-

Improved capitalization and smaller balance sheets should help several weather the likely consolidation that is coming, Moody's said.

September 3 -

Low pool concentrations of loans on properties located in Ida's path, plus robust property insurance are expected to rein in impacts and insulate noteholders.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

A majority of the deal was underwritten to a less-than-full documentation standard, but meets ATR standards. Almost half of the loans are on California homes.

September 1 -

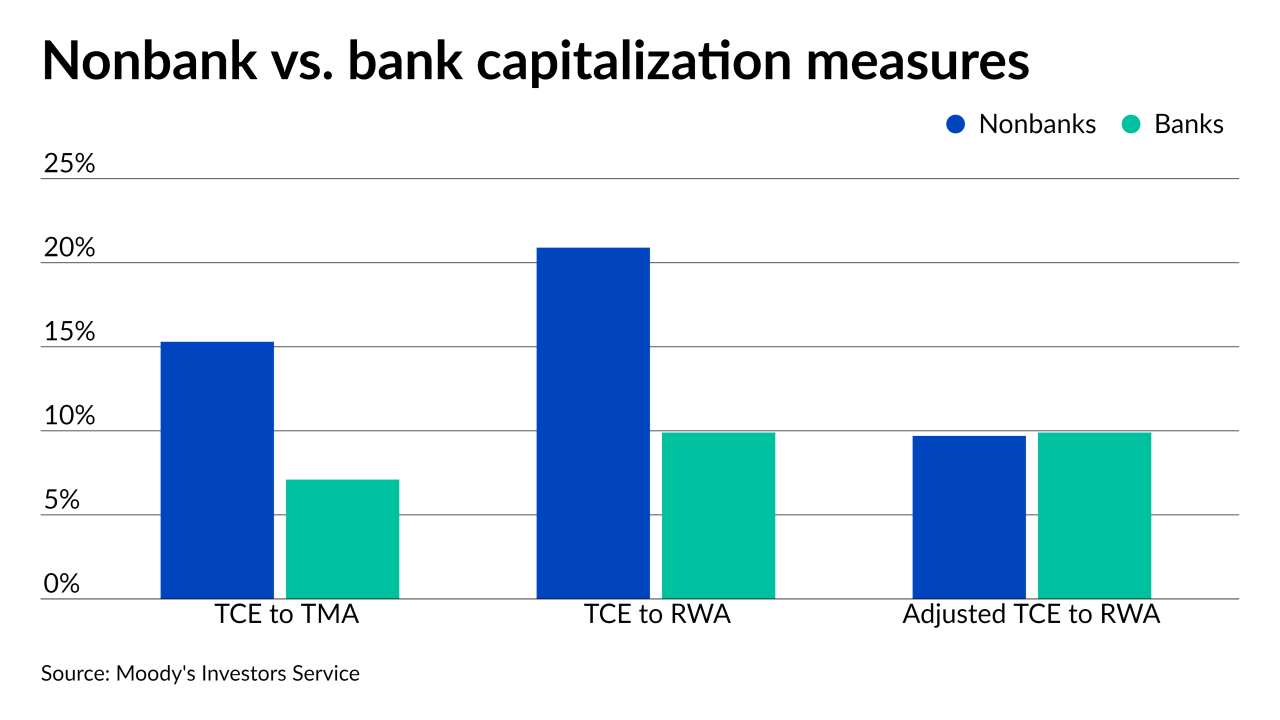

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

Dave banking app originally created to do away with overdraft charges has taken the industry by storm. It's on a mission to advance financial opportunities for all Americans. Join Penny Crosman, Executive Editor of American Banker and Jason Wilk, CEO and Co-Founder of Dave as they talk about how this app is changing the way people manage their money and what’s in store for the future of one-stop-shops for finances.

-

The deal appears to take advantage of a shift in federal rules reducing the level of non-owner-occupied loans Fannie Mae and Freddie Mac can purchase.

