The responses touch on a range of opportunities and challenges — from where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course.

Feed the financing needs of borrowers who plan on staying put

But these consumers do need to maintain their houses, and they may need products like home improvement loans to pay for repairs.

"Homes will always need renovations," said Michael Galanti, branch manager at Guaranteed Rate in Paramus, N.J.

Consumer spending on remodeling is expected to increase through 2019, according to projections by Harvard University's Joint Center for Housing Studies.

Work with a bilingual sales force to bring in more loans

"We communicate our message in both English and Spanish via social media, texts, email, the Realtors in our community, and in person," said Stephany Puente, branch manager at Point Mortgage Corp. in La Mesa, Calif. The move has increased attendance at the company's home buying seminars.

While only 4.5% of households in the United States have limited English proficiency, there are high concentrations of them in California, Texas, New York and Florida, according to the Urban Institute's Housing Finance Policy Center. The majority of these households speak Spanish.

The government-sponsored enterprises and their regulator recently launched

Consider condos

As a result, carefully underwritten condo loans may be a good way to boost production numbers in a tough market, Baret Kechian, branch manager at loanDepot in Hoboken, N.J., suggests.

"We have gotten almost every condo building in the area approved through our credit policy. So while some banks are having issues lending in certain condos, we have done a thorough review and have built a true edge in our local market," she said.

Condos and co-ops make up 11% of single-family resales and there are higher concentrations of them in New York and Florida, according to the National Association of Realtors.

Fannie Mae and Freddie Mac last year both extended appraisal waivers previously only available for traditional single-family homes to condos with the intent of making financing in this market more accessible.

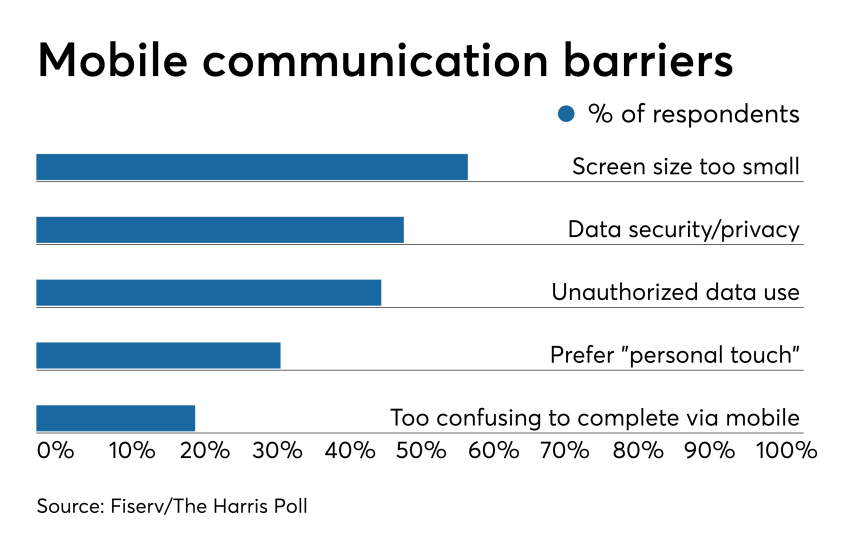

Use a mobile approach to do more in person

"Over the past two years my time in a physical office space working the typical 9-5 has dropped by over 50%," said Tim Kelly, a senior loan officer at Highlands Residential in Centreville, Va. "The majority of the time I work remotely, whether from home or at a local coffee shop. The ability to meet and communicate with clients digitally has been paramount. My clients and partners love the fact I'm not tethered to a desk anymore and available by more than just emails and phone calls."

While a growing number of consumers are using mobile devices for financial services, there are barriers to using them to complete transactions. Concerns include small screen sizes, data security concerns and a need for guidance, according to a recent survey by Fiserv and The Harris Poll.

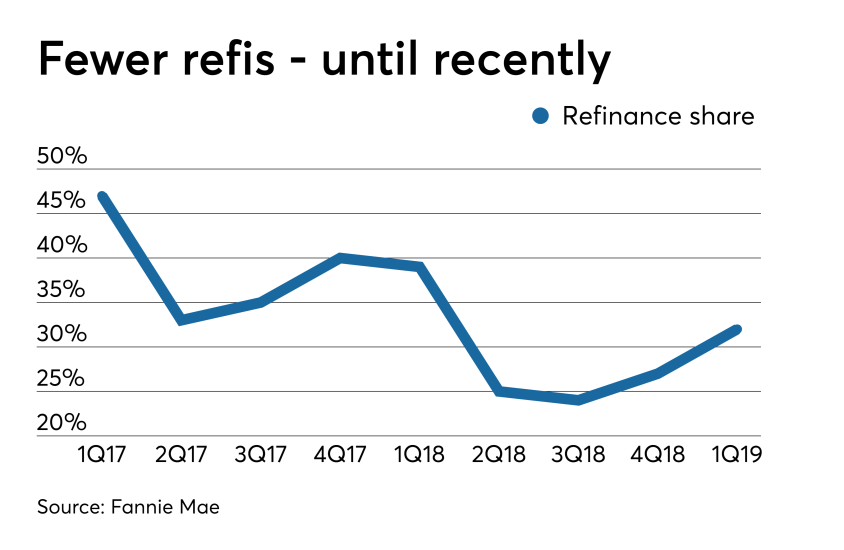

Be ready to change gears as rates fluctuate

"Last year involved adapting to ever-increasing interest rates and prices, heavy competition on low inventory for buyers, and managing customer expectations through that home buying process. This year is starting off with reduced interest rates, which has driven me to change some of my focus to refinance opportunities and connecting with prior clients that didn't buy after becoming disenchanted with rising rates and prices in 2018," said Brandon Pavlovic, a mortgage loan officer at NFM Lending in Tempe, Ariz.

The average rate for a 30-year mortgage almost reached 5% last year, but recently it has been closer to 4%, according to Freddie Mac.