Mortgage rates fall to new low, despite spike in Treasury yields

The 30-year fixed-rate mortgage averaged 2.71% for the week ending Dec. 3,

(Read full story

FHA's Dana Wade takes issue with 2021 loan limits

But in high-cost areas, the new FHA limit is $822,375 for a single-unit home, or 150% of the 2021 conforming loan limit of $548,250. For conforming mortgages in high-cost areas, the loan limit is also $822,375.

The new limits have Federal Housing Commissioner Dana Wade concerned.

"FHA's mission is to support low-to-moderate income borrowers, so why does the law permit FHA to insure mortgages up to $822,375?" she asked in a press release. "This is a question for Congress and the taxpayers who stand behind FHA to answer."

(Read full story

Mortgage firms set new record for per-loan profits even as costs rise

The average pretax production profit for independent mortgage companies and home-loan subsidiaries of chartered banks was 203 basis points of the principal balance on each unit originated during the period. That translates to net income of $5,535 per loan.

(Read full story

Regulators warn banks against using Libor in new contracts

In an interagency statement, the Office of the Comptroller of the Currency, Federal Reserve and Federal Deposit Insurance Corp. said that “[f]ailure to prepare for disruptions to USD LIBOR, including operating with insufficiently robust fallback language, could undermine financial stability and banks’ safety and soundness.”

(Read the full story

Forbearances increase as trend spreads to all loan types

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick to 3.36% from 3.35%

(Read full story

FHA extends endorsements of mortgages in forbearance through year-end

The extension of the FHA’s willingness to

(Read full story

Purchase mortgage defect risk rises again amid a hot housing market

"More important for fraud risk is the continued sellers' market, which may pressure home buyers to misrepresent information on their loan application to win the bid for a home," Odeta Kushi, First American's deputy chief economist, said in a statement. "The winter months should cool the hot sellers' market, which may relieve pressure on overall fraud risk."

(Read full story

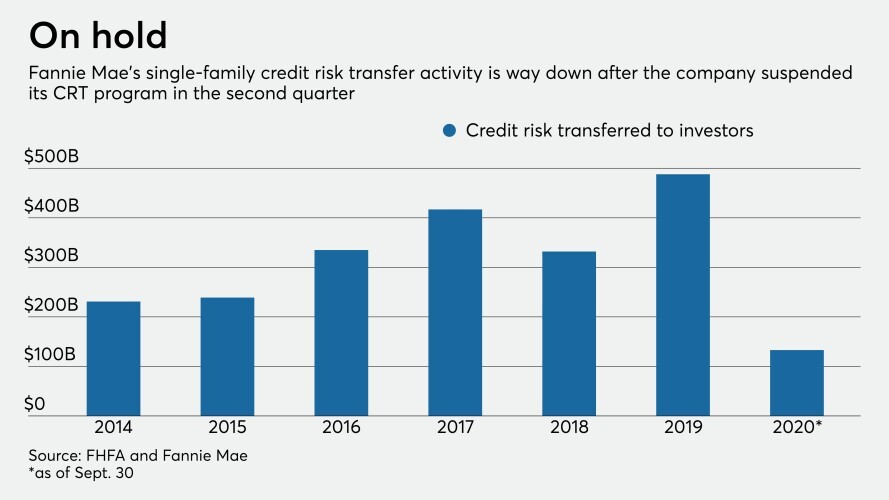

Why is Fannie Mae abandoning a practice that shields it from risk?

The shift is partly due to

“That means that risk is concentrated back on the balance sheet of Fannie and Freddie, and that's leaving more of it being absorbed by the taxpayer,” said Ed DeMarco, president of the Housing Policy Council and former acting director of the FHFA, who started the credit risk transfer program in 2013.

(Read full story

Digital mortgage firm Beeline expanding, hiring, adding new technology

The company’s platform aims to help borrowers apply for home loans in as little as 15 minutes by automating immediate validation of bank information used in qualification, according to a company press release.

“What’s really different about our technology is that it actually uses artificial intelligence to collect that data and verify it right away,” said Jess Kennedy, Beeline’s co-founder, general counsel and chief compliance officer. “A beeline is the shortest path to get somewhere and that’s really what we wanted to provide.”

(Read full story

Guild's 3Q income climbs over 2,000% on record originations

The company had net income of $182.1 million in the third quarter, up from $8.5 million for the same period last year. Its third-quarter results are in the middle of the range it expected when the company

(Read full story