Housing activity is down, costs to close are up, and lenders being forced to get creative hope digital advancements help combat these tough conditions, while also simplifying the process for consumers.

But going digital is no easy feat. Technology investments push up closing costs, at least in the short term, and lenders targeting quicker closing times can only shave off so many days in such a fragmented industry. Evolving cyber security risks also need to be addressed.

Nonetheless, lenders are certainly making progress with tech and embracing things like artificial intelligence, with 2019 set to be an important year for innovation in the mortgage world, according to FormFree CEO and Founder Brent Chandler.

From rising closing costs to implementation strategies, here's a look at five themes shaping the direction of digital mortgages in 2019, according to topics discussed at the Mortgage Bankers Association Technology Conference on March 24-27 in Dallas.

Money well spent?

But digital advancements are

The average total expenses to close a mortgage spiked, going to $8,405 in 2018 from $5,958 in 2013. Digitizing the process may not be the sole reason, but it’s a contributor, and is certainly putting the pressure on lenders to get creative to keep costs low.

Ingredients for success

At a time when institutions are extracting rich, comprehensive data, they're then just converting that data to a PDF and shipping it off; efforts are being made to digitize the process, but the initiatives are not carried across the lifecycle of the loan.

Part of the problem is companies aren't tackling issues piece-by-piece, and instead rely on one model to solve multiple issues. While one tool may be responsible for extracting data, another is likely required to facilitate it through an additional piece of the mortgage value chain.

The following formula can help institutions reach a successful technology implementation: identify a problem, determine whether they have the necessary data to settle the issue and then decide which machine learning model to use, according to David Frost, director of commercial mortgage servicing technology at Wells Fargo.

Holding back progress

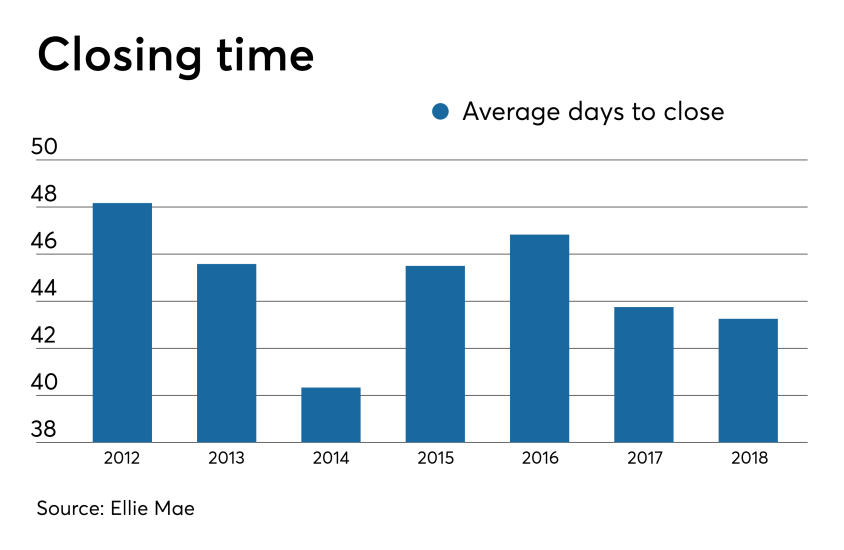

The average loan closing time fluctuated between 2012 to 2018, reaching a low within the range of 40.3 days in 2014 and a high of 48.2 days in 2012, according to Ellie Mae.

Though days to close did drop over the past couple of years, lenders are working to reduce it further, but they aren't really addressing how compartmentalized the industry is.

"Everywhere you look its

With technology quickened closing times are inevitable, though the amount of days that can be shaved off is up for debate.

The great debate

In taking tech steps forward, mortgage lenders evaluate whether

Purchasing a product is typically the quicker and most cost-effective option in the short run, as a tool is already in place for institutions to evaluate, and it'll be more readily available for integration. But companies developing their own technology, though a hefty and potentially expensive task, have the advantage of customization, and may wind up spending less money down the line.

Companies tapping a vendor for tech should ensure a product will properly integrate, and those opting to develop their own must have adequate resources, manpower and a solid understanding of regulatory standards.

But whether built or bought, staying mindful of business objectives sits at the core of tech implementation, requiring heavy attention from business leaders and stakeholders over a tech department.

Privacy at a price

From securing their own data, to that of vendor partners, and even protecting borrowers from wire fraud, lenders are gearing up to battle a sea of potential risks, and all

If borrowers lose their down payment money to a scam artist who intercepts loan information and sends false wiring information for a down payment, they can no longer purchase that house and the lender loses a loan.

Wire fraud alone generated more than $1.4 billion in losses from over 300,000 cases in 2017, according to the FBI's Internet Crime Complaint Center. The dollar volume and incidence of wire fraud has generally trended upward since 2013.