-

The cloud-based mortgage software company plans on trading on the New York Stock Exchange with a starting price of $24 to $26 per share.

July 19 -

The software provider’s offering hit the top of its price range estimate and started trading at $18 per share.

July 16 -

The New York-based lender projects it has a $3.6 trillion market opportunity outside of the U.S.

July 12 -

The company is looking to sell 20 million shares, with a 3 million underwriters' option, at between $16 and $18 per share.

July 6 -

The company plans on trading on the New York Stock Exchange under the ticker symbol BLND

June 21 -

The real estate technology company had a $498 million valuation, according to PitchBook, but it could get a sizable premium to that if it were to go public.

June 15 -

The company, on the cusp of going public via a merger, recently added Wells Fargo to its client roster.

May 26 -

Garg discusses how Better plans to maintain growth in a volatile market in an exclusive interview.

May 25 -

The company provides a secondary market outlet for its retail and wholesale lending corporate sibling as well as for small balance commercial loans.

May 21 -

Stock prices for the four stand-alone MI companies have declined significantly since the start of May.

May 13 -

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

United Wholesale Mortgage set off a brawl in the press when it forbade brokers from doing business with Rocket and Fairway. As a small group of brokers pursue legal action over the ultimatum, experts weigh in on whether the spat is benefiting the wholesale channel.

May 5 -

After the spinoff and a concurrent private sale to Bayview Asset Management, Genworth Financial will still own 80% of the rebranded Enact.

