The coronavirus has upended many aspects of life in the United States and the housing market is no exception. To this end, TD Bank recently fielded a survey on how the experience of the pandemic is changing consumer views on mortgages and housing.

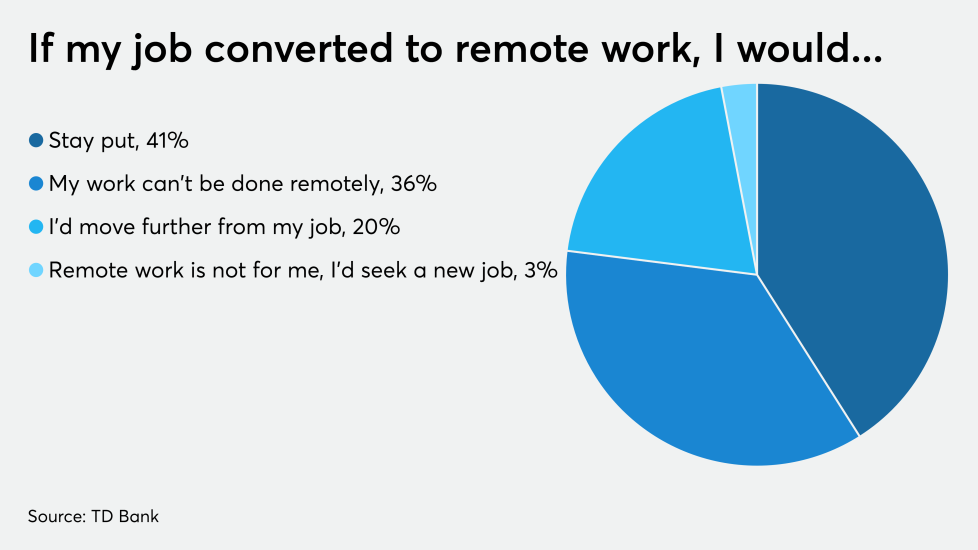

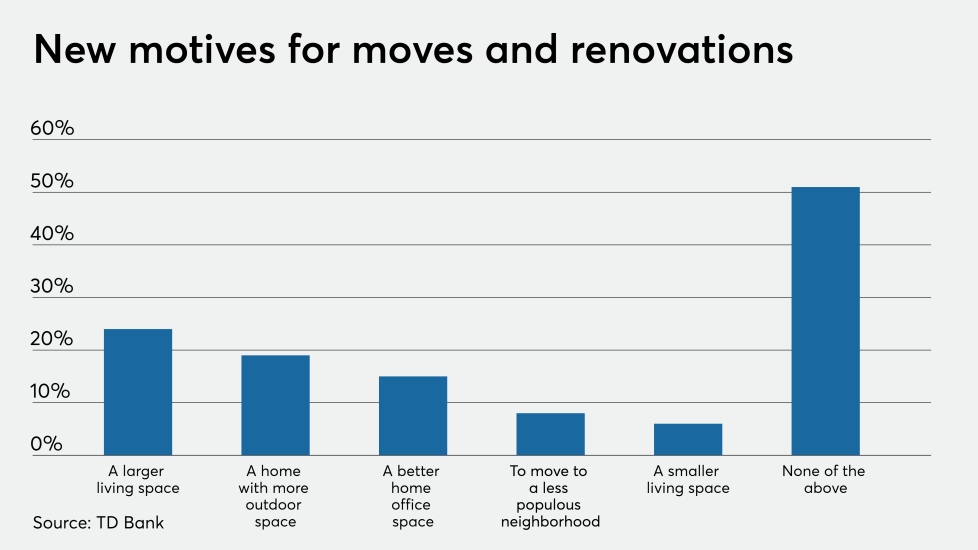

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic created new drivers for refinancing, moving and other housing decisions, the survey found.

While some consumer sentiments toward housing remain unchanged, there are clearly new motivations at play now, which are more pronounced for some specific types of borrowers.

"There's talk about somewhat of a flight to the suburbs in the purchase market given the fact that people can work from home, for example. The survey supports that and I think there's some reality to it in areas around New York and Washington, D.C.," said Steve Kaminski, head of residential lending at TD Bank. "I think some of this is marginal, and for some, trends like city dwellers moving to the suburbs may not be long-term. Time will tell, but in the meantime, our loan officers are having a lot of conversations with borrowers about things like that."

TD Bank surveyed more than 1,000 borrowers in June about how quarantine measures changed their view of mortgages and housing.

The regional breakdown of respondents was as follows: 38% were located in the South, 24% lived out West, 21% were based in the Northeast and 17% were in the Midwest.

Millennials represented 39% of those surveyed, followed by Generation X (28%), baby boomers (27%) and the Silent Generation (6%). Gen Z also was represented in the survey but the number of respondents was very small.

The majority of respondents were employed homeowners, but more than one-third were unemployed or furloughed at the time the survey was conducted, and nearly one-third were renters. A smaller percentage of borrowers (10%) were living with family members rent-free at the time.

What follows are some highlights from their responses.