-

The gulf between buyer demand and the amount of listings for sale drove housing values to a six-decade peak, according to CoreLogic.

August 3 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

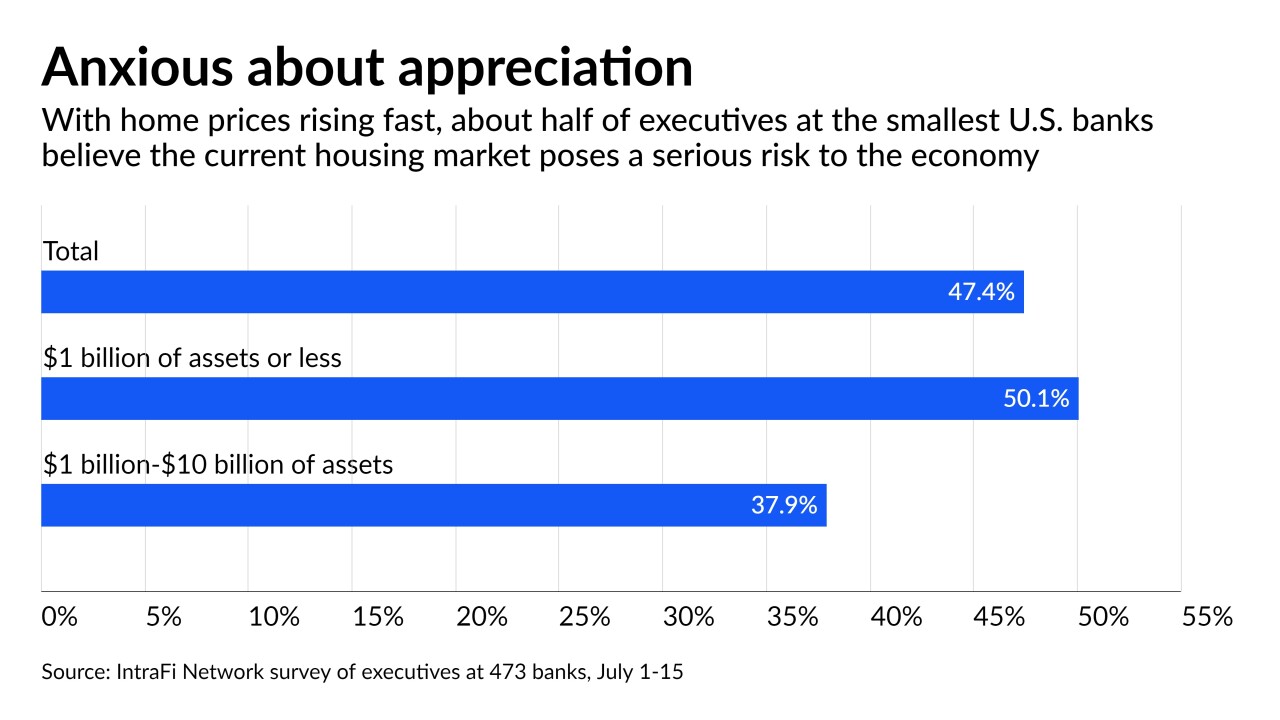

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

U.S. home prices once again surged the most in more than 30 years.

July 27 -

The average mortgage borrower has gotten a hometown discount when buying a property, as the rise of remote work allowed for migration away from large metropolitan areas, according to a Redfin report.

July 26 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

More units sold above asking price as skyrocketing home values pushed consumers out of the single-family market, according to Redfin.

July 21 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

Initial home construction rose 6.3% last month to a three-month high, according to government data released Tuesday.

July 20 -

In states where it is legalized, cannabis sales tax revenues led to greater home value appreciation through community reinvestment, according to an analysis by Clever Real Estate.

July 14