-

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

The Senate Banking Committee will hold two hearings at the end of March on Chairman Mike Crapo’s most recent framework for housing finance reform.

March 15 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

In remarks to credit unions, the Senate Banking Committee Chairman said that fixing the government-sponsored enterprises and data security were priorities.

March 13 -

Mortgage lenders are optimistic about their business prospects during this spring's home purchase season even with the negative sentiments about demand in the previous three months, Fannie Mae said.

March 13 -

The Securities Industry and Financial Markets Association approved changes to its good delivery guidelines that ease the path to the government-sponsored enterprises issuing uniform mortgage-backed securities starting on June 3.

March 12 -

Agency mortgage-backed security prepayment speeds increased in February with much of the refinance activity coming from newer loans and those with high coupons, a report from Keefe, Bruyette & Woods said.

March 11 -

Mark Calabria, who could be confirmed as early as this month, is expected to focus on changes to Fannie Mae and Freddie Mac’s conservatorships to let the mortgage giants keep more of their profits.

March 10 -

Freddie Mac is broadly offering instant representation and warranty relief for automatically validated self-employment income following a test of the concept last year.

March 6 -

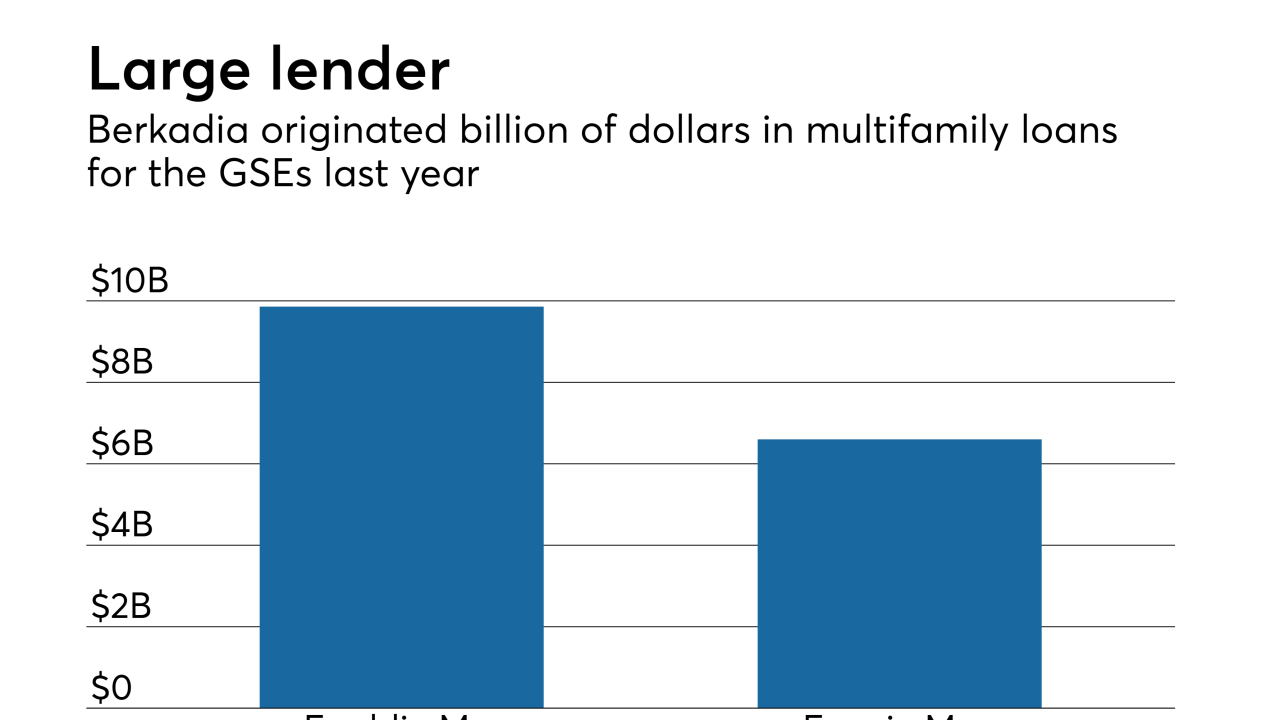

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6