-

Recent changes to housing policy and uncertainty regarding the coronavirus could slow that growth.

August 19 -

As more borrowers exit their plans, fewer than 4 million loans sit in forbearance, according to Black Knight.

August 14 -

The FHFA director’s move this week to impose an “adverse market fee” of 0.5% on most refinanced mortgages will shift billions out of the hands of American consumers and into the hands of Fannie Mae and Freddie Mac — and their private shareholders.

August 14 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

Earnings reports out this week beat pessimistic expectations, but strained coronavirus relief negotiations in Congress cloud the outlook for what's ahead.

August 7 -

The company reported nearly $23 million in losses for the second quarter, but that was an improvement on a quarter-to-quarter basis.

August 7 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

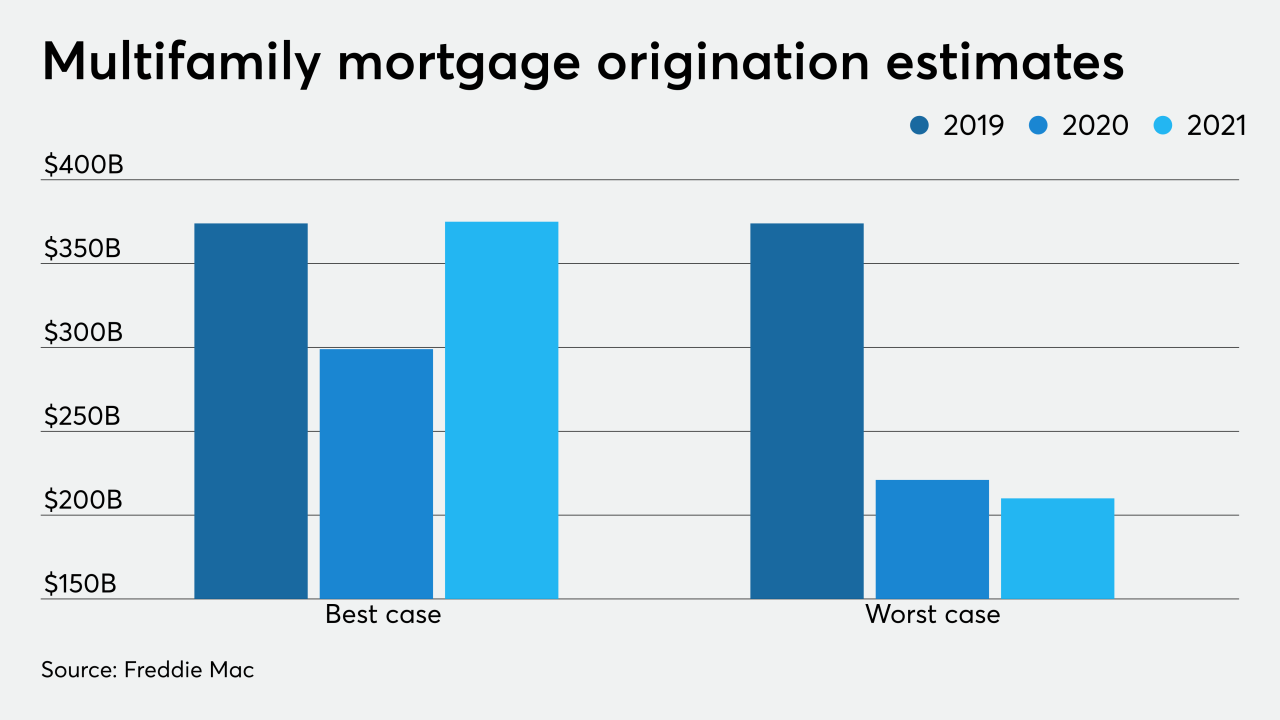

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

Fannie, Freddie also announced they'll face banklike liquidity standards starting Sept. 1.

July 31 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

Whalen: "It is tempting to think that low interest rates will cure all ills in the housing sector, but this view is seriously in error, as we learned in 2008."

July 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The Financial Stability Oversight Council’s plan to study the market explains very little about which activities or firms, like Fannie Mae and Freddie Mac, will be designated as systemically important. Here's some clearer guidance.

July 21

-

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations.

July 20 -

It starts with understanding investor, insurer and regulatory requirements and how they're interpreted and applied.

July 20 Simplifile

Simplifile -

Any intention that Ginnie Mae may have had to slow prepayment rates by changing the rules on RPLs seems to be thwarted by the grim economic reality facing the big banks.

July 15 Whalen Global Advisors LLC

Whalen Global Advisors LLC