Adverse market fee draws adverse reviews

Former employee hits Wells Fargo with sex discrimination lawsuit

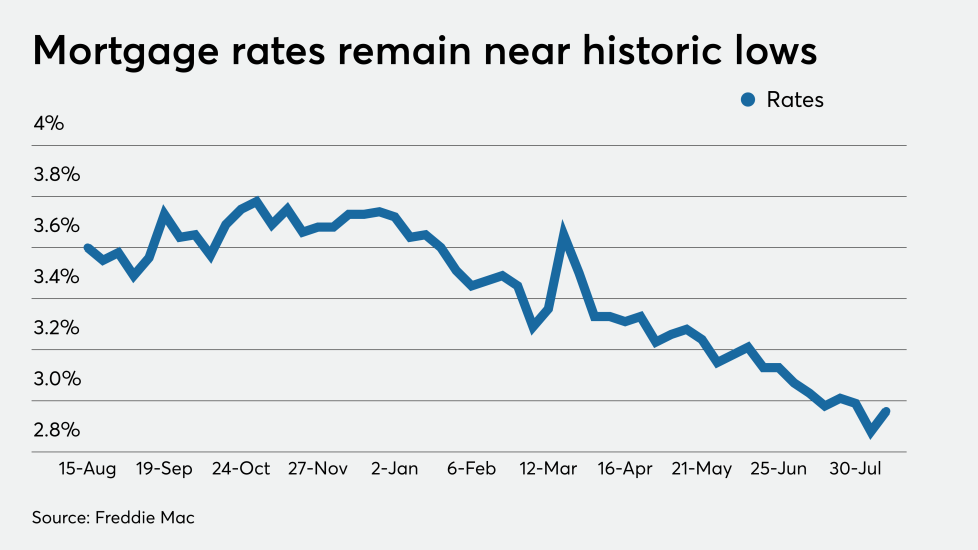

Mortgage rates shoot up, outlook pessimistic

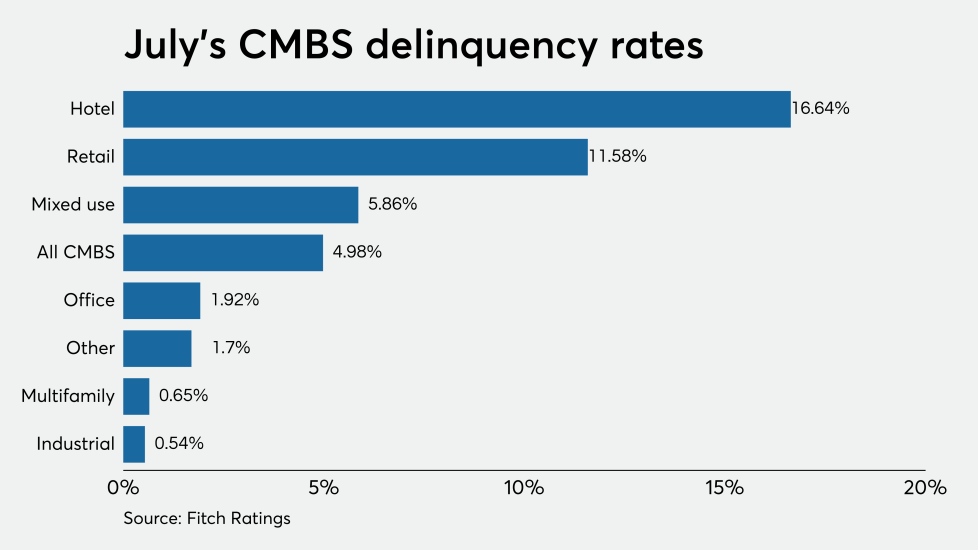

Serious delinquencies may grow exponentially in 2021

A Trump reelection would bring big implications for banks

Mortgage forbearances drop ... again

Loan applications rise as interest rates tumble

Does trouble lie ahead for commercial mortgages?

Bidding wars grow 5x in July