-

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

United Wholesale Mortgage set off a brawl in the press when it forbade brokers from doing business with Rocket and Fairway. As a small group of brokers pursue legal action over the ultimatum, experts weigh in on whether the spat is benefiting the wholesale channel.

May 5 -

After the spinoff and a concurrent private sale to Bayview Asset Management, Genworth Financial will still own 80% of the rebranded Enact.

May 4 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

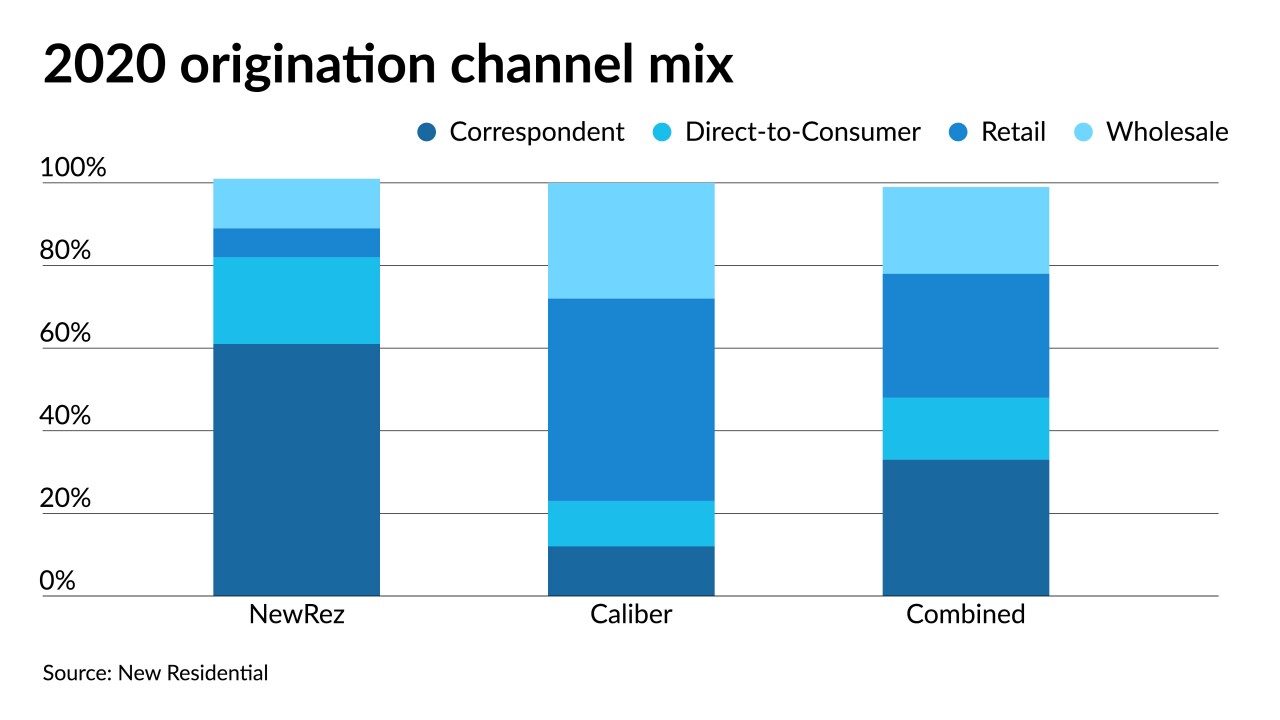

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

The inevitable cancellation of the takeover transaction by China Oceanwide means Genworth will be spinning out a portion of its U.S. mortgage insurance business.

