Loan performance

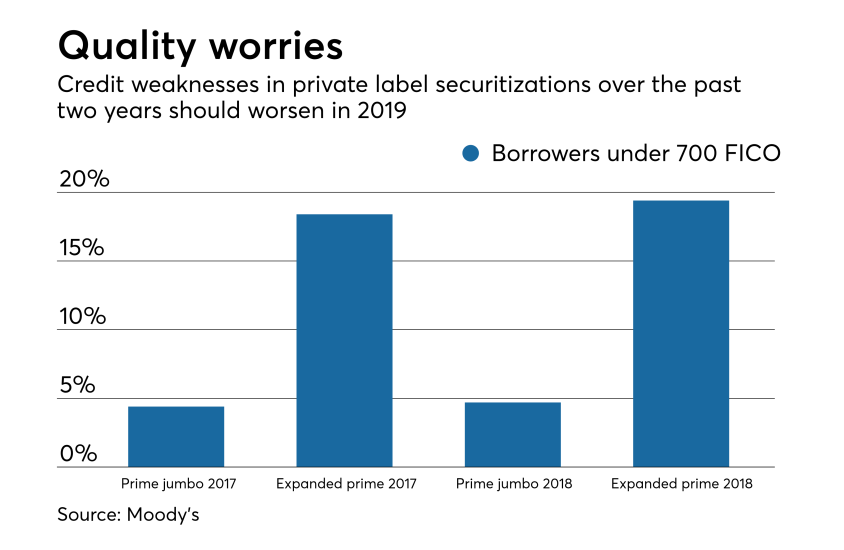

"The credit quality of new mortgages will remain solid in the coming year on the back of healthy borrower metrics and economic conditions," Moody's Investors Service analyst Max Sauray said in a press release. "Nevertheless, as the credit cycle matures, we expect some weaknesses that have emerged in recent years to worsen slightly in 2019."

There are already concerns on the effect of lower credit quality characteristics seen in expanded prime securitizations — those with a larger percentage of borrowers with credit scores under 700 — completed over the last two years compared with other post-2010 prime jumbo deals, Moody's said.

Here's a look at eight predictions for the secondary mortgage market in 2019.

Secondary market prices to rise

Ginnie Mae has been concerned about

There could be a liquidity crunch

Pricing woes drive job changes

Certain nonconventional loans make a return

Non-QM keeps growing

Pricing spreads to narrow

GSEs pulled back by new regulator