After a

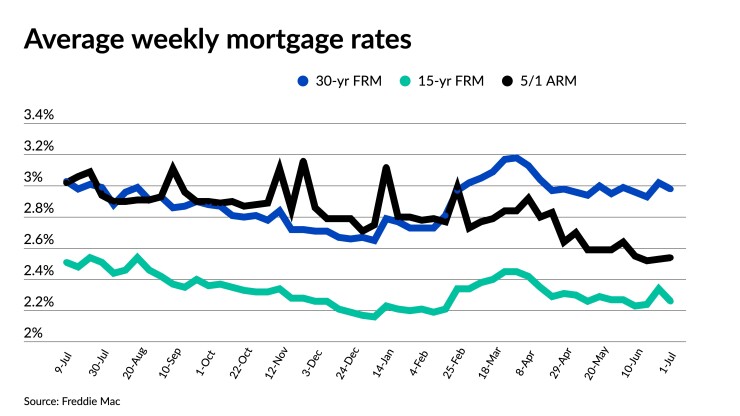

The average 30-year fixed rate mortgage slid back to 2.98% for the weekly period ending July 1, according to Freddie Mac’s Primary Mortgage Market Survey, a week after coming in at 3.02%. In the same period a year ago, the 30-year fixed-rate mortgage was 3.07% The average rate has posted at 3% or lower in 10 out of the last 11 weeks, with markets now appearing to take inflationary concerns in stride.

As the U.S. has rebounded from the economic quagmire caused by the Covid-19 pandemic more quickly than some expected, hints of interest-rate hikes by the Federal Reserve and data that has pointed to rising inflation have led to almost immediate mortgage-rate spikes. But the initial jumps have retreated as quickly, resulting in the current sub-3% holding pattern.

Last week’s release of the

“The muted reaction to the highest annual change in the core personal consumption expenditure price index in nearly three decades was the latest evidence that investors are buying into the idea that rising price pressures are transitory, and more accurate readings on inflation will come only after supply-chain restrictions ease,” said Zillow economist Matthew Speakman in a statement.

As markets seem to be factoring in price volatility as a natural consequence of recovery after last year’s severe economic shock, the current short supply of homes on sale and

“Although low and stable mortgage rates have kept the housing market booming over recent months, a deterioration in affordability and for-sale inventory has led to a market slowdown,” said Sam Khater, Freddie Mac’s chief economist.

This week’s

Rising home prices are expected to continue into the summer according to Lawrence Yun, the National Association of Realtors chief economist.

“Some calming of the market is only expected to happen in late autumn of this year and into 2022. Home price growth will be in the single digits in 2022,” he said in a blog.

15-year average also drops

As the 30-year average fell, the 15-year fixed-rate mortgage rate also decreased week over week, down to 2.26% from 2.34%. A year ago, the 15-year average came in at 2.56%.

But the average for the 5-year Treasury-indexed adjustable-rate mortgage inched up one basis point for the third consecutive week, coming in at 2.54% compared to 2.53% a week earlier. The 5/1 ARM average sat at 3% in the same week last year.