-

The company touted its investments in the wholesale channel while also reporting a slight quarterly drop in overall originations and gains on sale during an earnings call this week.

May 6 -

Fluctuating rules are redirecting some government-related loans to a disparate private market.

May 6 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

The 30-acre luxury retail development is among four investment-grade-worthy loans included in the multiborrower deal.

May 5 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

Short-term late payment rates rose again and later stage delinquencies remain at elevated levels compared to those prior to the pandemic, the Mortgage Bankers Association said.

May 3 -

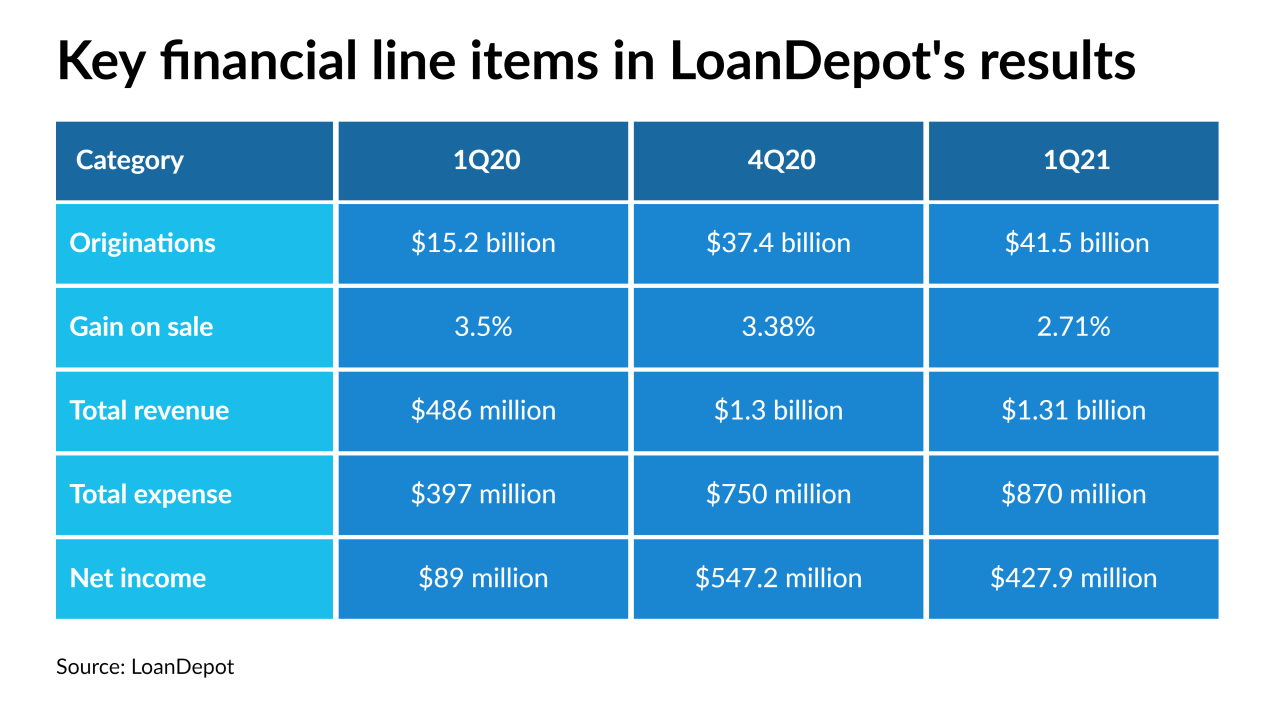

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

The West Palm Beach, Fla.-based lender sees an opportunity for even more growth after its deal to acquire a servicing portfolio from Texas Capital Bank.

April 29 -

The company says its first quarter net income nearly doubled from its showing in Q4 2020, due in part to cost-cutting and servicing income. It also revealed more information about unauthorized payment drafts by its vendor.

April 29 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

A new commercial-mortgage loan for seven facilities operated by the self-storage REIT is the largest of 41 loans in the conduit deal.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

However, conditions for commercial mortgages overall worsened slightly due to persistent concerns in the hotel and office sectors, a Moody’s Investors Service report found.

April 26 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

More than two-thirds of the economists surveyed expect the Federal Open Market Committee will give an early-warning signal of tapering this year, with the largest number — 45% — looking for a nod during the July-September quarter.

April 26 -

Thanks to a series of government measures, the pandemic did not cause the massive wave of distressed debt flooding the market that many expected, but certain property types remain vulnerable.

April 23 -

Though the government-sponsored enterprises have some of the lowest forbearance rates in the market, they expect to contend with a significant population of borrowers who face steep financial setbacks after the pandemic ends.

April 22