August 26 -

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24 -

The digital provider of commercial mortgage closing documentation hired a Guaranteed Rate executive and announced plans to add staff and integrate more loan operating systems.

August 24 -

The proceeds from the trust’s certificates will refinance some CMBS debt, among other balance sheet uses.

August 24 -

Revenue at the fintech company grew from prior periods without even taking into account any contributions from the Title365 acquisition at the end of the quarter.

August 20 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

The lending technology provider currently has 37,741 decisioning steps or pivot points on its platform.

August 18 -

The home purchase target for Fannie Mae and Freddie Mac would set a new 10% benchmark for qualified single-family lending in census tracts that meet certain demographic and income targets.

August 18 -

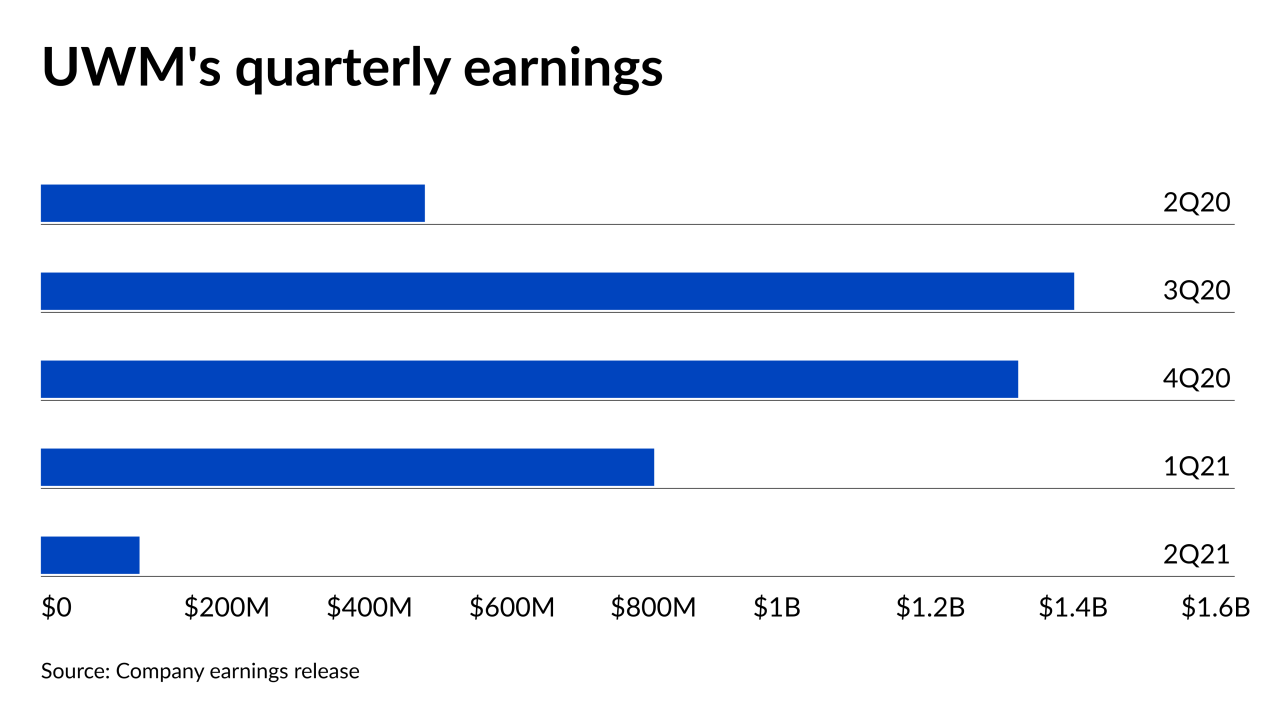

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

Financial institutions will have until early October to weigh in about new risk-based capital requirements for nonbanks.

August 13 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

This year's assessment for Fannie Mae and Freddie Mac is the first to take into account a January agreement between the Federal Housing Finance Agency and the Treasury Department that allowed the companies to retain more earnings.

August 13