After a two-week decline, mortgage application volume rose thanks to interest rates that continue to hit

The MBA's Weekly Mortgage Applications Survey for the week ending Aug. 7 showed a 6.2% jump in activity

The increases hit nearly every loan type. The refinance index led the way, growing 9.1% week-to-week — its highest level since April — and 46.7% year-over-year. The purchase index inched up 1% from last week while jumping 21.8% from the year before. This marks the 12th straight week the purchase index measured higher than its year-ago level.

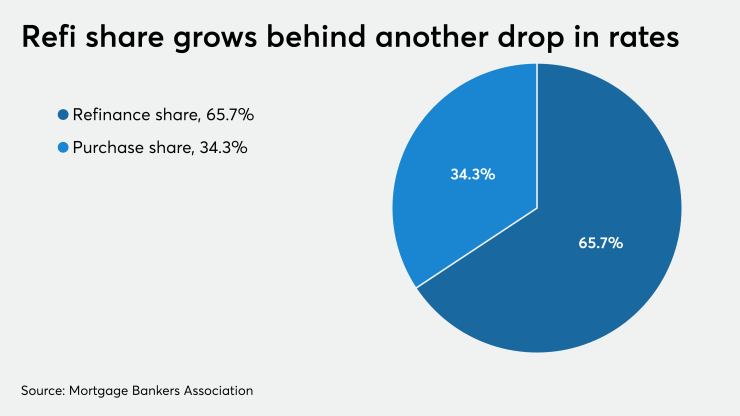

The refinance share of mortgage activity edged up to 65.7% of total applications from 63.9% the previous week — its highest share since May.

However, applications for adjustable-rate mortgages declined to 2.7% for total volume from 3.1% last week.

For the three government mortgage programs, the Federal Housing Administration share rose to 10.4% from 9.6%, Veterans Affairs inched up to 11.4% from 11.2%, and U.S. Department of Agriculture/Rural Housing Service remained at 0.6% from the week before.

"Mortgage rates fell across the board last week, as investors grew less optimistic of the economic rebound given the resurgence of virus cases. Loan types such as the 30-year fixed, 15-year fixed, and jumbo all reached survey lows," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) dropped to 3.06% from 3.14% one week prior. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate declined to 3.4% from 3.51%.

The average contract interest rate for 30-year fixed-rate FHA-insured mortgages crept down to 3.23% from 3.27%. For 15-year fixed-rate mortgages, the average fell to 2.67% from 2.73%. The average contract interest rate for 5/1 ARMs dipped to 3% from 3.09%.

While the heightened volume brings a surge of business for lenders, "the gradual slowdown in the improvement in