Borrower hunger for fully

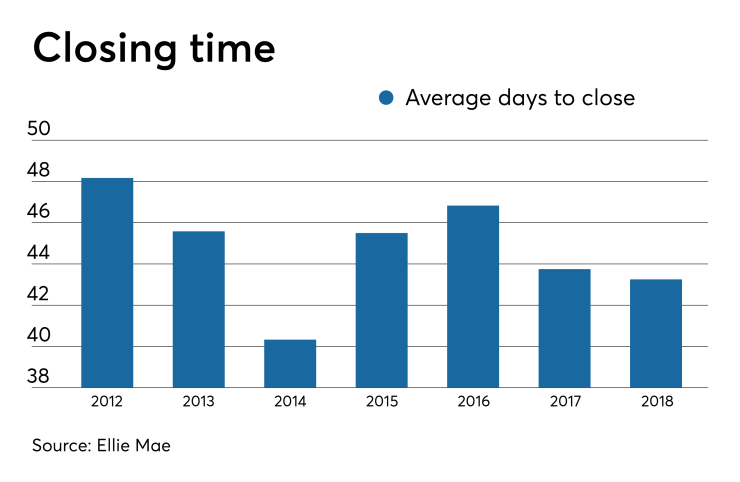

From application to approval, a typical mortgage takes 30 to 45 days to process. The average loan time ebbed and flowed from 2012 to 2018, reaching a low within the range of 40.3 days in 2014 and a high of 48.2 days in 2012, according to Ellie Mae.

Moving to a totally mobile model starts with complete information carry-through and automation, empowering the loan officer with actionable data. Automatically getting a consumer's income and spending behavior, along with all the property history smooths out the process and the loan decision can be made using automated underwriting, according to Jim Pathman, chief information officer at Plaza Home Mortgage.

Better data leads to better business decisions, quicker. Lapses in information are breaking points in workflow. Lenders try to solve these issues without addressing how compartmentalized the industry is. Aaron King, CEO of Snapdocs, believes in order for adoption to take place, everyone needs to play together in the same sandbox.

"Everywhere you look its

Vendors think introvertedly and try to protect their product above all else. In an ideal world, they'd think from the perspective of the industry as a whole and who they're selling to. "If everybody made that shift, you'd suddenly see all the most amazing, beautiful technology developed instead of all these things that don't work with each other," King said.

Lenders can't just speed up loan closing because they exist in an open ecosystem dependent on several other parties at the same time — including the responsiveness of the buyer and seller. Even if the technological resources improve and cooperate, mortgage immediacy would dovetail with regulatory and risk management. While this disjointedness gums up the workstreams, reductions in loan life cycle are inevitable.

Opinions on just how much it can get cut down vary.

"It will never be instantaneous in the true sense," Tim Smith, chief revenue officer at FirstClose, said in an interview. "I think if a lender can get it down to 18 days, that's really strong, that's basically cutting it in half. I think we're 18 to 24 months out before that happens."

King thinks it could even get down to a five-day close, assuming an ideal lockstep of technological assimilation across lenders and servicers. Bolder still, Jason Nadeau, chief digital officer at Fidelity National Financial, said the limit doesn't exist — or at least none that can't be broken.

"There are a few statutory limits, like giving some information three days before closing. So that's probably the boundary," Nadeau said. "Look at the things that take the longest today: to clear up the title, for the appraiser to appraise the home, and the lender to do the paperwork. In theory, if you