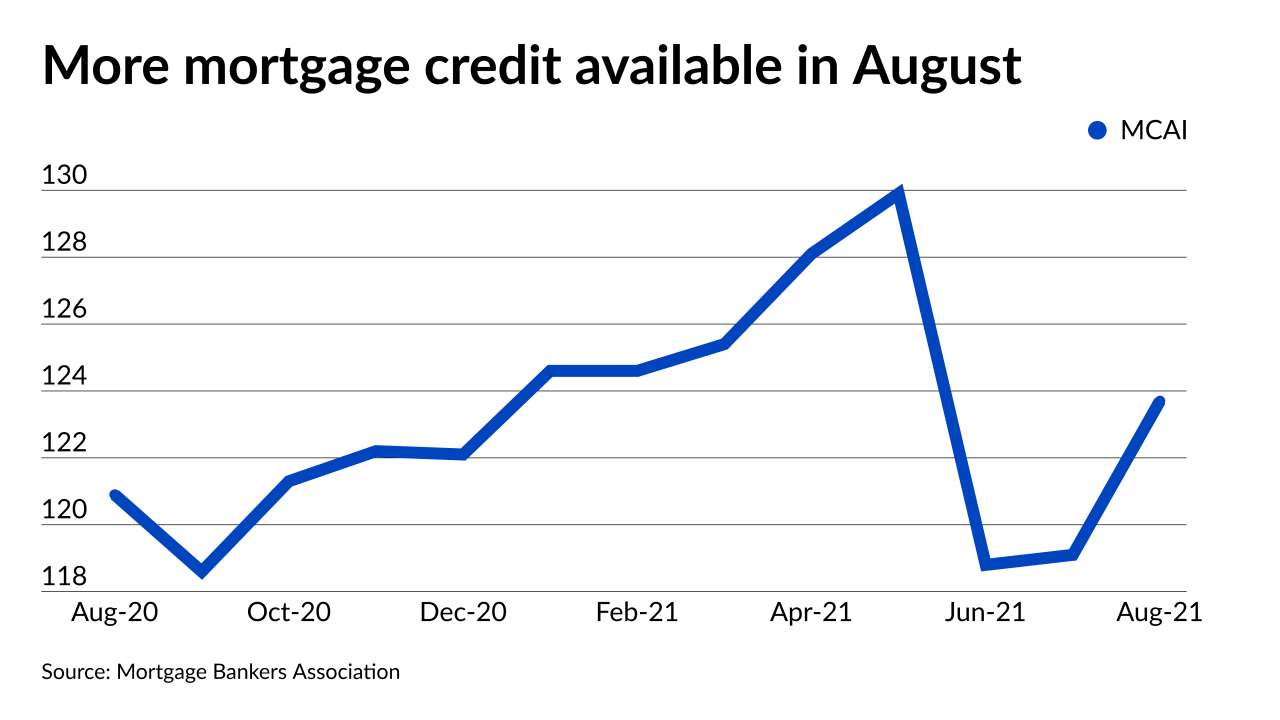

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9 -

The loan origination system provider, which launched an IPO on July 28, reported that its second quarter revenue and income grew 38% year-over-year.

September 8 -

The Loan Syndications and Trading Association alerts market participants to the challenges of term-SOFR transition before year-end.

September 8 -

The government-sponsored enterprises and their regulator are building on broader efforts by the Biden administration to close racial gaps in homeownership rates.

September 7 -

The government bond insurer allowed lenders to become “eIssuers” a little over a year ago, and the move contributed to a large surge in electronic notes this year.

September 7 -

Some progressive lawmakers argue the Federal Reserve’s deregulatory moves under Jerome Powell should disqualify him for a second term as chair. But the Biden administration could let him keep his job because of monetary policies that helped low-income workers.

September 6 -

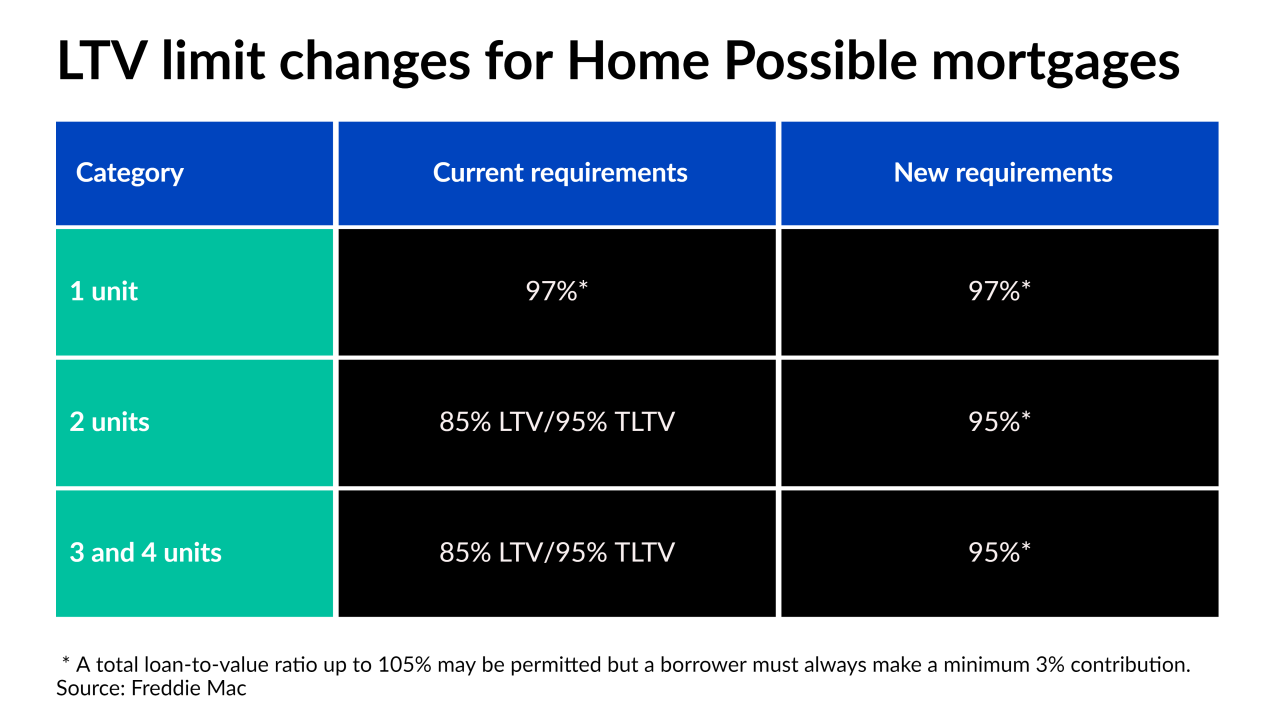

The changes could help one of the Biden administration’s affordable housing goals, which is aimed at making wealth-building through owner-occupied, 2- to 4-unit properties more attainable.

September 3