April 6 -

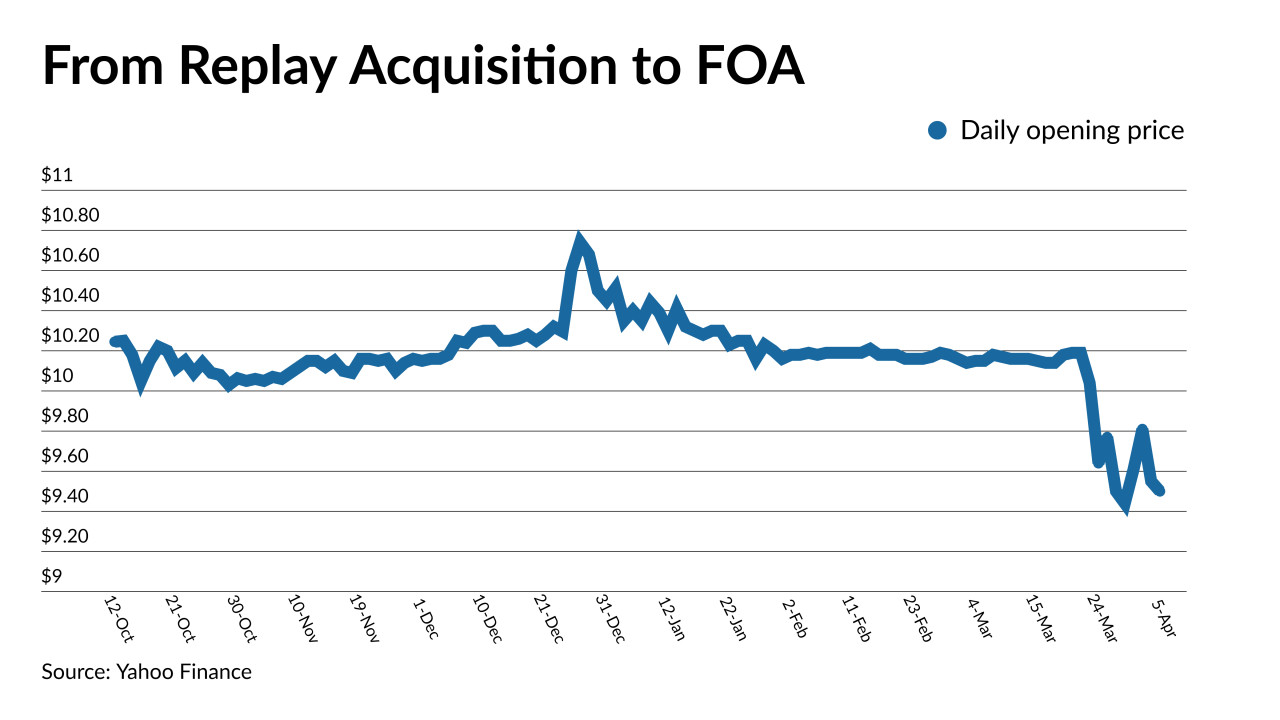

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The 11-year-old company, which went public earlier this year, sold new junk-rated bonds on Tuesday to refinance debt and to pay its shareholders a $200 million special dividend, according to a copy of the debt documents

March 24 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

Mortgage brokers are telling the company that they "are looking for another large source," according to President and CEO Willie Newman.

March 11 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

Rocket Cos. fell premarket, halting a three-day rally driven by sentiment that the home-loan provider was the latest retail-trader favorite for its high short interest.

March 3 -

The offering went down to $14 from an anticipated $19 to $21 per share.

February 11 -

But the company sees reasons to be optimistic about the second half of the year, CEO and Chairman Michael Nierenberg said during its fourth quarter earnings call

February 9 -

This is the third nonbank mortgage company offering in a row to decrease its size, but the reductions were more severe than the others.

January 29 -

For a surprising number of companies pursuing an IPO is a mistake, Endurance Advisory Partners CEO Stephen Curry says.

January 27Endurance Advisory Partners -

While it is looking for a higher price per share, the company will be selling fewer shares on its own behalf.

January 27 -

The mortgage lender will promote its brand, products and services through MLB-related television or radio ads, in addition to digital outlets.

January 26