-

The number of new housing permits issued in Connecticut communities surged by 13.7% last month compared to January 2019, according the state Department of Economic and Community Development.

February 27 -

Connecticut's home sale market ended 2019 pretty much the way it began the year, as overall prices for single-family houses remained stuck in neutral and sales slipped, compared with the previous year.

January 29 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

Sales of single-family houses in the Greater Hartford area recorded a lackluster 2019, barely gaining any ground over the previous year.

January 21 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

Connecticut's housing market saw mixed performance in November, with solid gains in year-over-year median sale prices and total sales, but showing some overall weakness in year-to-date data released by the Massachusetts-based Warren Group.

January 9 -

Home prices in 10 states are still valued below the peaks reached before the Great Recession, according to a new report by CoreLogic, a real estate analytics company.

January 7 -

Connecticut single-family home sale prices in October reached their highest level in 12 years for the month, a bit of welcome news in a housing market that is looking for a boost in a decade-plus recovery.

December 5 -

Home sale prices in Greater Hartford got a welcome bump up in October amid slower sales, and the outlook for the rest of the year also indicates slower home purchasing.

November 20 -

1st Alliance Lending is officially closing, but its CEO still plans to fight Connecticut's allegations that it used unlicensed personnel to take mortgage loan applications.

November 18 -

Connecticut's housing market saw modest gains in September, with the number of sales of single-family homes and condominiums increasing as well the median sale price for both types of properties.

November 1 -

A mortgage company's dispute with Connecticut over what tasks a licensed loan officer needs to handle points to a potential compliance concern for direct and digital lenders seeking to maximize efficiencies.

September 24 -

The spring home buying market — traditionally the strongest of the year — didn't do much to boost overall home sale prices in greater Hartford this year.

August 19 -

1st Alliance has ceased lending activities following the loss of bonding in Connecticut, plus financial concerns it links to a state regulatory dispute, but it may later seek to recapitalize.

August 16 -

Connecticut single-family home sales fell in June, the 11th consecutive monthly decline, as the median sale price also dropped.

August 1 -

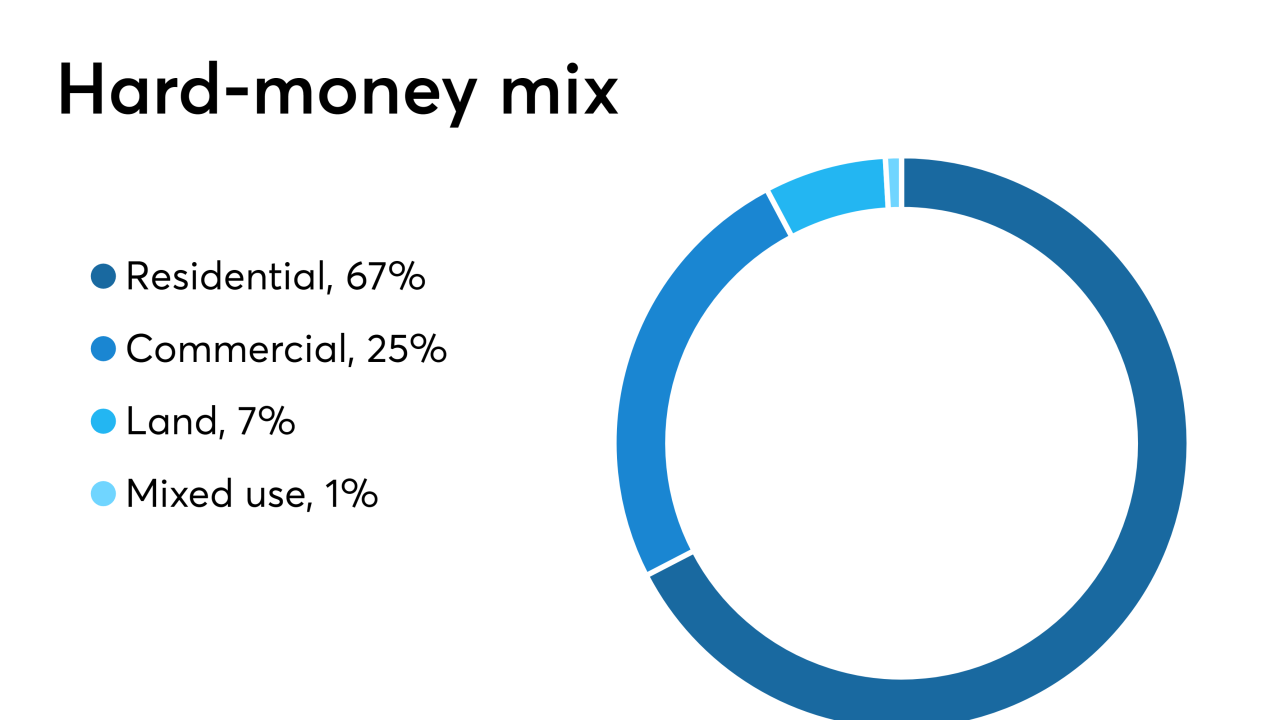

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The spring home buying market got off to a disappointing start in April, as sales sputtered and the state marked the ninth consecutive month of year-over-year sale declines.

June 3 -

Home sales across Connecticut in March provided a weak lead-in to the state's spring home buying season with sales and prices both registering year-over-year declines.

April 25 -

Northeast mortgage originators relied heavily on referral relationships with attorneys and financial planners and less so with homebuilders last year, the Top Producers 2019 survey found.

April 17 -

Sheldon Oak Central, a Connecticut affordable housing developer, is at risk of losing half a million dollars in federal subsidies if it can't come up with cash to rehab one of its aging properties.

April 15