Small loans can be nettlesome for lenders given their lack of economies of scale and

"Some people think, 'I'm not going to do a $60,000 loan, it's not worth it because I have the same overhead as a $300,000 loan and I can make way more money on a $300,000 loan,'" said Kevin Parra, CEO of Plaza Home Mortgage. "For us, we're fine with them. With small balance loans you get respectful payouts because they're less likely to refinance."

That's appealing to investors in a market where

A borrower with a low loan-balance tends to be slower to prepay than one with a larger mortgage because the costs involved in obtaining and closing a new loan stand as a deterrent.

"The smaller the loan is, the longer it takes you to break even on a refinance," said Bill Berliner, director of analytics at secondary market advisory firm Mortgage Capital Trading.

Borrowers also may be lower income individuals with poorer credit histories, which can make it more difficult to meet refinance underwriting requirement.

"The smaller loans borrower may not have as good as a credit which may make prepayment activity harder for that borrower segment," said Gagan Sharma, president and CEO at servicer BSI Financial.

But in a market with low delinquency rates like the current one, these loans fare well.

Investors will pay the most for prepayment protection if securitized mortgage pools each have a balance below $85,000 and trade outside the mainstream to-be-announced market.

Most agency mortgages are securitized through the TBA market in advance of actual delivery. But small balance loans trade in a separate market for custom mortgage pools.

"That market is a very popular market," said Walter Schmidt, senior vice president and manager, mortgage strategies, at FTN Financial. "It's kind of difficult to say whether there's a lot of trading there but pay-ups are very, very high right now because of that call protection."

While the traditional low loan-balance pool cuts off at a maximum balance of $85,000, loans as large as $150,000 or even $200,000 might be viewed as prepayment deterrents in the current market.

"It's a smaller pay-up, but do you do get some protection," said Geoff Caan, managing director, U.S. public fixed income, at SLC Management.

For home prices below $70,000, the financed share ranged from 25%-29% between 2010 and 2015. In comparison, 71% to 80% of homes priced in the $70,000-$150,000 range were financed, according to a 2018 report by the Urban Institute's Housing Finance Policy Center and the Federal Reserve Bank of Chicago.

This may have less to do with lender reluctance to make smaller loans in lower over time and more about

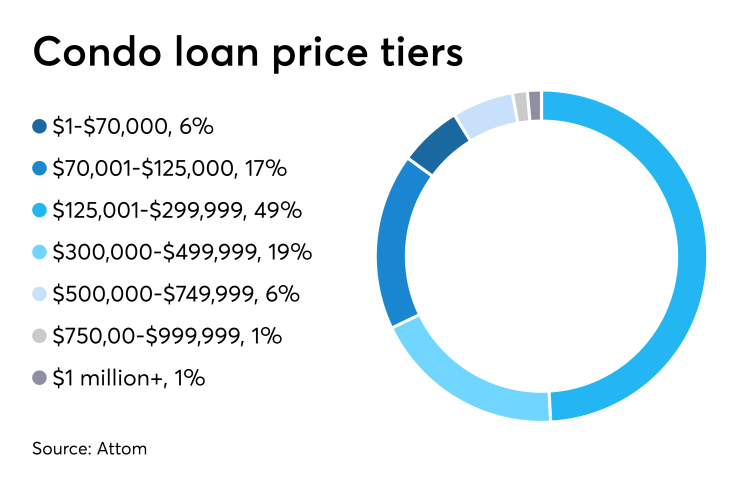

Single-family lenders are most likely to offer smaller-balance products in niche markets like condominiums where homes are more affordable. More than 70% of condo loans originated in 2018 had balances lower than $300,000, according to Attom Data Solutions.

Even with pay-ups, small loans' operational costs still could be a challenge, particularly in a niche like condos where underwriting and processing can be more complex.

But technology-augmented workflows could make those expenses manageable across a diversified book of business.

"Soup-to-nuts, lenders have to be more efficient," said Trevor Gauthier, president of Mortgage Cadence, an Accenture company.

Gauthier recommends automated digital verification of borrower information as being particularly helpful in generating efficiencies.

Technology also has been a competitive edge when it comes to contending with economies of scale in the small-balance commercial mortgage market, according to Randy Fuchs, principal and co-founder of property valuation, data and analytics provider Boxwood Means LLC.

Nonbanks — some of which are startups with technology-intensive platforms — are competing heavily with banks in the small-balance loan space in part because they are more automated, Fuchs explained.

"They can produce and close these loans at lower internal costs, and close them faster as well," he said.

But even if a commercial or residential mortgage lender can't process a small loan efficiently enough to generate a profit, that doesn't necessarily mean a transaction lacks business value.

Many banks are willing to invest in an initial transaction at a loss because it may pay off with more profitable repeat business or a referral one day.

"Most banks want to establish client relationships with the hopes that some of them turn out to be big accounts," said Fuchs.