-

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

While the London interbank offered rate won't go dark until 2021, the commercial real estate finance industry should start preparing for the transition now, says the Mortgage Bankers Association.

January 24 -

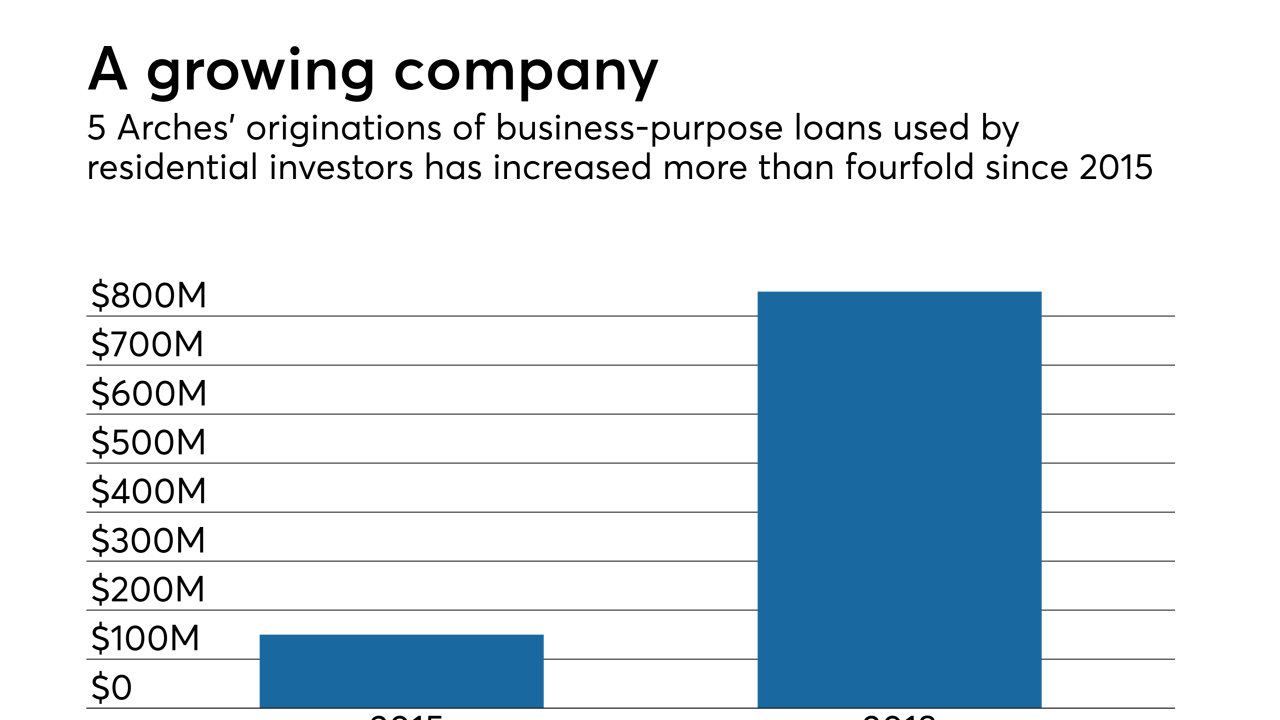

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

A federal appeals court ruling that found the leadership structure of the FHFA unconstitutional will face an "en banc" review later this month.

January 16 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

The standards for mortgage lending constrained in December, as a drop in conventional credit brought availability to its lowest point since February 2017, according to the Mortgage Bankers Association.

January 10 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

The mortgage industry faces myriad questions and challenges in 2019. Here's a look at 12 executives who will be behind the waves being made this year.

January 8 -

Lagging construction, rising interest rates and the broader economy don't really bode well for buyers of commercial real estate, but most CRE lenders still expect originations to increase in 2019, according to the Mortgage Bankers Association.

January 8 -

The White House has officially nominated Mark Calabria as the next director of the Federal Housing Finance Agency.

January 8 -

Freddie Mac completed its first multifamily credit risk transfer transaction that used an insurance/reinsurance structure.

January 4 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

The single-family rental market could benefit from more consistent loan terms and expanded secondary mortgage market opportunities, Freddie Mac found in a preliminary test of expanded involvement in the sector.

December 28 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28