May 4 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

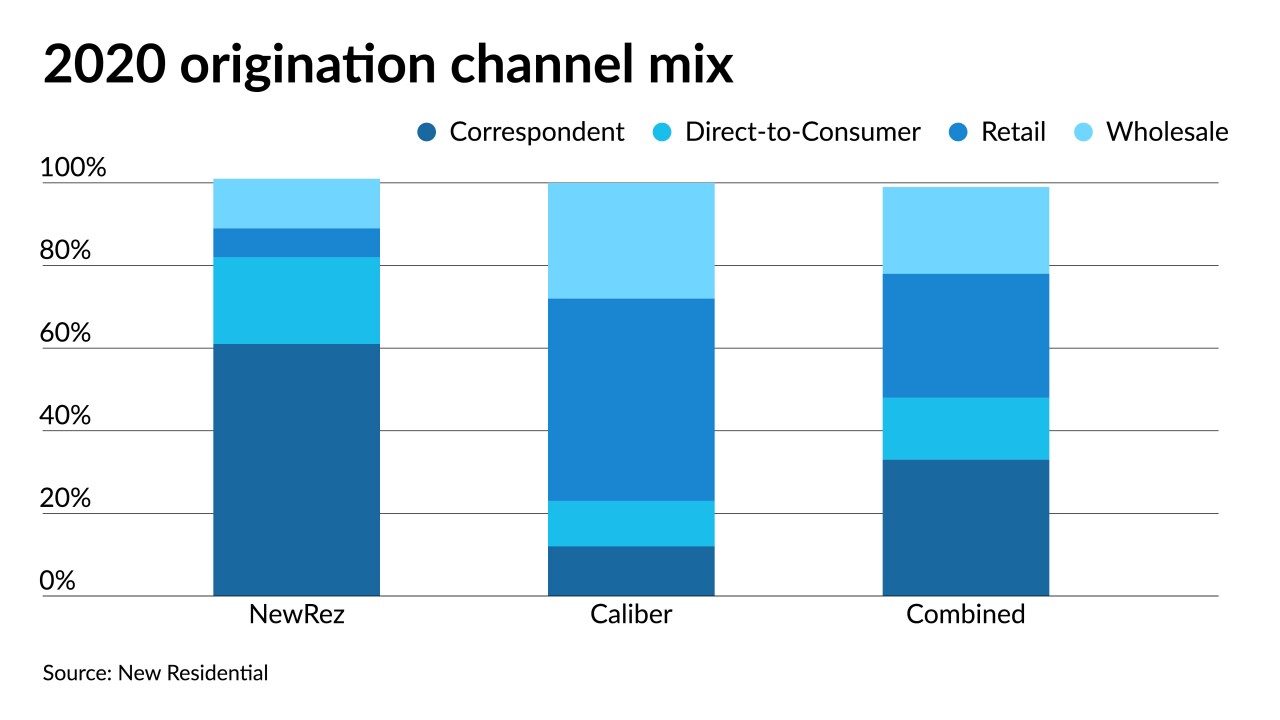

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

The inevitable cancellation of the takeover transaction by China Oceanwide means Genworth will be spinning out a portion of its U.S. mortgage insurance business.

April 6 -

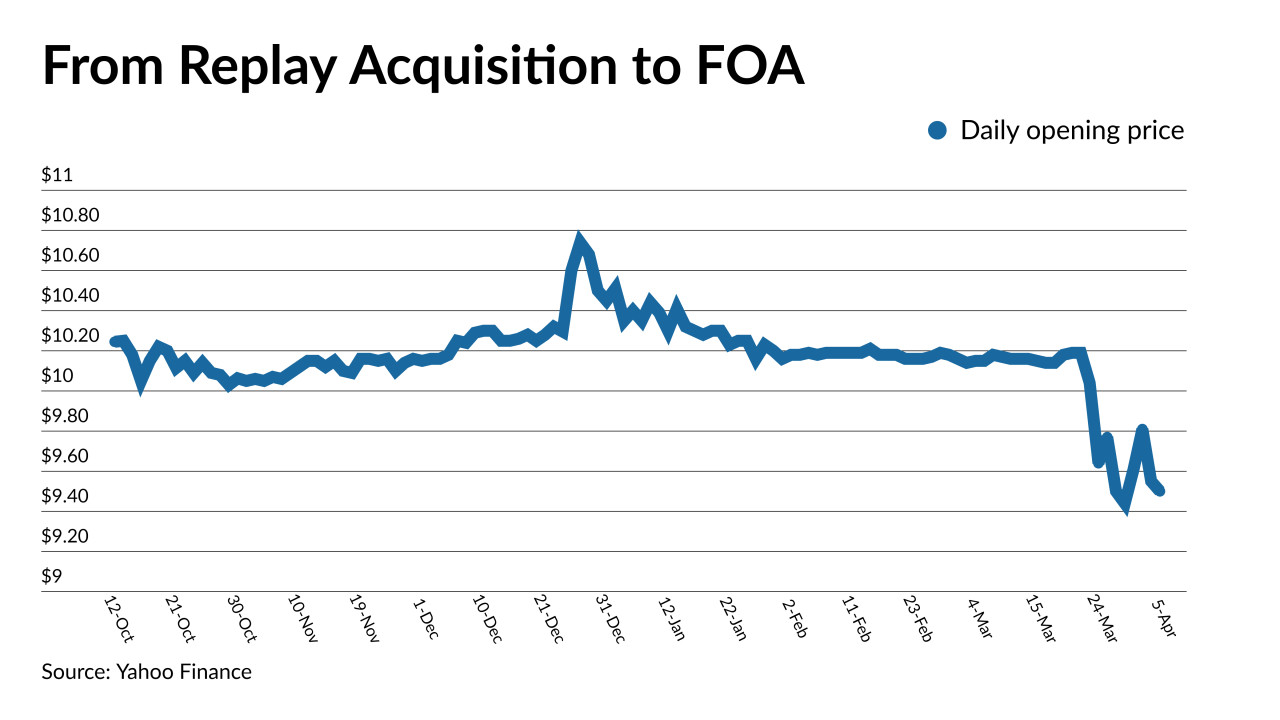

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The 11-year-old company, which went public earlier this year, sold new junk-rated bonds on Tuesday to refinance debt and to pay its shareholders a $200 million special dividend, according to a copy of the debt documents

March 24