It's a general rule to follow in the home buying process, but oft gets overlooked when shopping for a mortgage. Borrowers should shop around when applying for a loan since the spread of rates they'll get offered depends on density of mortgage lenders in their area.

"Don't go with the first lender you come across," Tendayi Kapfidze, chief economist at LendingTree, said in an interview. "There's a lot of borrowers who don't shop around at all. I think part of it is people shop more around for refinance than purchase because refinance is more of a rate-driven decision."

More lenders means there's more competition and more competition means lower rates can be had. Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees.

"Once people identify the house they want, they just want to get it done. The mortgage is an afterthought," Kapfidze said. "It’s a complex financial transaction and people are intimidated. They already have so many other things to think of with the home purchase itself. The mortgage is thought of in a more binary way that either gets approved or doesn’t. They don't think about the cost of it as much as they should."

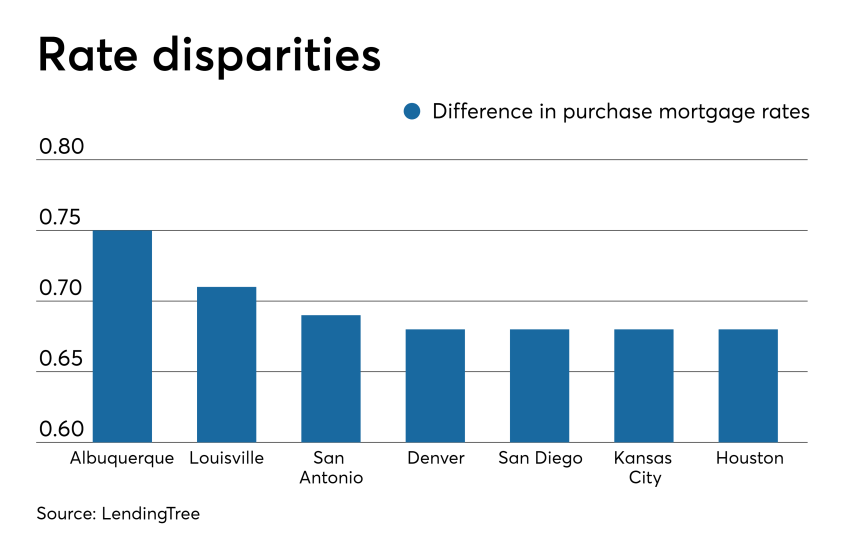

Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

The data is ranked by the interest savings over the lifetime of 30-year fixed-rate mortgages on an analysis across 50 metro areas, based on rates from the week ending May 5. The Mortgage Rate Competition Index measures the basis point spread between high and low APRs offered to users through the LendingTree marketplace.

No. 12 Portland, Ore.

Mortgage Rate Competition Index: 0.64

Median loan amount: $260,000

No. 11 Charlotte, N.C.

Mortgage Rate Competition Index: 0.67

Median loan amount: $247,500

No. 10 Salt Lake City, Utah

Mortgage Rate Competition Index: 0.67

Median loan amount: $260,000

No. 9 Boston, Mass.

Mortgage Rate Competition Index: 0.6

Median loan amount: $292,500

No. 8 New York, N.Y.

Mortgage Rate Competition Index: 0.64

Median loan amount: $276,250

No. 7 Minneapolis, Minn.

Mortgage Rate Competition Index: 0.66

Median loan amount: $268,125

No. 6 Los Angeles, Calif.

Mortgage Rate Competition Index: 0.6

Median loan amount: $300,000

No. 5 Albuquerque, N.M.

Mortgage Rate Competition Index: 0.75

Median loan amount: $255,000

No. 4 Seattle, Wash.

Mortgage Rate Competition Index: 0.65

Median loan amount: $255,000

No. 3 Denver, Colo.

Mortgage Rate Competition Index: 0.68

Median loan amount: $292,500

No. 2 San Diego, Calif.

Mortgage Rate Competition Index: 0.68

Median loan amount: $297,500

No. 1 San Francisco, Calif.

Mortgage Rate Competition Index: 0.63

Median loan amount: $332,500