Mortgage rates hit another all-time low

Guild Mortgage becomes the latest mortgage lender to go public

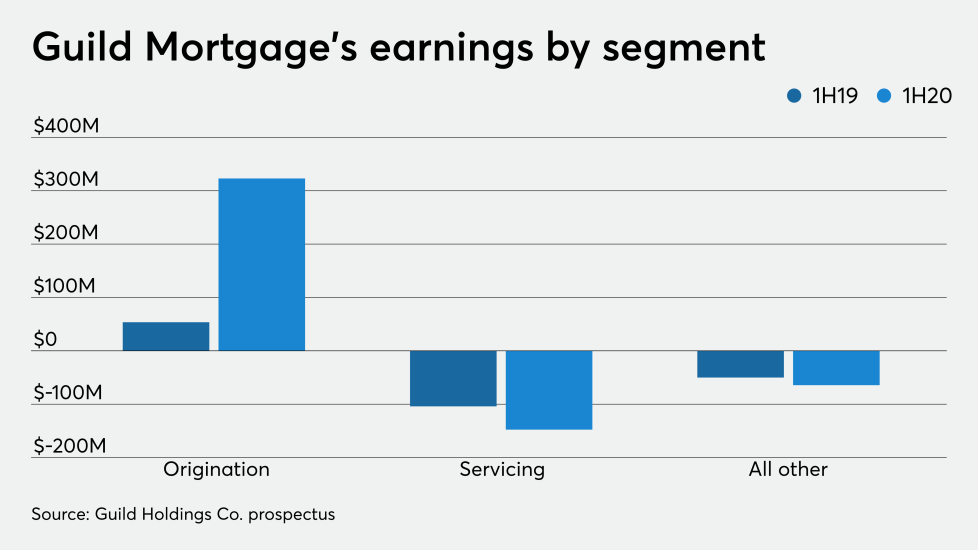

Guild's IPO will consist of 8.5 million Class A shares with an additional 1.275 million shares that could be sold as part of the underwriters' option. At the midpoint of the price range, with the additional shares included, Guild would raise approximately $176 million. (Read full story

Ginnie Mae MBS issuance shatters record

Fannie Mae predicts 2020 originations will top $4T

Borrowers missed $19.4B in third-quarter mortgage payments

About 4.7% of borrowers missed one payment over the past two quarters, 2% missed two, 1.5% missed three and 4.2% missed four or more. Third-quarter deferrals amounted to $19.4 billion in missed mortgage payments. The research revealed a slight improvement in the third quarter as more people returned to work, but that may not be indicative of future loan performance as uncertainty lies ahead. (Read full story

Wells Fargo faces growing pressure to slash costs

In January, Scharf described the San Francisco company as “extraordinarily inefficient.” Six months later, he argued that its expenses were at least $10 billion higher than they should be. So when Wells Fargo reported its third-quarter earnings on Wednesday, Wall Street was anticipating a detailed road map for cutting costs.

What Scharf provided instead was a promise to give an update in three months about shorter-term spending cuts, but no commitment about when the company will release a long-term plan for slashing its expenses. (Read full story

Finance of America joins the ranks of nonbanks going public

The SPAC, Replay Acquisition Corp., was founded by Edmond Safra, Gregorio Werthein and Gerardo Werthein. Among Finance of America's current investors is Blackstone Group, which, along with FOA's management will retain 70% of the company after the merger is completed. (Read full story