-

The government-sponsored enterprise's single-family credit reserve release caused earnings to spike.

July 29 -

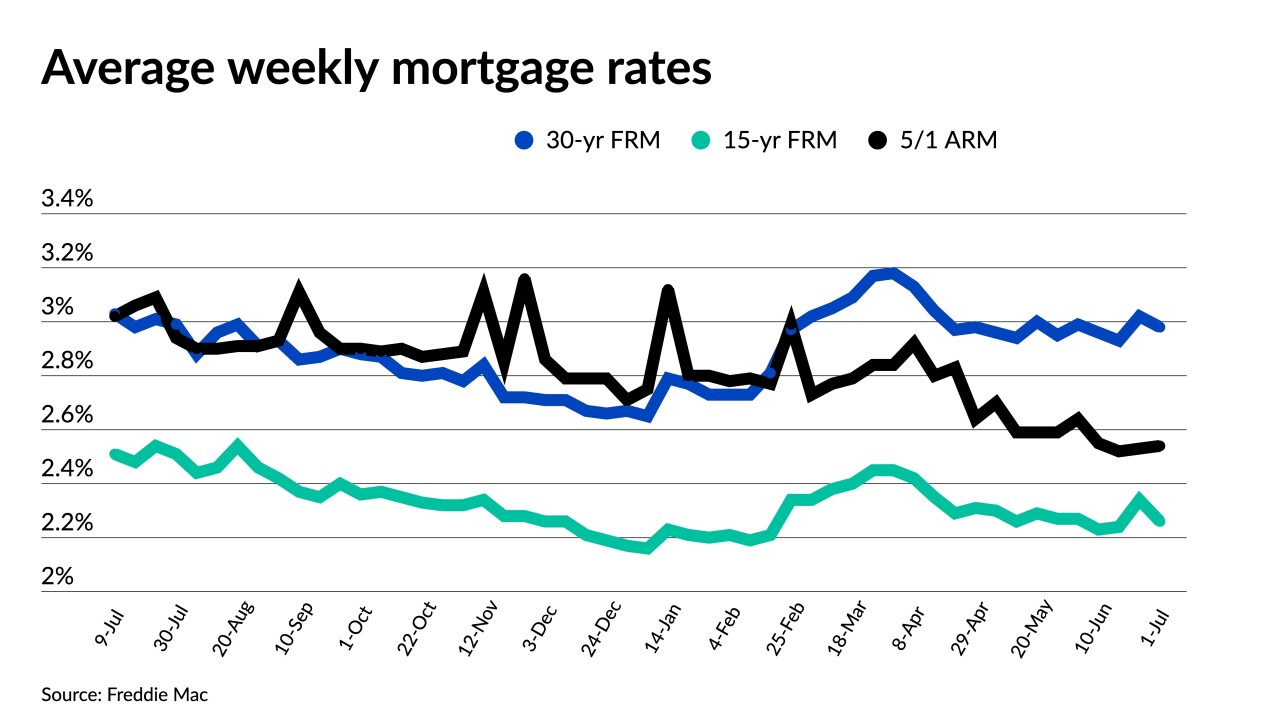

A rise in coronavirus cases and the removal of a 50-basis-point adverse market fee designed to protect Fannie Mae and Freddie Mac during the pandemic contributed to the largest weekly drop so far this year.

July 22 -

With talk of an overheating economy abating, economists see few signals that would indicate near-term rate spikes.

July 8 -

Estimates suggest public funds in aggregate may be adequate to cover arrears and potentially keep many in their homes as the eviction ban ends, but may not be evenly distributed.

July 1 -

Markets react calmly to inflationary worries, but short supply and rising home prices loom as a greater concern.

July 1 -

Corresponding Treasury yields seesawed over the past week, as some experts see “transitory” inflation persisting.

June 24 -

The justices on Wednesday threw out a key part of a challenge brought by firms including Paulson & Co., Pershing Square Capital Management and Fairholme Funds to the government’s collection of more than $100 billion in profits from Fannie Mae and Freddie Mac.

June 23 -

Signs from the Fed regarding tapering and interest rate hikes could spell the end to the year’s low rates.

June 17 -

Recent reports show inflation rising, but employment underperforming, while interest rates dropped across the board.

June 10 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8