“Slower but steady growth,” will likely characterize next year’s overall market, according to Mark Palim, deputy chief economist and vice president at Fannie Mae.

“There are risks from the global slowdown, and trade dislocation in the business world, but we think the economy is doing reasonably well,” he said.

For mortgage lenders, that overall economic backdrop is further distinguished by continuing housing shortages and national home price gains.

Both of these are expected to further strain affordability, limiting purchase and refinancing activity next year to degrees widely dependent on additional variables.

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

Refi rates may be evolving in the GSE sector

For one, the GSEs have their respective refinancing shares running 7 to 10 percentage points higher than the Mortgage Bankers Association’s. (The MBA’s figure for the first quarter is 48%, compared to Fannie Mae’s 35% and Freddie Mac’s 38%.)

Also, the GSEs’ regulator is floating the idea of setting

Most home prices expected to keep climbing, but exceptions may exist

It’s long been known that Northern California’s priciest markets have been under strain, and at least two

In addition,

“We only put out a national forecast, but is it possible that home prices decline in individual metros? It absolutely is,” said Palim.

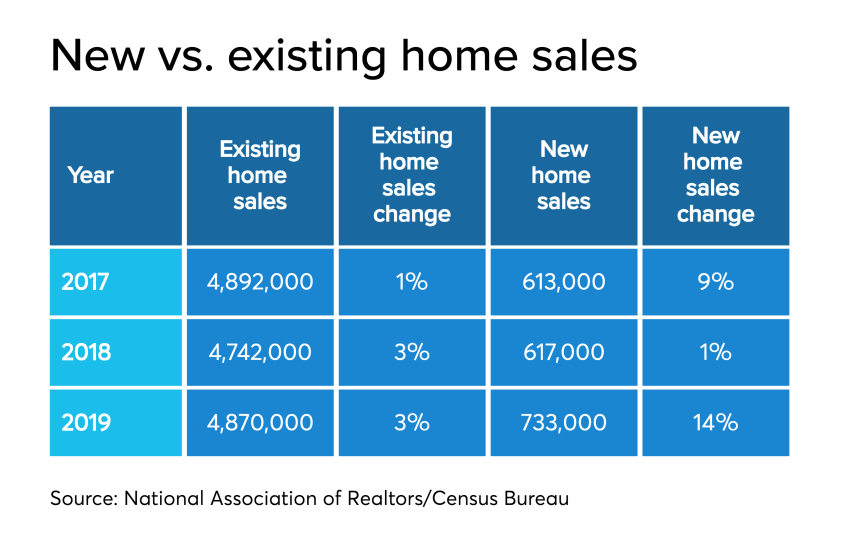

New-home sales gains have outpaced growth in the resale housing market

The latest annualized estimate for single-family new-home sales in 2019 clocked in at 733,000 on Tuesday, up from 617,000 in 2018 and 613,000 in 2017, according to the Census Bureau.

But the latest annual number given by the National Association of Realtors for existing-home sales is still lower than two years ago at 4,870,000. Home resales totaled 4,742,000 in 2018 and 4,892,000 in 2017.

"Given how much mortgage rates have come down, it’s been good to see existing home sales pick up," Palim noted. "But I’m a little surprised they haven’t picked up more."

The timing of when new-home and resale numbers are reported distorts comparisons. NAR aims to account for it with its index that measures pending home sales figures. That index, like home resale estimates, suggests 2019’s sales will fall short of 2017’s.

A higher savings rate may be contributing to slower growth in the housing market

"Even though wages are strong, the savings rate picked up over the last couple years, and it remains higher than you would expect with this robust of an economy," said Palim. "Consumers more cautious than you would otherwise think given the level of the unemployment rate and the long expansion.”

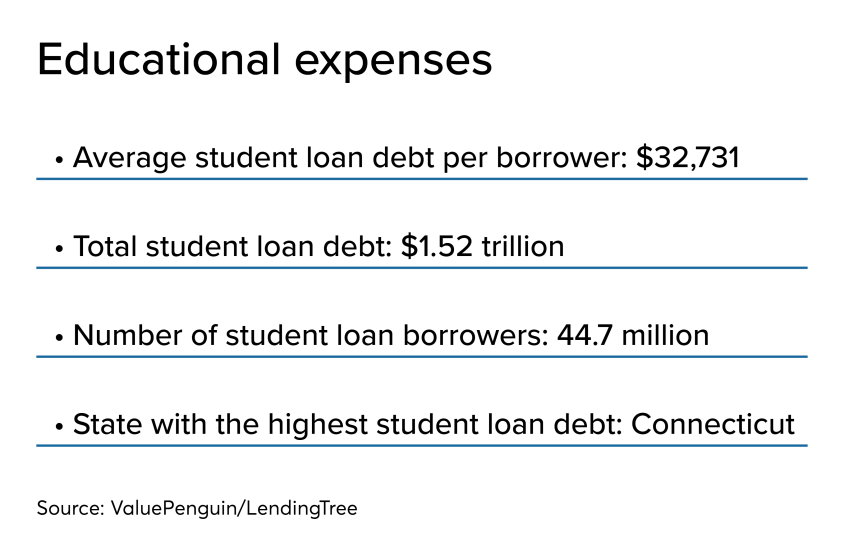

Concern about consumer debt is growing

In addition, the Federal Housing Administration and both GSEs have been restricting their exposure to higher debt-to-income ratios.

There are “warning signs” in certain non-mortgage debt sectors, Palim said. In addition to student and auto loans, he suggests keeping an eye on debt in